D.R. Horton (DHI) Q2 Earnings & Revenues Beat, Shares Rise

D.R. Horton, Inc.’s DHI second-quarter fiscal 2022 earnings and revenues beat the respective Zacks Consensus Estimate, as well as improved on a year-over-year basis. The company increased its revenue guidance for the full year, depicting DHI’s industry-leading market share, broad geographic footprint and diverse product offerings across multiple brands.

Shares of the company gained 3.1% following the earnings release on Apr 26.

Pertaining to fiscal second-quarter results, Donald R. Horton, the chairman of the board, said, “Housing market conditions remain strong despite the rise in mortgage rates, as we continue to experience homebuyer demand that exceeds our pace of supply. We are still selling homes later in the construction cycle to better ensure the certainty of the home close date for our homebuyers, and we are continuing to work to stabilize and then reduce our construction cycle times to historical norms. With 33,900 homes in backlog, 59,800 homes in inventory, a robust lot supply and strong trade and supplier relationships, we are well-positioned to grow our consolidated revenues by more than 25% in fiscal 2022.”

Earnings & Revenue Discussion

DHI reported adjusted earnings of $4.03 per share for the quarter, surpassing the Zacks Consensus Estimate of $3.37 by 19.6% and increasing a whopping 59% from the year-ago period.

Total revenues (Homebuilding, Forestar, Rental and Financial Services) came in at $8 billion, up 24.1% year over year. The reported figure surpassed the consensus mark of $7.62 billion.

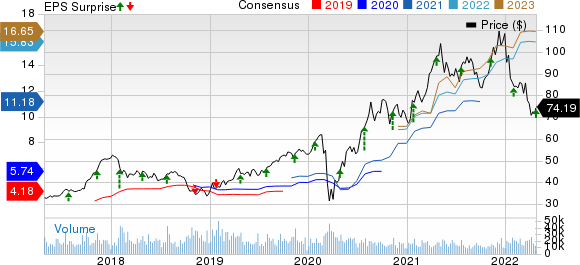

D.R. Horton, Inc. Price, Consensus and EPS Surprise

D.R. Horton, Inc. price-consensus-eps-surprise-chart | D.R. Horton, Inc. Quote

Segment Details

Homebuilding revenues of $7.51 billion increased 21.4% from the prior-year quarter. The upside was led by higher pricing.

Home closings inched up 1% from the prior-year quarter to 19,828 homes, but homes closed increased 21.5% in value to $7.5 billion.

Net sales orders declined 10% year over year to 24,340 homes. Nonetheless, the value of net orders advanced 10.2% year over year to $9.7 billion. The cancellation rate was 16%, up from 15% a year ago.

Order backlog of homes at quarter-end was 33,859 homes, down 5.5% year over year. Nonetheless, the value of the backlog was up 14.6% from the prior year to $13.31 billion.

Financial Services’ revenues decreased 1.3% from the year-ago level to $222.1 million.

Forestar contributed $421.6 million to total quarterly revenues, reflecting a decline from $287.1 million a year ago.

The Rental business generated revenues of $222.9 million for the quarter.

Margins

Consolidated pre-tax margin expanded 520 basis points to 23.5% for the quarter.

Balance Sheet Details

D.R. Horton’s cash, cash equivalents and restricted cash totaled $1.69 billion as of Mar 31, 2022 compared with $3.24 billion at fiscal 2021-end. At fiscal second quarter-end, it had $2 billion of available capacity on the revolving credit facility. Total homebuilding liquidity was $3.2 billion.

At fiscal second quarter-end, DHI had 59,800 homes in inventory, of which 26,000 were unsold. D.R. Horton’s homebuilding land and lot portfolio totaled 574,000 lots at fiscal second quarter-end. Of these, 23% were owned, and 77% were controlled through land and lot purchase contracts.

At March-end, homebuilding debt totaled $3.3 billion, with homebuilding debt to total capital of 16.4%. The trailing 12-month return on equity was 34%.

D.R. Horton repurchased 3.1 million shares of common stock for $266 million during the fiscal second quarter. The company’s remaining stock repurchase authorization as of Mar 31, 2022 totaled $2 million.

Fiscal 2022 Guidance Updated

Total revenues are now expected in the range of $35.3-$36.1 billion versus $34.5-$35.5 billion projected earlier. Homes closed are anticipated within 88,000-90,000 units versus 90,000-92,000 units expected earlier. The income tax rate is expected to be 24%. The company expects shares outstanding to be 3% lower than fiscal 2021-end.

Zacks Rank

Currently, D.R. Horton carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some Recent Construction Releases

UFP Industries, Inc.’s UFPI first-quarter 2022 earnings and net sales beat the Zacks Consensus Estimate as well as improved impressively on a year-over-year basis.

With this, UFPI’s earnings and sales surpassed the consensus mark in all the trailing five quarters. The uptrend was mainly driven by the diversity of markets and an improved pricing model.

Acuity Brands, Inc. AYI reported impressive second-quarter fiscal 2022 results, wherein both the top and bottom lines handily beat the Zacks Consensus Estimate as well as improved from the prior year.

Despite global supply chain challenges and unpredictable market conditions, AYI’s higher sales from both the segments along with price increases and product and productivity improvements drove the results.

Watsco, Inc. WSO reported stellar results for first-quarter 2022. The company’s earnings and sales topped their respective Zacks Consensus Estimate as well as increased strongly on a year-over-year basis.

WSO is benefiting from regular investments in customer-focused technologies and the expansion of its branch network. Also, continued investment in technologies designed to revolutionize customer experience added to the positives.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UFP Industries, Inc. (UFPI) : Free Stock Analysis Report

Watsco, Inc. (WSO) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

Acuity Brands Inc (AYI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research