Fortune Brands (FBHS) Q2 Earnings & Revenues Beat Estimates

Fortune Brands Home & Security, Inc. FBHS reported second-quarter 2021 earnings before charges/gains of $1.56 per share, which surpassed the Zacks Consensus Estimate of $1.37 by 13.9%. On a year-over-year basis, the bottom line increased 66% on the back of sales growth.

In the second quarter, Fortune Brands’ net sales were $1,936.1 million, increasing 41% from the year-ago figure. The improvement was driven by solid performance across all its segments. Also, the top line beat the consensus estimate of $1,885 million by 2.7%.

Segmental Details

Quarterly net sales for Cabinets grew 31% year over year to $706 million. Results were driven by continued solid demand for the company’s products.

Plumbing net sales increased 38% year over year to $694.6 million. Results were driven by impressive performance across the business.

Outdoors & Security’s net sales increased 61% to $535.5 million on the back of double-digit sales growth for composite decking, doors and security products.

Costs & Expenses

In the second quarter, Fortune Brands’ cost of sales increased 38% year over year to $1,230.3 million. It represented 63.5% of net sales compared with 64.9% in the year-ago quarter. Selling, general and administrative expenses increased 43% to $394.6 million, and represented 20.4% of the net sales compared with 20.1% a year ago.

Operating income before charges/gains increased 51% to $297.5 million. Operating margin before charges/gains climbed 110 basis points to 15.4%. Interest expenses decreased 4.5% to $21.2 million.

Balance Sheet

Exiting the second quarter, Fortune Brands’ cash and cash equivalents were $460 million, up 29.2% from $356.1 million at the end of the previous quarter. Its long-term debt decreased 2.8% to $2,608.3 million sequentially.

In the first six months of 2021, net cash provided by operating activities was $262.7 million compared with $260.5 million in the year-ago period. Capital expenditure amounted to $65.8 million, up from $42.3 million. In the first six months of the year, its free cash flow was $230.7 million, down 5.4% from the year-ago period.

In the first six months of 2021, the company rewarded shareholders with a dividend payout of $72 million. The amount represents growth of 8.1% year over year. Amount spent on purchasing treasury stock totaled $156 million, up 4%.

Outlook

For 2021, Fortune Brands anticipates sales to increase 23-25% from the previous year, higher than growth of 20-22% guided earlier. Earnings before charges/gains are estimated to be $5.65-$5.85 per share compared with 5.45-$5.65 per share predicted earlier. Also, it anticipates generating free cash flow of $675-$725 million.

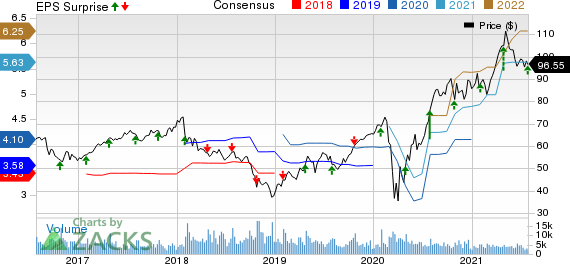

Fortune Brands Home & Security, Inc. Price, Consensus and EPS Surprise

Fortune Brands Home & Security, Inc. price-consensus-eps-surprise-chart | Fortune Brands Home & Security, Inc. Quote

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks are AZZ Inc. AZZ, Brady Corporation BRC and Donaldson Company, Inc. DCI. While AZZ currently sports a Zacks Rank #1 (Strong Buy), Brady and Donaldson carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AZZ delivered an earnings surprise of 21.24%, on average, in the trailing four quarters.

Brady delivered an earnings surprise of 1.58%, on average, in the trailing four quarters.

Donaldson delivered an earnings surprise of 9.02%, on average, in the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AZZ Inc. (AZZ) : Free Stock Analysis Report

Donaldson Company, Inc. (DCI) : Free Stock Analysis Report

Fortune Brands Home & Security, Inc. (FBHS) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research