Texas Capital (TCBI) Q2 Earnings Top Estimates, Revenues Dip

Texas Capital Bancshares, Inc. TCBI reported adjusted earnings per share of $1.31 in second-quarter 2021, surpassing the Zacks Consensus Estimate of $1.22. Results compare favorably with the prior-year quarter’s reported a loss of 73 cents.

Lower expenses were driving factors. The firm’s credit quality witnessed an improvement. A fall in net interest income along with margin pressure was a deterrent.

Management noted, “Building on an incredibly productive first quarter, second quarter successes included executing our largest capital markets transaction to-date with a $375.0 million subordinated note issuance, making the strategic decision to sell our portfolio of mortgage servicing rights to better align resources for the future and continuing to add new talent in key strategic areas at a record-setting pace.”

Net income available to common stockholders for the reported quarter was $67.2 million against a net loss of $36.8 million in the prior-year quarter.

Revenues Decline, Costs Fall

Total revenues (net of interest expense) declined 19% year over year to $227.1 million in the second quarter due to a decline in both non-interest income and net interest income. Revenues lagged the Zacks Consensus Estimate of $238.3 million.

Texas Capital’s net interest income was around $197 million, down 6% year over year, as a fall in interest expenses was partly muted by lower interest income. Net interest margin contracted 20 basis points (bps) year over year to 2.10%.

Non-interest income decreased 57% to $30.1 million. The decline primarily resulted from a dip in net gain on the sale of loans held for sale as well as brokered loan fees, offset by increases in service charges on deposit accounts and other non-interest income.

Non-interest expenses decreased 32% to $149.1 million from the prior-year quarter. This mainly resulted from decreases in marketing expenses, communication and technology expenses, servicing-related and merger-related expenses.

As of Jun 30, 2021, total loans declined 1.9% on a sequential basis to $23.94 billion, while deposits declined 13.6% to $28.8 billion.

Credit Quality Strengthens

Non-performing assets totaled 0.36% of the loan portfolio plus other real estate-owned assets compared with the prior-year quarter’s figure of 0.68%. Total non-performing assets declined 50.2% to $86.6 million compared with the prior-year quarter.

Negative provisions for credit losses aggregated $19 million against the provision expenses of $100 million in the year-ago quarter. The company’s net charge-offs were $2.4 million compared with $74.1 million as of Jun 30, 2020.

Capital Ratios Improve

The company’s capital ratios improved in the second quarter. Tangible common equity to total tangible assets came in at 7.9% compared with the year-earlier quarter’s 7%.

Common equity Tier 1 ratio was 10.5%, up from the prior-year quarter’s 8.8%. Leverage ratio was 8.4% compared with 7.5% as of Jun 30, 2020.

Stockholders’ equity was up 11.9% year over year to $3.2 billion as of Jun 30, 2021.

Conclusion

Texas Capital’s controlled expenses and a solid balance sheet during the June-end quarter look impressive. Apart from this, an improving economic situation is anticipated to enable the company to decrease the provision for credit losses and drive the performance in the days to come. However, margin pressure might erode near-term profitability.

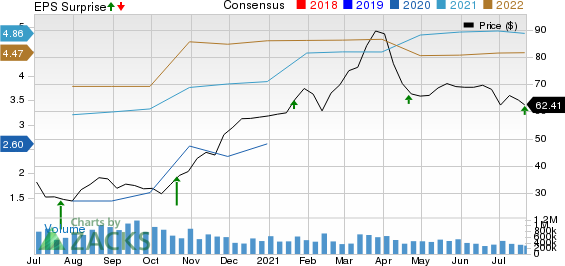

Texas Capital Bancshares, Inc. Price, Consensus and EPS Surprise

Texas Capital Bancshares, Inc. price-consensus-eps-surprise-chart | Texas Capital Bancshares, Inc. Quote

Currently, Texas Capital carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

KeyCorp’s KEY second-quarter 2021 earnings of 72 cents per share handily surpassed the Zacks Consensus Estimate of 55 cents. The bottom line improved substantially from 16 cents earned in the prior-year quarter.

Zions Bancorporation’s ZION second-quarter 2021 net earnings per share of $2.08 surpassed the Zacks Consensus Estimate of $1.25. The bottom line marks a significant improvement from 34 cents earned in the year-ago quarter.

State Street’s STT second-quarter 2021 adjusted earnings of $1.97 per share outpaced the Zacks Consensus Estimate of $1.78. The bottom line was 4.8% higher than the prior-year level.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

State Street Corporation (STT) : Free Stock Analysis Report

Texas Capital Bancshares, Inc. (TCBI) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

Zions Bancorporation, N.A. (ZION) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research