Adtalem (ATGE) Up on Financial Services Unit Sale Announcement

Adtalem Global Education Inc. ATGE has inked a deal with a consortium of Wendel Group and Colibri Group to sell its Financial Services segment for $1 billion in cash. The deal is likely to close in third-quarter fiscal 2022, subject to customary closing conditions.

The Financial Services segment — which includes ACAMS (Association of Certified Anti-Money Laundering Specialists), Becker Professional Education and OnCourse Learning — will be treated as a held for sale and discontinued operation beginning second-quarter fiscal 2022. The company is scheduled to report fiscal second-quarter results on Feb 8.

Post the news release, ATGE’s shares jumped a whopping 13.7% during the trading session on Jan 24.

Image Source: Zacks Investment Research

Steve Beard, president and CEO of Adtalem, said, "This transaction is the culmination of a long-term strategy to sharpen the focus of our portfolio and greatly enhance our ability to address – at scale – the rapidly growing and unmet demand for healthcare professionals in the U.S."

Increased Focus on Healthcare Institutions to Boost Growth

The Medical and Healthcare segment, which accounted for 81.5% of Adtalem’s total fiscal 2021 revenues, includes operations of Chamberlain and medical and veterinary schools (comprising American University of the Caribbean School of Medicine or AUC, Ross University School of Medicine or RUSM, and Ross University School of Veterinary Medicine or RUSVM).

The company’s health care and international institutions have shown significant improvement in revenues and profitability since fiscal 2013. In particular, healthcare institution Chamberlain’s new and total student enrollment was solid in fiscal 2021. Although first-quarter fiscal 2022 enrollment declined from record-high enrollment in the comparable year-ago period, the company expects demand for healthcare professionals to outpace supply in the future.

This university remains well positioned to gain from the growing demand for nurses and other healthcare professionals and the increasing roles they play in the healthcare industry. The company has plans to capitalize on this supply-demand imbalance in nursing and the broader healthcare industry by investing in new programs in the markets wherein it sees the maximum demand. The company is optimistic about the demand trend in the medical and healthcare segment from both students and employees.

In this regard, ATGE acquired Laureate Education, Inc.’s LAUR leading online healthcare education unit — Walden University. Also, it recently launched a research-based program, the Social Determinants of Learning.

In fiscal 2021, Chamberlain announced a partnership with Stride, Inc. to motivate high school students for nursing careers — one of the nation’s top in-demand healthcare jobs — with Stride Career Prep.

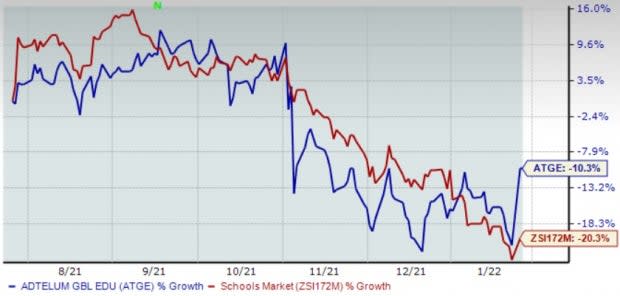

In the past six months, shares of Adtalem have outperformed the Zacks Schools industry. Adtalem has been witnessing solid demand for its programs and offerings, leading to growth in new student enrollment at Medical and Healthcare institutions. Also, the company’s strategic initiatives are expected to boost enrolment.

Zacks Rank

Adtalem currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some Better-Ranked Stocks in the Zacks Consumer Discretionary Sector

Some better-ranked stocks in the Zacks Consumer Discretionary sector include Laureate Education, Universal Technical Institute, Inc. UTI and Pool Corporation POOL.

Baltimore, MD-based Laureate Education has been benefiting from higher enrollment, given the recovery of the Latin American higher-education market from the damages caused by the COVID-19 pandemic and robust growth from Laureate's investments in new digital capabilities. The company has carried out divestiture programs that drove significant value for shareholders over the years. Its best-in-class digital learning assets and physical footprint in Mexico and Peru have been driving growth. The company expects to carry out a more capital-efficient business model that delivers high-quality education via efficient omni-channel distribution modes.

Laureate Education currently carries a Zacks Rank #2 (Buy). This company’s earnings for 2021 are expected to grow 168.9%.

Universal Technical provides technical education training in automotive, diesel, collision repair and refinishing, motorcycle, marine and personal watercraft technologies.

The company’s expected earnings growth rate for fiscal 2022 stands at 59.3%. Universal Technical currently has a Zacks Rank #2.

Pool Corp. is a wholesale distributor of swimming pool supplies, equipment and related products. The company is gaining from the solid performance of the base business, a large market presence and strategic expansions through acquisitions. It is also benefiting from solid demand across heaters, pumps, filters, lighting, automation and pool remodeling. The company remains optimistic about its products (such as automation and the connected pool), the continuation of de-urbanization trends along with strengthening of the southern migration.

Pool Corp. currently carries a Zacks Rank #2. For 2021, Pool Corp.’s earnings are expected to grow 80.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pool Corporation (POOL) : Free Stock Analysis Report

Universal Technical Institute Inc (UTI) : Free Stock Analysis Report

Laureate Education (LAUR) : Free Stock Analysis Report

Adtalem Global Education Inc. (ATGE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research