Valmont's (VMI) Q2 Earnings and Revenues Beat Estimates

Valmont Industries, Inc. VMI registered profits of $62.1 million or $2.89 per share in second-quarter 2021, up from $22.6 million or $1.06 per share in the year-ago quarter.

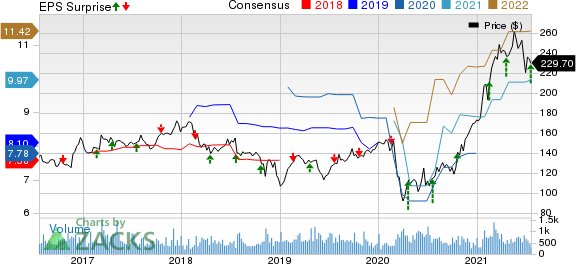

Barring one-time items, adjusted earnings were $3.06 per share in the reported quarter, up from $2 logged in the year-ago quarter. The figure topped the Zacks Consensus Estimate of $2.51 per share.

Revenues in the quarter were $894.6 million, up 29.9% year over year. The figure also surpassed the Zacks Consensus Estimate of $816.1 million. The upside in revenues was led by strong sales in the Irrigation segment and strong market demand for renewable energy usage in the Utility Support Structures segment.

Valmont Industries, Inc. Price, Consensus and EPS Surprise

Valmont Industries, Inc. price-consensus-eps-surprise-chart | Valmont Industries, Inc. Quote

Segment Highlights

Infrastructure-Related

Sales in the Engineered Support Structures segment increased 6.3% year over year to $269.4 million. Favorable pricing, increased sales of wireless communication products and components and a positive currency impact from the Australian dollar offset the lower volumes in transportation markets.

Sales in the Utility Support Structures segment rose 15.8% year over year to $267.9 million. The upside was driven by higher volumes resulting from elevated demand for renewable energy generation, utilities’ investments in grid resiliency and increased pricing.

Sales in the Coatings segment increased 22.7% year over year to $98.2 million on the back of an improved macro-environment driving up volumes, favorable pricing and foreign-currency impacts.

Agriculture-Related

Sales in the Irrigation unit amounted to $282 million, up 87.2% year over year on higher volumes across all markets, favorable pricing and a rise in technology sales. Sales in North America were $156.1 million, up 57.6% year over year led by persistent strength in agricultural markets and higher industrial tubing sales.

International irrigation sales shot up 144% year over year to $125.9 million. Ongoing deliveries of large projects in Egypt, strong demand in Brazil and higher sales in Europe acted as tailwinds.

Financial Position

Valmont ended second-quarter 2021 with cash and cash equivalents of $199.3 million, down 43.9% year over year. Long-term debt stood at $860.9 million, increasing 10.6% year over year.

Cash flows from operating activities were $37 million for the second quarter, down from $88.3 million in the same period a year ago.

Outlook

In the second half of 2021, the company expects sequential margin improvement in Utility Support Structures, as prices are to offset steel cost inflation. It also hopes to leverage its supply chain and execute pricing strategies across the portfolio to recover from the impact of inflation.

For 2021, it expects an increase in net sales in the range of 16-19%, up from the prior range of 9-14%. It also anticipates an increase in Irrigation segment revenues in the range of 45-50%, up from the prior range of 27-30% year over year. The company also expects earnings of $9.90-$10.60, up from the prior range of $9.30-$10.00 per share.

Price Performance

The company’s shares have surged 83.2% in the past year compared with the industry’s rise of 52.3%.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Valmont currently carries a Zacks Rank #2 (Buy).

Other top-ranked stocks in the industrial products space are Tenaris S.A. TS, ABB Ltd. ABB and AZZ Inc. AZZ, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Tenaris has a projected earnings growth rate of roughly 328.6% for the current fiscal. The company’s shares have surged 52% over a year.

ABB has an expected earnings growth rate of around 35.7% for the current fiscal. The company’s shares have gained 36.8% over the past year.

AZZ has an expected earnings growth rate of 44.1% for the current fiscal. The company’s shares have jumped 67.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valmont Industries, Inc. (VMI) : Free Stock Analysis Report

ABB Ltd (ABB) : Free Stock Analysis Report

AZZ Inc. (AZZ) : Free Stock Analysis Report

Tenaris S.A. (TS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research