General Mills (GIS) Sells Helper & Suddenly Salad Businesses

General Mills, Inc. GIS is progressing well with its Accelerate strategy. The company concluded the sale of its Helper main meals and Suddenly Salad side dishes businesses to Eagle Family Foods Group for nearly $610 million in cash. Net sales from these businesses came in at roughly $235 million in fiscal 2021.

This divestiture goes in tandem with General Mills’ Accelerate strategy and enhances the company’s North America Retail unit’s growth profile. The sale of these businesses will help GIS increase its focus on categories and brands with better opportunities.

General Mills has also been undertaking prudent buyouts as part of its Accelerate strategy. To this end, the company acquired TNT Crust last month. TNT Crust is a manufacturer of high-quality frozen pizza crusts for regional and national pizza chains, foodservice distributors and retail outlets. Earlier a portfolio company of Peak Rock Capital, TNT Crust’s net sales came in at roughly $100 million in 2021. As part of this buyout, General Mills also bought two manufacturing facilities in Green Bay, WI, and one manufacturing facility in St. Charles, MO.

Let’s delve deeper into General Mills’ Accelerate strategy, which helped drive the company’s fourth-quarter fiscal 2022 results, which were reported last week.

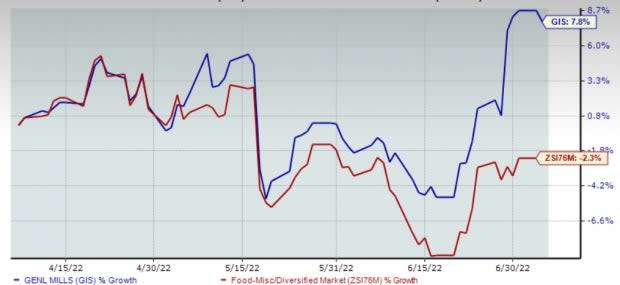

Image Source: Zacks Investment Research

Accelerate Strategy – a Key Driver

General Mills’ Accelerate strategy was unveiled in February 2021. The plan aids the company in making the choices of how to win and where to play to boost profitability while enhancing shareholder returns in the long run. Under how to win, General Mills is focused on four pillars that are designed to provide a competitive advantage. These include brand building, undertaking innovations, unleashing scale and maintaining business strength. The ‘where to play’ principle is outlined to enhance the company’s capabilities to generate profitability through geographic and product prioritization along with portfolio restructuring. This includes prioritizing investments, investing in five Global Platforms, driving growth in Local Gem brands and reshaping the portfolio.

General Mills is focused on reshaping the portfolio to accelerate growth. The company concluded the acquisition of Tyson Foods’ pet treats business on Jul 6, 2021. GIS noted that the acquisition bodes well amid growing pet-food category trends stemming from the humanization of pets, especially in the pandemic. In another move, General Mills divested a 51% controlling interest in its European Yoplait operations to Sodiaal in November 2021. On Nov 24, 2021, General Mills unveiled plans to offload its European dough businesses to a leading ready-to-bake dough solutions company – Cerelia.

A Look at Q4 & Ahead

General Mills posted robust fourth-quarter fiscal 2022 results, wherein the top and bottom lines increased year over year and beat the Zacks Consensus Estimate. The company continued to benefit from its Accelerate strategy, as part of which it remains focused on its core business and portfolio-reshaping actions. Management announced or concluded seven transactions, including buyouts and divestitures, in fiscal 2022, aimed at driving growth in the long run.

Adjusted earnings per share (EPS) of $1.12 rose 23% year over year on a constant-currency (cc) basis. The upside can be mainly attributed to the elevated adjusted operating profit and reduced average diluted shares outstanding. The bottom line surpassed the Zacks Consensus Estimate of $1.01 per share. Net sales of $4,891.2 million advanced 8% from the year-ago quarter’s figure. The top line surpassed the Zacks Consensus Estimate of $4,802 million.

For fiscal 2023, organic net sales are anticipated to grow roughly 4-5%. The net effect of divestitures, buyouts and currency movements is anticipated to lower the full-year net sales growth by roughly 3%. The adjusted operating profit growth at cc is anticipated between a 2% decline and an increase of 1%. This includes a 3-point net adverse impact of divestitures and buyouts concluded in fiscal 2022. Adjusted EPS growth at cc is envisioned to be flat to up 3%. This includes a 3-point net adverse impact of divestitures and buyouts concluded in fiscal 2022. Currency woes are likely to have a nearly 1% adverse impact on the adjusted operating profit and adjusted EPS.

Shares of this Zacks Rank #3 (Hold) company have risen 7.8% in the past three months against the industry’s decline of 2.3%.

3 Solid Staple Stocks

Some better-ranked stocks are Sysco Corporation SYY, Pilgrim’s Pride PPC and Campbell Soup CPB.

Sysco, which engages in marketing and distributing various food and related products, sports a Zacks Rank #1 (Strong Buy). Sysco has a trailing four-quarter earnings surprise of 9.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for SYY’s current financial-year sales and EPS suggests growth of 32.6% and 124.3%, respectively, from the year-ago reported number.

Pilgrim’s Pride, which produces, processes, markets and distributes fresh, frozen and value-added chicken and pork products, carries a Zacks Rank #2 (Buy). Pilgrim’s Pride has a trailing four-quarter earnings surprise of 31.4%, on average.

The Zacks Consensus Estimate for PPC’s current financial-year EPS suggests growth of almost 43% from the year-ago reported number.

Campbell Soup, which manufactures and markets food and beverage products, currently carries a Zacks Rank #2. Campbell Soup has a trailing four-quarter earnings surprise of 10.8%, on average.

The Zacks Consensus Estimate for CPB’s current financial-year sales suggests growth of 0.5% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Campbell Soup Company (CPB) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

Pilgrim's Pride Corporation (PPC) : Free Stock Analysis Report

To read this article on Zacks.com click here.