Howmet Aerospace Inc. Surpasses First Quarter Revenue and Earnings Estimates, Boosts Full-Year ...

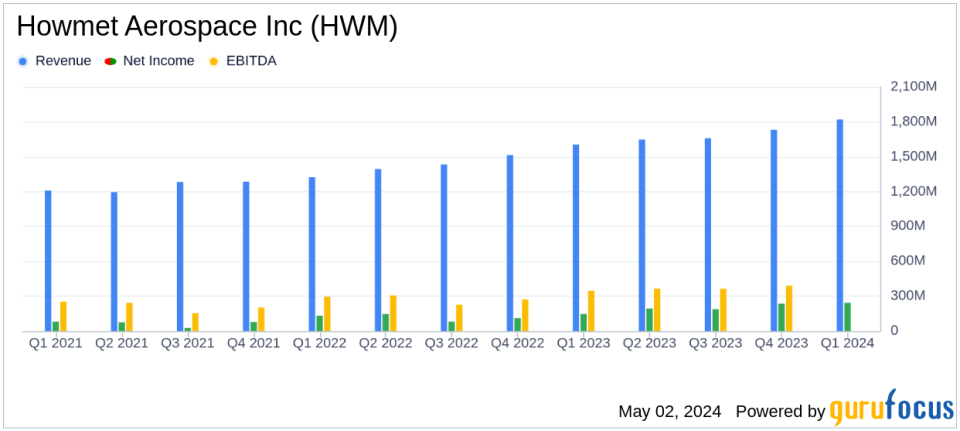

Revenue: Reported $1.82 billion in Q1 2024, a 14% increase year-over-year, surpassing the estimated $1.737 billion.

Net Income: Achieved $243 million in Q1 2024, significantly exceeding the estimated $213.89 million.

Earnings Per Share (EPS): Recorded $0.59 in Q1 2024, outperforming the estimated $0.52.

Adjusted EBITDA: Reached $437 million in Q1 2024, marking a 21% increase from the previous year.

Free Cash Flow: Posted $95 million in Q1 2024, marking the first positive cash flow for a first quarter.

Stock Repurchases: Invested $150 million in common stock repurchases, continuing a trend for the 12th consecutive quarter.

Dividend: Paid a quarterly common stock dividend of $0.05 per share and plans to increase it to $0.07 in Q3 2024, pending board approval.

On May 2, 2024, Howmet Aerospace Inc (NYSE:HWM) announced its first quarter results for 2024, revealing a significant outperformance against analyst expectations and an optimistic outlook for the rest of the year. The company reported a record first quarter revenue of $1.82 billion, a 14% increase year over year, surpassing the estimated $1.737 billion. Earnings per share (EPS) for the quarter stood at $0.59, also exceeding the forecast of $0.52. The full details of the financial performance can be accessed through Howmet Aerospace's 8-K filing.

Howmet Aerospace, headquartered in Pittsburgh, Pennsylvania, is a prominent player in the aerospace and transportation industries. The company specializes in advanced engineered solutions, focusing on jet engine components, aerospace fastening systems, and airframe structural components. Howmet operates through four segments: Engine Products, Fastening Systems, Engineered Structures, and Forged Wheels, delivering critical performance and efficiency enhancements across various applications.

Financial and Operational Highlights

The robust revenue growth was primarily fueled by a 23% increase in the commercial aerospace market. Adjusted net income for the quarter, excluding special items, was $238 million compared to $175 million in the first quarter of 2023, marking a substantial improvement. The adjusted EBITDA also saw a significant rise, reaching $437 million, up 21% from the previous year, with the margin expanding by approximately 150 basis points to 24.0%.

Operational efficiency and strategic stock repurchases underscored the quarter's success, with $150 million deployed towards buying back common stock. Looking forward, Howmet Aerospace raised its full-year 2024 revenue guidance by $200 million, reflecting a more favorable demand outlook despite production challenges with Boeing's 737 MAX.

Segment Performance and Future Outlook

Each of Howmet's business segments reported strong performance during the quarter. The Engine Products segment saw an 11% increase in revenue, while the Fastening Systems segment's revenue jumped 25%, driven by recovery in wide-body aircraft. The Engineered Structures and Forged Wheels segments also reported revenue increases of 27% and a stable performance, respectively.

CEO John Plant highlighted the exceptional start to the year, attributing the success to robust demand across all markets, particularly in commercial aerospace. He also noted the company's strong balance sheet and low leverage, which supports continued shareholder returns through dividends and stock repurchases. The quarterly dividend is expected to increase by 40% to $0.07 per share in the third quarter of 2024, pending board approval.

Strategic Moves and Industry Positioning

Howmet Aerospace's strategic initiatives, including a new $1 billion commercial paper program and an upgrade by Moodys to investment grade status, position the company well for sustained growth. These moves, coupled with continuous innovation and patent acquisitions, strengthen Howmet's competitive edge in the aerospace and transportation sectors.

In conclusion, Howmet Aerospace's first quarter performance not only surpassed expectations but also set a positive tone for the year. With increased guidance and strong market demand, the company is well-positioned to maintain its growth trajectory and enhance shareholder value.

For detailed insights and further information, visit Howmet Aerospace's official website or access the full earnings report and supplementary materials provided during their quarterly investor call.

Explore the complete 8-K earnings release (here) from Howmet Aerospace Inc for further details.

This article first appeared on GuruFocus.