Beacon (BECN) Focuses on Ambition 2025 Amid Inflation Woes

Beacon Roofing Supply, Inc. BECN has been benefiting from strategic growth plans, robust acquisitions and cost-reduction efforts.

The company is on track to fulfil its Ambition 2025 strategic plan, where it expects sales to reach $9 billion and adjusted EBITDA to be $1 billion by 2025. The company is working toward reducing its expenses and increasing margins year over year.

However, this Zacks Rank #3 (Hold) company has been witnessing higher costs and expenses due to persisting high material and labor inflation. Economic risks like volatile interest rates are also causes of concern.

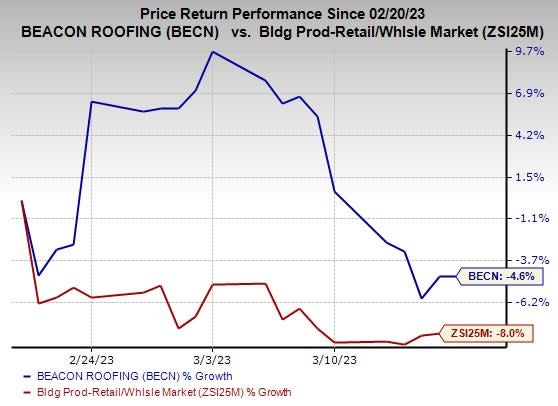

Image Source: Zacks Investment Research

Although BECN has outperformed the Zacks Building Products - Retail industry, it has declined 4.6% in the past month.

Growth Drivers

Ambition 2025 Targets Bode Well: Beacon is gaining from its focus on achieving its Ambition 2025 strategic plan. The plan was announced on Feb 24, 2022 and according to it the company anticipates sales to reach $9 billion (8% CAGR). EBITDA is expected to be $1 billion (10% CAGR), which would translate into an 11% EBITDA margin (up 100 basis points from 2021).

In 2022, Beacon opened 16 new branch locations, surpassing its target of adding 10 locations annually. Also, the company opened 16 Greenfields in 12 different states. The company also granted restricted stock unit and special awards to 130 employees as part of the plan.

The company’s focus on four key strategic initiatives — organic growth, digital, OTC (On-Time and Complete) and branch operating performance — bodes well. The company is focused on improving sales and operating performance at exterior and interior branches and intends to enhance the overall customer experience with increased scope and scale of business. Also, its OTC strategy leverages the density of its branch network and helps to serve customers more effectively and efficiently.

Robust Acquisitions: Beacon has been focusing on business expansion through bolt-on acquisitions and divestitures. In 2022, Beacon made five acquisitions. It has already made one acquisition in 2023.

In the second half of 2022, it completed two acquisitions. On Jan 4, 2023, Beacon acquired First Coastal Exteriors, LLC, a distributor of complementary residential and commercial building products. On Dec 30, 2022, the company acquired Whitney Building Products, LLC, with one of its branches located in Massachusetts and on Nov 1, 2022, it acquired Coastal Construction Products in the United States, with 18 branches primarily in the Southeast.

In the first half of 2022, BECN completed three acquisitions. In June 2022, the company acquired Complete Supply, Inc., in Willowbrook, IL. On Apr 29, 2022, it acquired a distributor of complementary residential exterior building supplies, Wichita Falls Builders Wholesale, Inc. Builders Wholesale. On Jan 1, 2022, it completed the acquisition of Crabtree Siding and Supply, a wholesale distributor of residential exterior building materials.

Downsizing Costs: Beacon is investing in various initiatives to lower costs and expenses. It is moving ahead with the integration of Allied Building Products and progressing with the employee transition process. Regarding the specific synergy components, Beacon began consolidating procurement programs to secure the best supply arrangement from vendors on a market-by-market basis. These efforts are contributing to a reduction in operating costs for the company.

In 2022, operating and adjusted EBITDA margins expanded 140 bps and 70 bps year over year, respectively, courtesy of higher pricing in a volatile market and a higher non-residential product sales mix. The company downsized its operating expenses by 160 bps in 2022, driving margins.

For the first quarter of 2023, the company expects the gross margin to be 25.5%. Also, for 2023, its expectation for adjusted EBITDA is in the range of $810 million-$870 million.

Headwinds

High-Cost Inflation: Beacon’s growth prospects are being affected by increased inflationary pressure across most product categories, despite undertaking various cost-saving initiatives. Also, the cost of inputs is increasing owing to macroeconomic risk.

Adjusted operating expense increased 18.5% in the fourth quarter of 2022. The increase was primarily due to increased headcount, inflationary pressure and wages, fuel, and lease-related expenses such as rents, real estate taxes, utilities and maintenance costs as well as higher incentive compensation.

Economic Risks: As most of Beacon’s work is performed outdoor and is based on repair and remodeling activity, it is vulnerable to COVID-induced economic disruptions. The selling, administrative and general expense was up by $2 million in 2022 due to the direct impact of COVID-19.

Also, the company depends highly on new residential construction. The growth in the new residential construction market has been sluggish in the past few months, due to rising inflationary pressure, affordability issues and interest rate hikes. For 2023, Beacon anticipates low demand from the new residential construction market.

Key Picks

Here are some better-ranked stocks that investors may consider in the Zacks Retail-Wholesale sector. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chuy's Holdings, Inc. CHUY currently sports a Zacks Rank #1 (Strong Buy). CHUY delivered a trailing four-quarter earnings surprise of 19.1%, on average. Shares of CHUY have risen 48.9% in the past six months.

The Zacks Consensus Estimate for CHUY’s 2023 sales and EPS suggests growth of 10.8% and 19%, respectively, from the corresponding year-ago period’s levels.

Arcos Dorados Holdings Inc. ARCO sports a Zacks Rank #1. ARCO has a long-term earnings growth rate of 11.6%. Shares of the company have increased 2.5% in the past six months.

The Zacks Consensus Estimate for ARCO’s 2023 sales suggests growth of 8.7% buts EPS suggests a decline of 11.6%, from the year-ago period’s levels.

Brinker International, Inc. EAT carries a Zacks Rank #2 (Buy). EAT has a long-term earnings growth rate of 7.1%. The stock has increased 26.9% in the past six months.

The Zacks Consensus Estimate for EAT’s fiscal 2023 sales suggests growth of 8.2% but EPS suggests a decline of 12%, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Beacon Roofing Supply, Inc. (BECN) : Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report