First Eagle Investment's Strategic Moves in Q1 2024: A Closer Look at Meta Platforms Inc

Insights into First Eagle's Latest 13F Filing and Its Impact on Portfolio Dynamics

First Eagle Investment (Trades, Portfolio), with its rich heritage dating back to 1864, stands as a beacon of value-oriented investment philosophy. As an independent investment management firm, First Eagle is committed to preserving capital through absolute long-term performance, employing rigorous bottom-up fundamental analysis to minimize risk. Their strategy is deeply rooted in acquiring securities whose intrinsic value and long-term potential significantly outweigh the perceived market risks. This approach is evident in their latest 13F filing for the first quarter of 2024, which reveals significant transactions including new buys, position increases, and notable reductions.

Summary of New Buys

During the first quarter of 2024, First Eagle Investment (Trades, Portfolio) expanded its portfolio by adding 23 new stocks. Noteworthy additions include:

Gold Fields Ltd (NYSE:GFI), purchasing 5,369,818 shares, making up 0.19% of the portfolio, valued at $85.33 million.

Kinross Gold Corp (NYSE:KGC), with 3,900,000 shares, representing about 0.05% of the portfolio, totaling $23.91 million.

Healthpeak Properties Inc (NYSE:DOC), acquiring 421,692 shares, which account for 0.02% of the portfolio, valued at $7.91 million.

Key Position Increases

First Eagle also strategically increased its stakes in 256 stocks, with significant boosts in:

Barrick Gold Corp (NYSE:GOLD), adding 14,138,639 shares, bringing the total to 58,820,050 shares. This adjustment increased the share count by 31.64%, impacting the portfolio by 0.53%, with a total value of $978.77 million.

C.H. Robinson Worldwide Inc (NASDAQ:CHRW), with an additional 2,003,158 shares, bringing the total to 11,486,055 shares. This represents a 21.12% increase in share count, valued at $874.55 million.

Summary of Sold Out Positions

First Eagle Investment (Trades, Portfolio) exited 31 holdings in the first quarter of 2024, including:

S&P 500 ETF TRUST ETF (SPY), selling all 27,500 shares, impacting the portfolio by -0.03%.

QuidelOrtho Corp (NASDAQ:QDEL), liquidating all 195,936 shares, also resulting in a -0.03% portfolio impact.

Key Position Reductions

Reductions were made in 102 stocks, with significant cuts in:

Meta Platforms Inc (NASDAQ:META), reducing holdings by 2,054,359 shares, a -36.63% decrease, impacting the portfolio by -1.73%. The stock traded at an average price of $446.07 during the quarter, returning 0.86% over the past three months and 33.39% year-to-date.

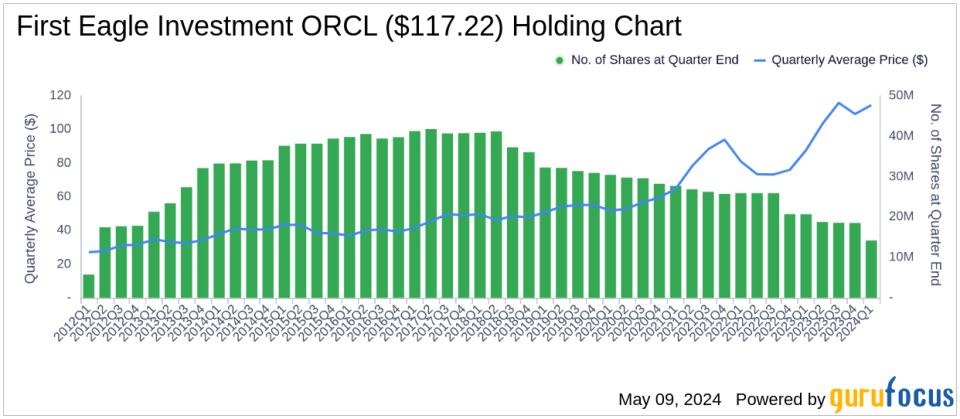

Oracle Corp (NYSE:ORCL), cutting 4,321,271 shares, a -23.33% reduction, impacting the portfolio by -1.09%. The stock's average trading price was $114.46 during the quarter, with returns of 0.70% over the past three months and 11.84% year-to-date.

