REAL TIME PRICE

EXTENDED HOURS

| Day’s Range | - |

| 52 Week Range | - |

| Fire, Marine, and Casualt... | |

Hartford Financial Services Group (HIG) Price Target Increased by 7.56% to 111.26

The average one-year price target for Hartford Financial Services Group (NYSE:HIG) has been revised to 111.26 / share. This is an increase of 7.56% from the prior estimate of 103.45 dated March 28, 2024.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 85.85 to a high of 151.20 / share. The average price target represents an increase of 13.85% from the latest reported closing price of 97.73 / share.

Hartford Financial Services Group Declares $0.47 Dividend

On February 21, 2024 the company declared a regular quarterly dividend of $0.47 per share ($1.88 annualized). Shareholders of record as of March 4, 2024 received the payment on April 2, 2024. Previously, the company paid $0.47 per share.

At the current share price of $97.73 / share, the stock's dividend yield is 1.92%.

Looking back five years and taking a sample every week, the average dividend yield has been 2.41%, the lowest has been 1.83%, and the highest has been 4.23%. The standard deviation of yields is 0.46 (n=233).

The current dividend yield is 1.07 standard deviations below the historical average.

Additionally, the company's dividend payout ratio is 0.22. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is 0.34%, demonstrating that it has increased its dividend over time.

What is the Fund Sentiment?

There are 1783 funds or institutions reporting positions in Hartford Financial Services Group.

This is an increase

of

91

owner(s) or 5.38% in the last quarter.

Average portfolio weight of all funds dedicated to HIG is 0.26%,

a decrease

of 1.07%.

Total shares owned by institutions decreased

in the last three months by 0.54% to 324,368K shares.

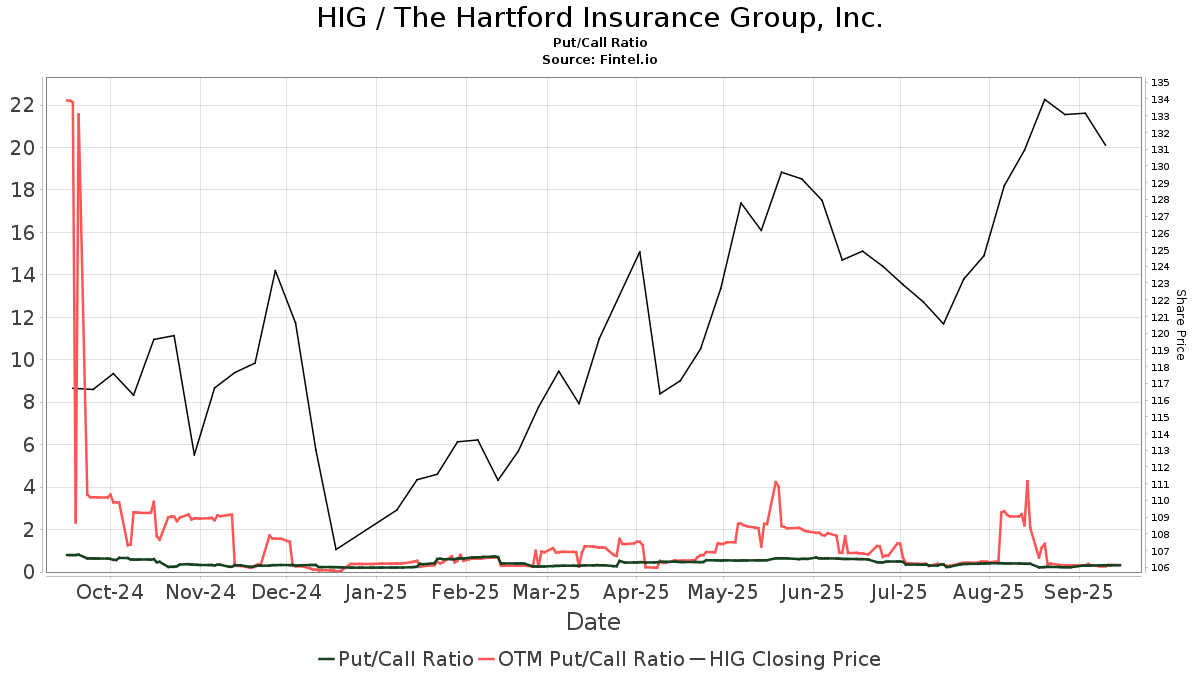

The put/call ratio of HIG is 1.08, indicating a

bearish

outlook.

