Investors Who Bought Prestige Consumer Healthcare (NYSE:PBH) Shares Three Years Ago Are Now Up 46%

Low-cost index funds make it easy to achieve average market returns. But across the board there are plenty of stocks that underperform the market. Unfortunately for shareholders, while the Prestige Consumer Healthcare Inc. (NYSE:PBH) share price is up 46% in the last three years, that falls short of the market return. Some buyers are laughing, though, with an increase of 38% in the last year.

See our latest analysis for Prestige Consumer Healthcare

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last three years, Prestige Consumer Healthcare failed to grow earnings per share, which fell 20% (annualized).

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Therefore, we think it's worth considering other metrics as well.

You can only imagine how long term shareholders feel about the declining revenue trend (slipping at 3.0% per year). The only thing that's clear is there is low correlation between Prestige Consumer Healthcare's share price and its historic fundamental data. Further research may be required!

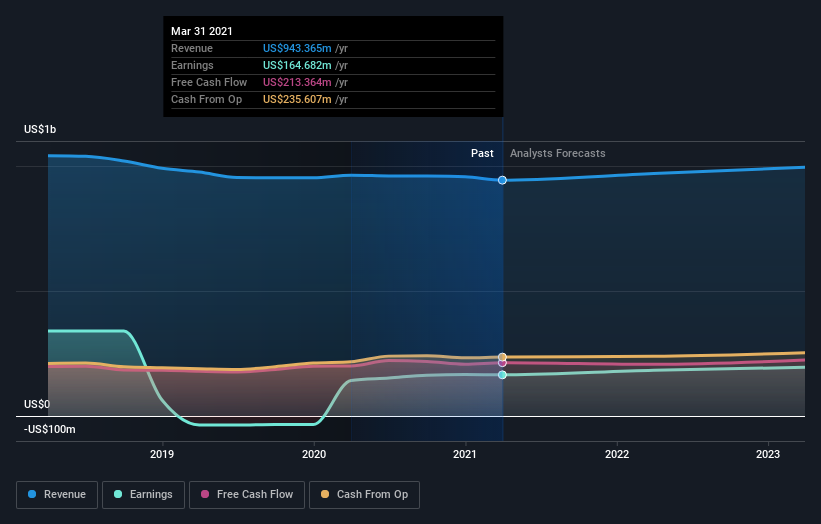

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Prestige Consumer Healthcare has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Prestige Consumer Healthcare

A Different Perspective

Prestige Consumer Healthcare provided a TSR of 38% over the year. That's fairly close to the broader market return. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 0.5%, which was endured over half a decade. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Prestige Consumer Healthcare , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.