Portfolio Overview

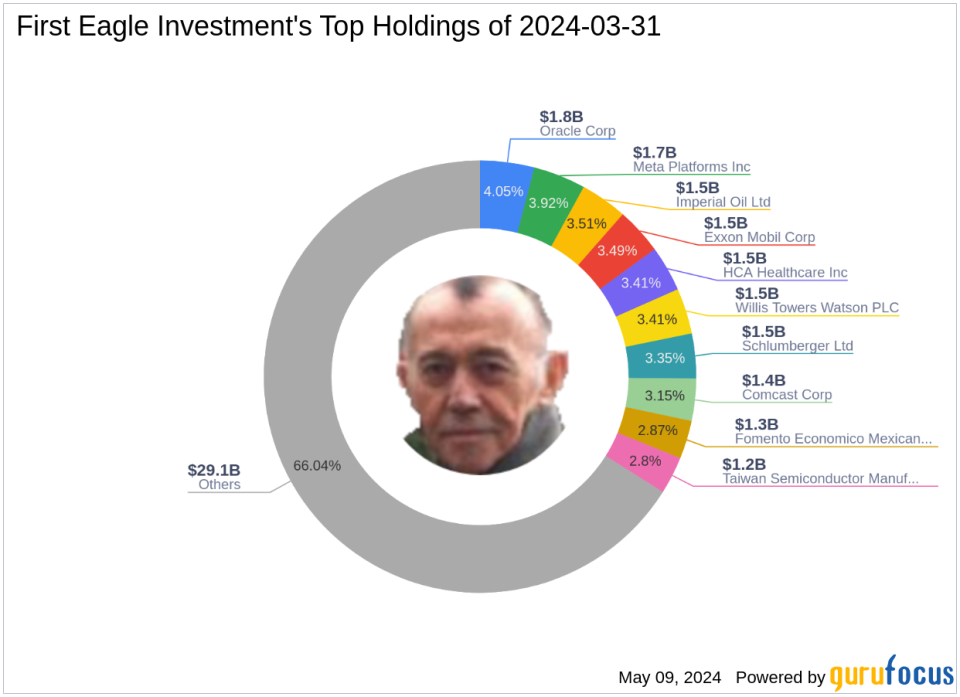

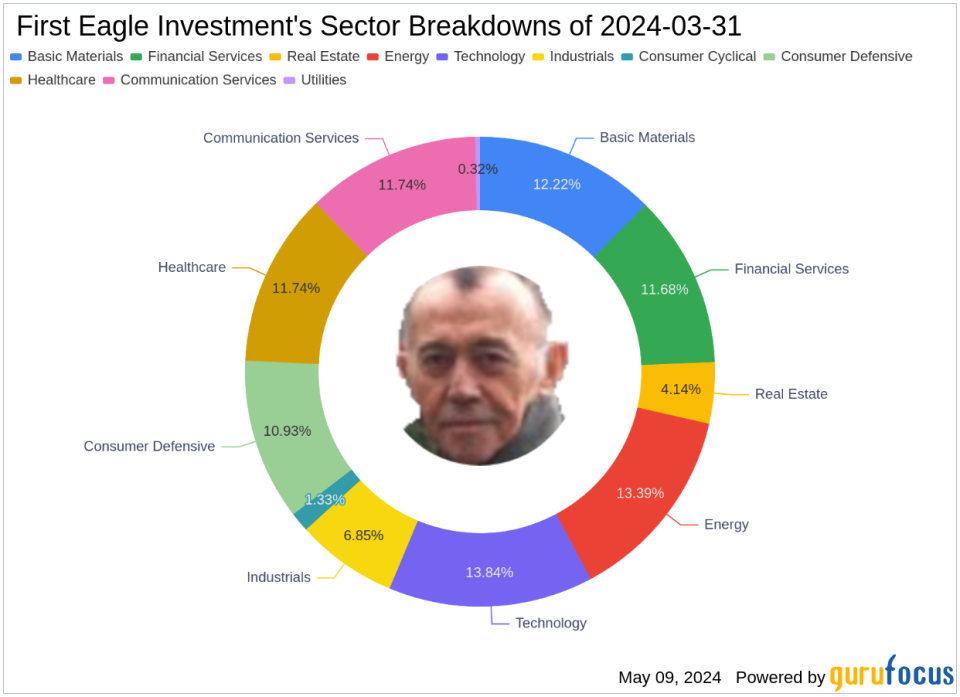

As of the first quarter of 2024, First Eagle Investment (Trades, Portfolio)'s portfolio included 403 stocks. The top holdings were 4.05% in Oracle Corp (NYSE:ORCL), 3.92% in Meta Platforms Inc (NASDAQ:META), 3.51% in Imperial Oil Ltd (IMO), 3.49% in Exxon Mobil Corp (NYSE:XOM), and 3.41% in HCA Healthcare Inc (NYSE:HCA). The holdings are predominantly concentrated across 11 industries, including Technology, Energy, Basic Materials, and others, reflecting a diverse and strategic allocation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.