We Think GSI Technology (NASDAQ:GSIT) Needs To Drive Business Growth Carefully

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we'd take a look at whether GSI Technology (NASDAQ:GSIT) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for GSI Technology

How Long Is GSI Technology's Cash Runway?

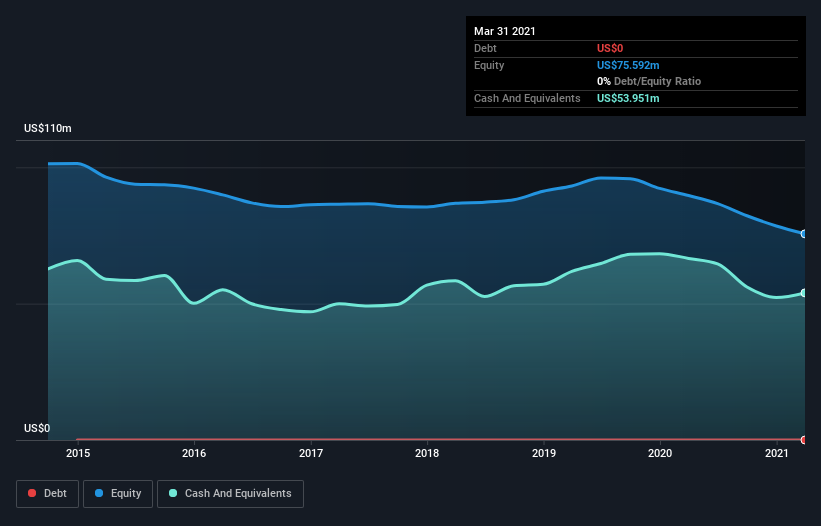

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In March 2021, GSI Technology had US$54m in cash, and was debt-free. Importantly, its cash burn was US$15m over the trailing twelve months. Therefore, from March 2021 it had 3.5 years of cash runway. There's no doubt that this is a reassuringly long runway. Depicted below, you can see how its cash holdings have changed over time.

How Well Is GSI Technology Growing?

One thing for shareholders to keep front in mind is that GSI Technology increased its cash burn by 208% in the last twelve months. While that's concerning on it's own, the fact that operating revenue was actually down 36% over the same period makes us positively tremulous. In light of the above-mentioned, we're pretty wary of the trajectory the company seems to be on. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how GSI Technology has developed its business over time by checking this visualization of its revenue and earnings history.

Can GSI Technology Raise More Cash Easily?

While GSI Technology seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

GSI Technology's cash burn of US$15m is about 12% of its US$130m market capitalisation. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

Is GSI Technology's Cash Burn A Worry?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought GSI Technology's cash runway was relatively promising. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. On another note, we conducted an in-depth investigation of the company, and identified 2 warning signs for GSI Technology (1 shouldn't be ignored!) that you should be aware of before investing here.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.