I Built A List Of Growing Companies And Auswide Bank (ASX:ABA) Made The Cut

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Auswide Bank (ASX:ABA). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Auswide Bank

How Fast Is Auswide Bank Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, Auswide Bank has grown EPS by 6.3% per year. While that sort of growth rate isn't amazing, it does show the business is growing.

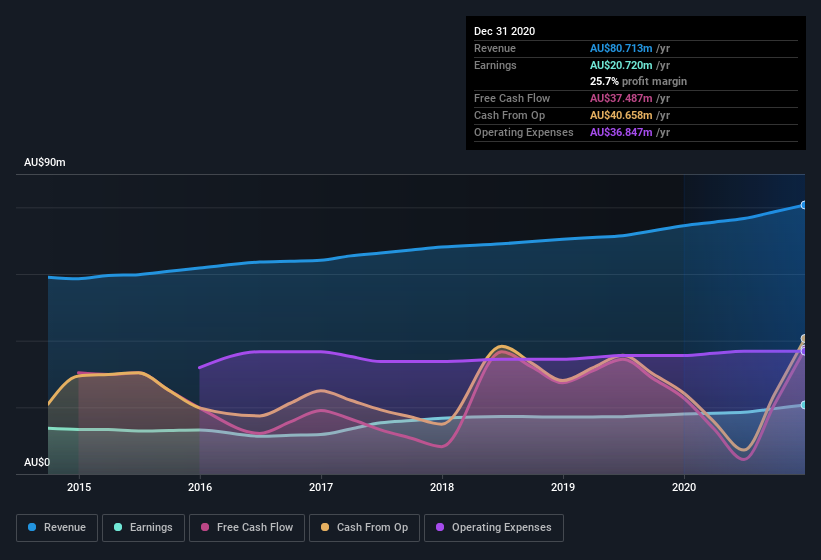

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Auswide Bank's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Auswide Bank maintained stable EBIT margins over the last year, all while growing revenue 8.3% to AU$81m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Since Auswide Bank is no giant, with a market capitalization of AU$284m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Auswide Bank Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Like a sturdy phalanx Auswide Bank insiders have stood united by refusing to sell shares over the last year. But my excitement comes from the AU$92k that Non-Executive Director Grant Murdoch spent buying shares (at an average price of about AU$6.54).

The good news, alongside the insider buying, for Auswide Bank bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have AU$37m worth of shares. That's a lot of money, and no small incentive to work hard. That amounts to 13% of the company, demonstrating a degree of high-level alignment with shareholders.

Does Auswide Bank Deserve A Spot On Your Watchlist?

One important encouraging feature of Auswide Bank is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. We should say that we've discovered 2 warning signs for Auswide Bank that you should be aware of before investing here.

As a growth investor I do like to see insider buying. But Auswide Bank isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.