NBT Bancorp Inc. (NBTB) Reports Q1 2024 Earnings: Aligns with Analyst EPS Projections

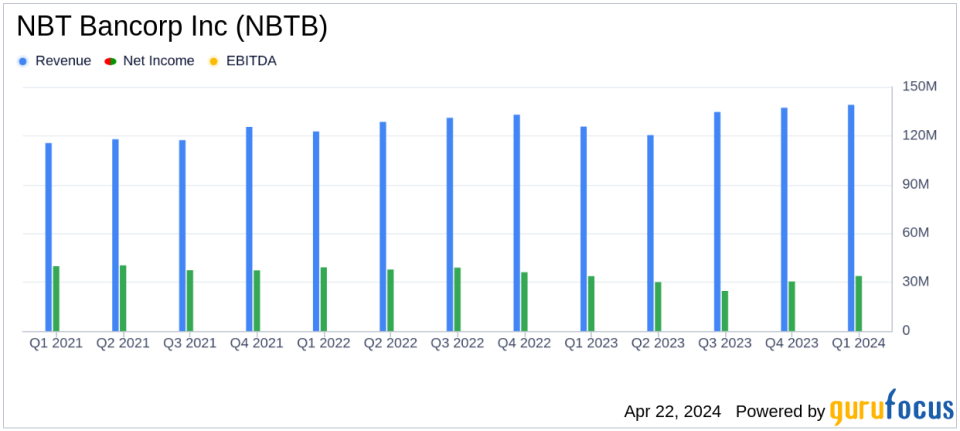

Net Income: Reported $33.8 million for Q1 2024, slightly above the estimate of $32.18 million.

Earnings Per Share (EPS): Achieved $0.71 per diluted share, surpassing the estimated $0.68.

Revenue: Generated $95.8 million in net interest income on a fully taxable equivalent basis for Q1 2024.

Loan Growth: Total loans reached $9.69 billion as of March 31, 2024, marking a 1.6% annualized increase from the end of 2023.

Deposit Increase: Deposits rose to $11.20 billion, up 2.1% from December 31, 2023.

Noninterest Income: Accounted for $43.2 million, representing 31.2% of total revenues, excluding net securities gains (losses).

Capital Ratios: Common equity tier 1 (CET1) ratio stood at 11.68%, indicating a robust capital position.

NBT Bancorp Inc. (NASDAQ:NBTB) disclosed its first-quarter financial results for 2024 on April 22, 2024, through its 8-K filing. The company reported a net income of $33.8 million, translating to $0.71 per diluted share, which aligns closely with analyst expectations of $0.68 per share. This performance marks a slight increase from the previous year's first quarter net income of $33.7 million, or $0.78 per diluted share.

NBT Bancorp Inc., headquartered in Norwich, NY, operates primarily through its subsidiary, NBT Bank, N.A., and other financial services entities. The bank offers a comprehensive range of retail and commercial banking products, along with trust and investment services, across multiple Northeastern states. A significant portion of its loan portfolio is dedicated to commercial loans, reflecting its strategic focus on serving the varied needs of individuals, corporations, and municipalities.

Quarterly Financial Highlights

The company's net interest income on a fully taxable equivalent basis was $95.8 million with a net interest margin (NIM) of 3.14%, showing a minor decrease from the previous quarter. Noninterest income was robust at $43.2 million, contributing to 31.2% of total revenues, excluding net securities gains and losses. This diversification in revenue streams underscores NBT's strategic initiatives to mitigate risks associated with fluctuating interest rates.

Total loans by the end of the quarter stood at $9.69 billion, marking a modest increase from the previous quarter, while deposits saw a more significant rise of 2.1% to $11.20 billion. The increase in deposits highlights strong customer trust and a solid market presence.

Operational and Strategic Developments

John H. Watt, Jr., President and CEO of NBT, commented on the quarter's performance, emphasizing the resilience of the bank's balance sheet and its strategic positioning for growth, particularly in light of recent substantial investments in semiconductor manufacturing in Upstate NY. These developments are expected to transform the regional economic landscape and present new opportunities for growth and expansion for NBT.

The bank's asset quality remains stable with nonperforming loans to total loans ratio consistent at 0.39%. The allowance for loan losses to total loans was reported at 1.19%, indicating prudent risk management and credit policies in place.

Capital and Liquidity

NBT Bancorp maintains a strong capital position with a CET1 ratio of 11.68% and a leverage ratio of 10.09%. These metrics reflect the bank's robust financial health and its ability to withstand economic fluctuations. Additionally, the tangible book value per share stood at $22.07, providing an attractive value proposition to investors.

Looking Forward

As NBT Bancorp continues to navigate a complex banking environment, its focus on expanding fee-based businesses and leveraging significant regional economic developments positions it well for sustained growth. The bank's strategic initiatives are aligned with its long-term objectives of maximizing shareholder value and enhancing its competitive stance in the Northeastern banking sector.

The company will host a conference call to discuss the quarterly results further and outline future strategies, which will likely provide additional insights into its operational tactics and financial health.

For detailed financial figures and future updates, stakeholders and interested investors are encouraged to refer to the official NBT Bancorp communications and filings.

Explore the complete 8-K earnings release (here) from NBT Bancorp Inc for further details.

This article first appeared on GuruFocus.