Cliq Digital's (ETR:CLIQ) five-year earnings growth trails the 48% YoY shareholder returns

Cliq Digital AG (ETR:CLIQ) shareholders might be concerned after seeing the share price drop 28% in the last quarter. But that does not change the realty that the stock's performance has been terrific, over five years. In that time, the share price has soared some 514% higher! So we don't think the recent decline in the share price means its story is a sad one. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 36% drop, in the last year. Anyone who held for that rewarding ride would probably be keen to talk about it.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Cliq Digital

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

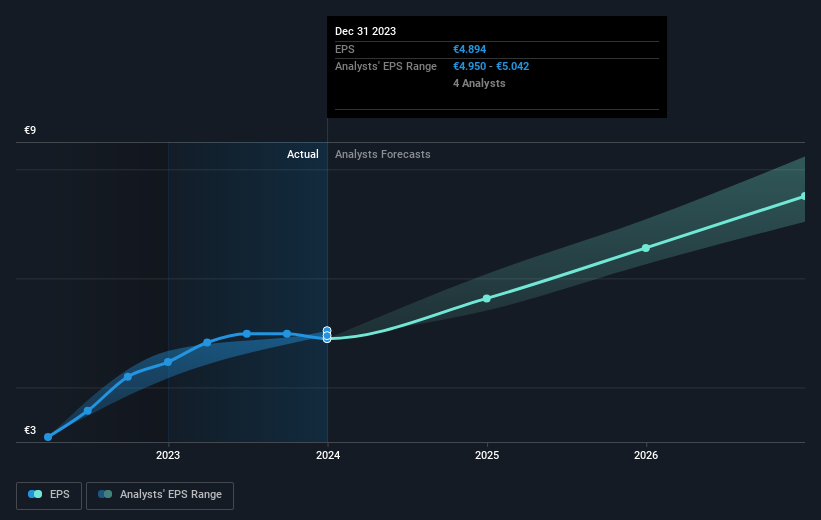

Over half a decade, Cliq Digital managed to grow its earnings per share at 70% a year. This EPS growth is higher than the 44% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. This cautious sentiment is reflected in its (fairly low) P/E ratio of 3.28.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Cliq Digital has grown profits over the years, but the future is more important for shareholders. This free interactive report on Cliq Digital's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered Cliq Digital's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Cliq Digital's TSR of 610% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

While the broader market gained around 5.7% in the last year, Cliq Digital shareholders lost 36%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 48%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Cliq Digital that you should be aware of.

But note: Cliq Digital may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.