REAL TIME PRICE

EXTENDED HOURS

| Day’s Range | - |

| 52 Week Range | - |

Flutter Entertainment (FLUT) Price Target Increased by 5.51% to 247.22

The average one-year price target for Flutter Entertainment (NYSE:FLUT) has been revised to 247.215 / share. This is an increase of 5.51% from the prior estimate of 234.30 dated March 30, 2024.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 200.41 to a high of 326.28 / share. The average price target represents an increase of 30.28% from the latest reported closing price of 189.76 / share.

What are Other Shareholders Doing?

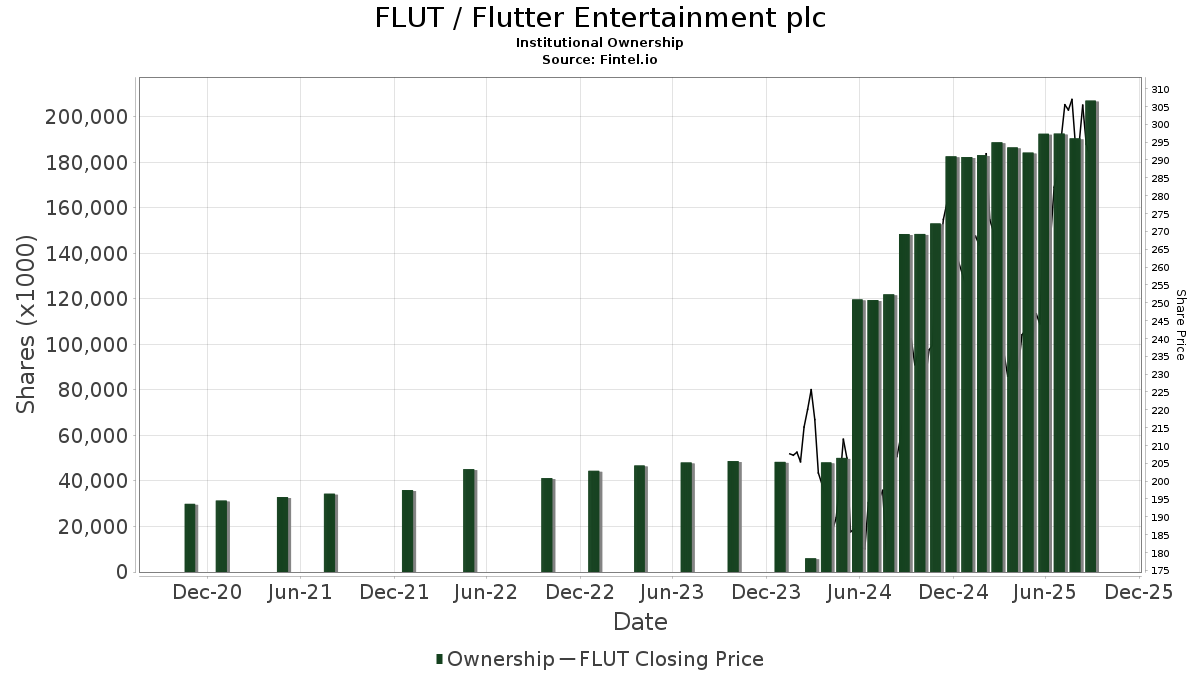

AEPGX - EUROPACIFIC GROWTH FUND holds 10,239K shares representing 5.77% ownership of the company. In its prior filing, the firm reported owning 664K shares , representing an increase of 93.52%. The firm increased its portfolio allocation in FLUT by 1,433.30% over the last quarter.

AGTHX - GROWTH FUND OF AMERICA holds 6,002K shares representing 3.38% ownership of the company. In its prior filing, the firm reported owning 5,730K shares , representing an increase of 4.53%. The firm increased its portfolio allocation in FLUT by 29.20% over the last quarter.

CWGIX - CAPITAL WORLD GROWTH & INCOME FUND holds 2,678K shares representing 1.51% ownership of the company. In its prior filing, the firm reported owning 2,682K shares , representing a decrease of 0.12%. The firm increased its portfolio allocation in FLUT by 28.93% over the last quarter.

VGTSX - Vanguard Total International Stock Index Fund Investor Shares holds 2,409K shares representing 1.36% ownership of the company. In its prior filing, the firm reported owning 2,393K shares , representing an increase of 0.66%. The firm increased its portfolio allocation in FLUT by 16.95% over the last quarter.

AMCPX - AMCAP FUND holds 2,181K shares representing 1.23% ownership of the company. In its prior filing, the firm reported owning 2,102K shares , representing an increase of 3.62%. The firm increased its portfolio allocation in FLUT by 29.44% over the last quarter.

Stories by George Maybach

Berenberg Bank Initiates Coverage of Porvair (LSE:PRV) with Buy Recommendation

Fintel reports that on May 16, 2024, Berenberg Bank initiated coverage of Porvair (LSE:PRV) with a Buy recommendation.

Oppenheimer Initiates Coverage of Capricor Therapeutics (CAPR) with Outperform Recommendation

Fintel reports that on May 17, 2024, Oppenheimer initiated coverage of Capricor Therapeutics (NasdaqCM:CAPR) with a Outperform recommendation.

Lake Street Initiates Coverage of Mission Produce (AVO) with Buy Recommendation

Fintel reports that on May 17, 2024, Lake Street initiated coverage of Mission Produce (NasdaqGS:AVO) with a Buy recommendation.

Guggenheim Downgrades Lithia Motors (LAD)

Fintel reports that on May 17, 2024, Guggenheim downgraded their outlook for Lithia Motors (NYSE:LAD) from Buy to Neutral.

CL King Downgrades Cracker Barrel Old Country Store (CBRL)

Fintel reports that on May 17, 2024, CL King downgraded their outlook for Cracker Barrel Old Country Store (NasdaqGS:CBRL) from Buy to Neutral.

Scotiabank Downgrades Macerich (MAC)

Fintel reports that on May 17, 2024, Scotiabank downgraded their outlook for Macerich (NYSE:MAC) from Sector Perform to Sector Underperform.

Scotiabank Upgrades Tanger (SKT)

Fintel reports that on May 17, 2024, Scotiabank upgraded their outlook for Tanger (NYSE:SKT) from Sector Underperform to Sector Perform.

B of A Securities Upgrades Robinhood Markets (HOOD)

Fintel reports that on May 17, 2024, B of A Securities upgraded their outlook for Robinhood Markets (NasdaqGS:HOOD) from Underperform to Buy.

Jefferies Upgrades DuPont de Nemours (DD)

Fintel reports that on May 17, 2024, Jefferies upgraded their outlook for DuPont de Nemours (NYSE:DD) from Hold to Buy.

William Blair Downgrades SoundThinking (SSTI)

Fintel reports that on May 17, 2024, William Blair downgraded their outlook for SoundThinking (NasdaqCM:SSTI) from Outperform to Market Perform.