Federal Realty (FRT) to Report Q2 Earnings: What to Expect?

Federal Realty Investment Trust FRT is set to report second-quarter 2021 results on Aug 4, after the bell. The company’s quarterly results will likely display increases in both revenues and funds from operations (FFO) per share.

In the last-reported quarter, this retail real estate investment trust (REIT) reported a surprise of 14.71% in terms of FFO per share. Results reflected higher-than-anticipated revenues.

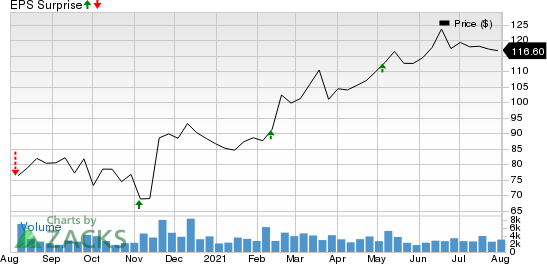

Over the last four quarters, Federal Realty surpassed estimates on three occasions and missed in the other, the average negative surprise being 3.32%. The graph below depicts the surprise history of the company:

Federal Realty Investment Trust Price and EPS Surprise

Federal Realty Investment Trust price-eps-surprise | Federal Realty Investment Trust Quote

Let’s see how things have shaped up prior to this announcement.

Key Factors

The retail real estate market had already been battling dwindling traffic issues, store closures and retailer bankruptcies, and then the pandemic had only aggravated its woes. However, per a report from CBRE Group CBRE, amid an improving economy and solid consumer demand, total retail sales jumped 31%, year over year, in the second quarter.

The total retail availability rate shrunk 30 basis points (bps), quarter over quarter, to 6.2%. There have been wide variations in availability rates by markets, with suburban and secondary markets outperforming urban cores. The second-quarter net absorption remained positive for the third straight quarter, highlighting continued demand recovery from the pandemic-induced disruptions. Moreover, average retail asking rent expanded 20 bps sequentially and 10 bps year over year, to $20.86 per square feet. While retail completions increased 48% quarter over quarter to 7.1 million square feet during the April-June period, the figure is down 10% from the prior year.

Federal Realty too is anticipated to have benefited from the recovery in the retail real estate market. The company has a portfolio of premium retail assets, mainly situated in the major coastal markets from Washington, D.C. to Boston, MA; San Francisco and Los Angeles. The company has strategically selected first ring suburbs of eight major metropolitan markets. Due to the strong demographics and infill nature of its properties, the company has been able to maintain a high occupancy level over the years. Moreover, its focus on open-air format and The Pick-Up concept are likely to have helped the company attract tenants in the second quarter amid the current health crisis.

The vaccination program acceleration, government stimulus measures and the reopening of the retail sector have encouragingly brought relief. The economy is improving, and the bounce back in consumer demand is boosting retail sales, which, in turn, are driving demand for the retail real estate space. Tenants now stand in a better position to generate revenues and meet their rent payments. Therefore, pressure on retail landlords might have reduced, and the company’s rent-collection figures are anticipated to have improved. As such, Federal Realty’s rent collection figures are expected to have improved in the second quarter.

Federal Realty has been capitalizing on expansion opportunities in premium markets, which generates income growth and creates long-term value, and this continued in the second quarter. In June 2021, the retail REIT announced the acquisition of four properties. Particularly, Federal Realty has acquired Grossmont Shopping Center in greater San Diego, CA and Chesterbrook Shopping Center in McLean, VA. Further, in the Phoenix Metro area, AZ, the company entered into a binding contract to buy Camelback Colonnade and Hilton Village. The buyouts are strategic fits, given the scope for value creation through redevelopment, merchandising and capital investment.

The Zacks Consensus Estimate for quarterly revenues is pegged at $219.86 million, calling for a 24.8% increase from the year-ago period. The consensus mark for rental revenues is $216 million, up from the year-ago period’s $175 million.

Federal Realty’s activities during the soon-to-be-reported quarter were adequate to gain analysts’ confidence. The Zacks Consensus Estimate for the second-quarter FFO per share has been revised a cent upward to $1.16 in a month’s time. It also suggests 50.6% growth year on year.

Here is what our quantitative model predicts:

Our proven model predicts a surprise in terms of FFO per share for Federal Realty this season. The combination of a positive Earnings ESP, and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), increases the chances of a FFO beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Federal Realty currently carries a Zacks Rank of 3 and has an Earnings ESP of +2.11%.

Other Stocks That Warrant a Look

Here are a few other stocks in the REIT sector that you may want to consider, as our model shows that these too have the right combination of elements to report positive surprises this quarter:

The Macerich Company MAC, scheduled to announce quarterly numbers on Aug 4, currently has an Earnings ESP of +4.30% and carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

STORE Capital Corporation STOR, set to report quarterly results on Aug 5, has an Earnings ESP of +1.23% and carries a Zacks Rank of 3, at present.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macerich Company The (MAC) : Free Stock Analysis Report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report

STORE Capital Corporation (STOR) : Free Stock Analysis Report

CBRE Group, Inc. (CBRE) : Free Stock Analysis Report

To read this article on Zacks.com click here.