In strong bull markets like this one, it often feels like there are no more value opportunities left to find. Everything worth buying has already been bid up to eye-watering valuations, while any stock that looks cheap on paper turns out to be cheap for good reasons.

That does not mean all value opportunities are gone, however. Using the GuruFocus Predictable Companies screener, I screened the market for predictable companies that are trading below book value. The stocks that meet the criteria for the Predictable Companies screener are those that have typically posted strong revenue growth and been profitable holdings for investors over the past decade.

Let’s take a look at the five stocks that made it past this screen to see whether or not they deserve their bottom-of-the-barrel prices.

Telecom Argentina

Telecom Argentina SA (TEO, Financial), a major Argentinian telecommunications company, has a predictability rank of four out of five stars, a 10-year revenue per share growth rate of 29.10% and a price-book ratio of 0.89.

The stock traded for $5.02 per share on Oct. 5 for a market cap of $2.15 billion. According to the GuruFocus Value chart, the stock is modestly overvalued; while its shareholder returns have been good over the past decade, the stock has tanked since the beginning of 2018.

Operating in a relatively unstable emerging market, Telecom Argentina is at the mercy of its market. Civil unrest, high inflation and government restrictions on internet and telephone service prices have caused the top and bottom lines to falter. If the economic and political situation in Argentina improves, the company could be poised to make a strong comeback, though investors who are not comfortable with a high level of risk may want to steer clear of this one.

ORIX

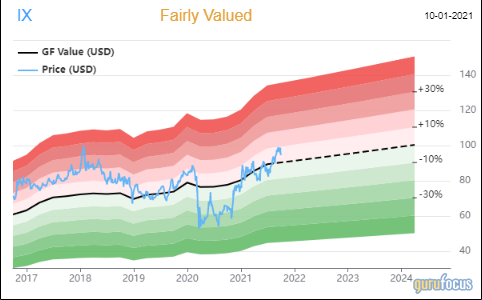

ORIX Corp. (IX, Financial) is a Japanese global diversified financial services company. It has a business predictability rank of four and a half out of five stars, a 10-year revenue growth rate of 8.50% and a price-book ratio of 0.86.

The stock traded for $96.64 on Oct. 1 for a market cap of $23.32 billion. According to the GF Value chart, the stock is fairly valued; its price-earnings ratio of 12.77 is slightly lower than the industry median, but higher than its own 10-year median of 8.94.

ORIX has operations in just about every area of finance, including leasing, lending, rentals, life insurance, real estate financing and development, venture capital, investment and retail banking, commodities funds and securities brokering. The majority of its revenue comes from financial services, followed by life insurance. The company’s bottom line declined in 2020, but just like the period following the financial crisis in 2008, the company should see its profits recover along with the global economy.

Celestica

Celestica Inc. (CLS, Financial) is a Canadian electronics manufacturing services company that has a predictability rank of four out of five stars, a 10-year revenue growth rate of 8.80% and a price-book ratio of 0.83.

The stock traded for $9.09 per share on Oct. 5 for a market cap of $1.15 billion. According to the GF Value chart, the stock is modestly overvalued; on average over the past 10 years, investors have rarely seen their positions fall underwater, but the stock also hasn’t provided stellar returns. The price-earnings ratio of 12.95 is below the company’s 10-year median of 15.10.

Celestica’s revenue has had its ups and downs over the past decade, but net income has remained fairly consistent. The strategy over this time seems to have been maintaining the status quo. However, with the recently announced acquisition of Singaporean design, engineering and manufacturing solutions company PCI Ltd., Celestica’s management aims to pursue a high-growth, high-margin strategy, strengthening its focus on engineering engagements. If successful, this could drive up the stock’s price and valuation multiples.

New Oriental Education & Technology Group

New Oriental Education & Technology Group Inc. (EDU, Financial) is a provider of private educational services in China. It has a predictability rank of five out of five stars, a 10-year revenue growth rate of 21.70% and a price-book ratio of 0.69.

The stock traded for $2.04 per share on Oct. 5 for a market cap of $3.68 billion. According to the GF Value chart, the stock could be a value trap; it was a highly profitable investment for most of the past decade, but the drop in the share price that kicked off in February this year has been far too steep and suggests that the market sees permanent impairment to the company.

Looking at revenue and net income by quarter, we can see that New Oriental posted the worst quarterly net income in its history for the most recent fiscal quarter, which ended in May. The reason for the bottom-line decline and the share price decline is a new regulation from the Chinese government that specifically targets the private education sector with the goal of reducing the time and money spent on after-school tutoring. Depending on the interpretation of this law, it is possible that New Oriental could see a significant reduction in its revenue. It also warns that since it is technically registered as a Cayman Islands holding company rather than a Chinese company, it could lose the rights to the contracts from which it derives its revenue.

YPF

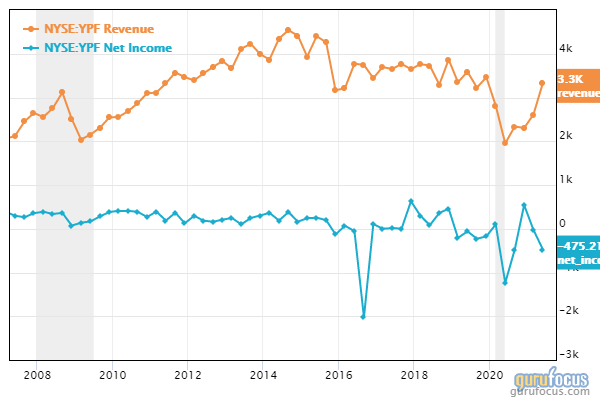

YPF SA (YPF, Financial) is a vertically integrated Argentinian oil and gas company with a predictability rank of five out of five stars, a 10-year revenue growth rate of 33.30% and a price-book ratio of 0.52.

The stock traded at $4.90 per share on Oct. 5 for a market cap of $1.93 billion. According to the GF Value chart, the stock is modestly undervalued. The share price has had its ups and downs over the past decade, but like the majority of the oil and gas industry, it has been on a general downtrend.

Analysts are divided on what to expect from the oil and gas industry going forward. It’s unlikely that the industry as a whole will experience an oil boom on par with historical oil booms, since oil demand has already grown so much globally that new growth will be a relatively small change in terms of percentage. Clean energy is seen as the future of energy in most developed countries, which is why many investors are keener on clean energy stocks, as the growth potential seems higher. However, fossil fuels are expected to see a higher increase in demand in less developed nations such as Argentina, so the long-term growth potential for YPF could be better than for many other small oil and gas companies, though the company still carries significant economic and political risk. Overall, the top and bottom lines have remained fairly stagnant since 2014.

Conclusion

The companies listed above are all trading at bottom-of-the-barrel prices, but it seems that most of them are cheap for a reason. The risk of investing in these equities is high. New Oriental faces government regulations that could not only limit its income streams but also penalize its corporate structure. Telecom Argentina and YPF SA will depend on the recovery and growth of the Argentinian economy for future profits and capital gains.

On the other hand, ORIX and Celestica seem like they could have steam left. ORIX has financial services operations around the world and could be a global economic recovery play, while Celestica is transitioning to a growth strategy that has the potential to rejuvenate its business and its stock.

However, investors who are expecting a worsening recession or stock market downturn soon might not see any more benefit in struggling, cheap stocks than in successful, expensive ones.