The put/call ratio of HIG is 1.08, indicating a

bearish

outlook.

What are Other Shareholders Doing?

Price T Rowe Associates holds 18,659K shares representing 6.28% ownership of the company. In it's prior filing, the firm reported owning 21,969K shares, representing a decrease of 17.74%. The firm decreased its portfolio allocation in HIG by 11.72% over the last quarter.

Jpmorgan Chase holds 10,556K shares representing 3.55% ownership of the company. In it's prior filing, the firm reported owning 12,883K shares, representing a decrease of 22.04%. The firm decreased its portfolio allocation in HIG by 90.99% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 9,432K shares representing 3.17% ownership of the company. In it's prior filing, the firm reported owning 9,503K shares, representing a decrease of 0.75%. The firm increased its portfolio allocation in HIG by 0.54% over the last quarter.

VFINX - Vanguard 500 Index Fund Investor Shares holds 7,346K shares representing 2.47% ownership of the company. In it's prior filing, the firm reported owning 7,348K shares, representing a decrease of 0.03%. The firm increased its portfolio allocation in HIG by 0.09% over the last quarter.

Invesco holds 7,207K shares representing 2.42% ownership of the company. In it's prior filing, the firm reported owning 7,421K shares, representing a decrease of 2.98%. The firm decreased its portfolio allocation in HIG by 91.14% over the last quarter.

Hartford Financial Services Group Background Information

(This description is provided by the company.)

The Hartford is a leader in property and casualty insurance, group benefits and mutual funds. With more than 200 years of expertise, The Hartford is widely recognized for its service excellence, sustainability practices, trust and integrity.

Stories by George Maybach

JP Morgan Upgrades Joby Aviation (JOBY)

Fintel reports that on May 3, 2024, JP Morgan upgraded their outlook for Joby Aviation (NYSE:JOBY) from Underweight to Neutral.

JP Morgan Downgrades Driven Brands Holdings (DRVN)

Fintel reports that on May 3, 2024, JP Morgan downgraded their outlook for Driven Brands Holdings (NasdaqGS:DRVN) from Overweight to Neutral.

JP Morgan Downgrades Vestis (VSTS)

Fintel reports that on May 3, 2024, JP Morgan downgraded their outlook for Vestis (NYSE:VSTS) from Overweight to Neutral.

JP Morgan Upgrades Williams-Sonoma (WSM)

Fintel reports that on May 3, 2024, JP Morgan upgraded their outlook for Williams-Sonoma (NYSE:WSM) from Underweight to Neutral.

BMO Capital Upgrades Coeur Mining (CDE)

Fintel reports that on May 3, 2024, BMO Capital upgraded their outlook for Coeur Mining (NYSE:CDE) from Market Perform to Outperform.

Craig-Hallum Downgrades XPEL (XPEL)

Fintel reports that on May 3, 2024, Craig-Hallum downgraded their outlook for XPEL (NasdaqCM:XPEL) from Buy to Hold.

Bernstein Downgrades Peloton Interactive (PTON)

Fintel reports that on May 3, 2024, Bernstein downgraded their outlook for Peloton Interactive (NasdaqGS:PTON) from Outperform to Market Perform.

JP Morgan Upgrades Mister Car Wash (MCW)

Fintel reports that on May 3, 2024, JP Morgan upgraded their outlook for Mister Car Wash (NYSE:MCW) from Neutral to Overweight.

RBC Capital Initiates Coverage of FTAI Aviation (FTAI) with Outperform Recommendation

Fintel reports that on May 3, 2024, RBC Capital initiated coverage of FTAI Aviation (NasdaqGS:FTAI) with a Outperform recommendation.

Compass Point Downgrades Centerspace (CSR)

Fintel reports that on May 3, 2024, Compass Point downgraded their outlook for Centerspace (NYSE:CSR) from Buy to Neutral.