Old Dominion Freight Line Matches Analyst EPS Estimates in Q1 2024

Earnings Per Share (EPS): Reported at $1.34, meeting the estimated EPS of $1.34.

Net Income: Reached $292.3 million, slightly below the estimate of $292.94 million.

Revenue: Totalled $1.46 billion, falling short of the estimated $1.473 billion.

Operating Income: Increased to $386.4 million from $383.0 million in the previous year, reflecting a 0.9% growth.

Operating Ratio: Slightly deteriorated to 73.5% from 73.4% year-over-year.

Capital Expenditures: Amounted to $119.5 million for the quarter, with plans to invest approximately $750 million throughout 2024.

Shareholder Returns: $85.3 million spent on share repurchases and $56.6 million on cash dividends during the quarter.

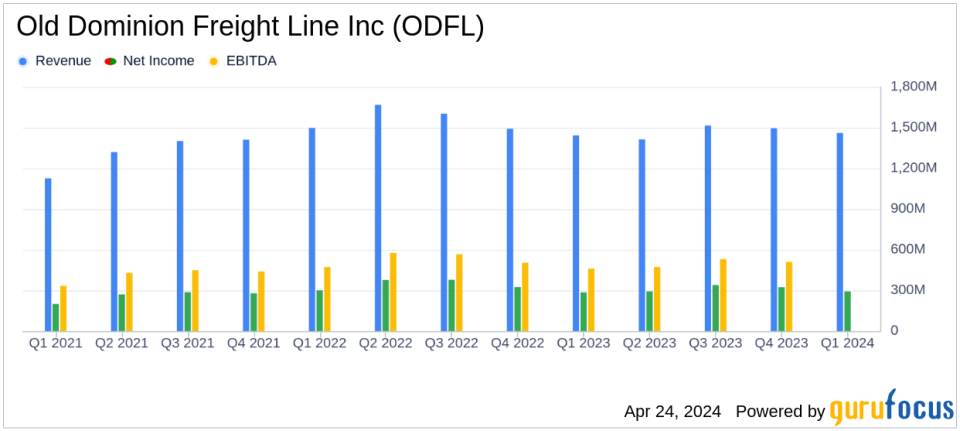

On April 24, 2024, Old Dominion Freight Line Inc (NASDAQ:ODFL) disclosed its first-quarter financial results, aligning with analysts' expectations on earnings per share (EPS) but slightly missing on revenue projections. The detailed financial outcomes can be accessed through their 8-K filing. The company reported an EPS of $1.34, consistent with the estimated EPS of $1.34, and posted a revenue of $1,460.07 million against an expected $1,473.43 million.

Old Dominion Freight Line, a major player in the less-than-truckload (LTL) market in the United States, operates over 250 service centers with more than 11,000 tractors. Known for its operational efficiency and high profitability, the company focuses on enhancing network density and maintaining top-tier service quality through significant investments in infrastructure.

Financial Performance Overview

In the first quarter of 2024, Old Dominion saw a modest year-over-year revenue increase of 1.2%, with total revenue reaching $1,460.07 million. The LTL services, its core business segment, contributed $1,446.73 million, marking a 1.6% increase from the previous year. However, revenue from other services declined by 24.9%, totaling $13.34 million.

The company's net income for the quarter was $292.30 million, a 2.5% rise from $285.04 million in the same period last year. This improvement reflects Old Dominion's effective yield management and operational efficiencies, despite the ongoing economic softness impacting the broader transportation sector.

Strategic Execution and Market Positioning

President and CEO Marty Freeman highlighted the company's resilience amid economic challenges. He noted, "Our ability to provide customers with superior service at a fair price continues to support our yield management initiatives and market share gains." Despite a 3.2% decrease in LTL tons per day, the company achieved a 4.1% increase in LTL revenue per hundredweight, indicating a strong focus on revenue quality and pricing strategies.

Old Dominion's operating ratio slightly increased to 73.5% from 73.4% a year earlier, influenced by a rise in direct operating costs as a percentage of revenue. This was partially offset by increased depreciation costs linked to ongoing capital expenditure strategies aimed at enhancing service capabilities and market reach.

Capital Allocation and Shareholder Returns

The company's robust cash flow management was evident, with net cash provided by operating activities amounting to $423.9 million. Old Dominion ended the quarter with $581.0 million in cash and cash equivalents. Capital expenditures for the quarter stood at $119.5 million, part of a planned total of $750 million for 2024, focusing on real estate, service center expansions, and technology investments.

Furthermore, Old Dominion continued to deliver value to its shareholders, spending $85.3 million on share repurchases and $56.6 million on cash dividends during the quarter.

Looking Forward

Despite the prolonged economic headwinds, there are signs of improving demand for Old Dominion's services. The company remains optimistic about its strategic positioning and its ability to enhance shareholder value through sustained market share growth and operational excellence.

Investors and analysts can look forward to more detailed discussions in the company's conference call, which will provide further insights into its strategies and outlook for the coming quarters.

Explore the complete 8-K earnings release (here) from Old Dominion Freight Line Inc for further details.

This article first appeared on GuruFocus.