Here's Why You Should Hold Onto Dow (DOW) Stock for Now

Dow Inc. DOW is expected to benefit from cost and productivity initiatives, firm demand across several markets and investment in high-return projects.

The company’s shares are down 17.8% over a year, compared with a 5.5% decline recorded by its industry.

Let’s find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

Image Source: Zacks Investment Research

What’s Favoring DOW?

Dow should gain from cost synergy savings and productivity actions. It focuses on maintaining cost and operational discipline. The company is realizing a full $300 million EBITDA run rate benefit from restructuring programs being initiated in the third quarter of 2020. Dow also expects its investment in digital initiatives to drive efficiency and allow it to realize $300 million EBITDA run rate by the end of 2023. The company is also implementing targeted actions focused on optimizing labor and purchased service costs, lowering turnaround spending and boosting productivity. Dow expects these initiatives to deliver $1 billion in cost savings in 2023.

The company is also seeing higher demand across a number of markets including mobility, renewable energy and pharmaceutical. It is also witnessing firm global demand in functional polymers and performance silicones. The momentum across these markets is likely to continue moving ahead.

Moreover, Dow remains focused on investing in attractive areas through highly accretive projects. It is investing in several high-return growth projects including the expansion of downstream silicones capacity. The company completed its Fort Saskatchewan expansion in 2021, which is expected to support higher polyethylene demand. It also commissioned its fluidized catalytic dehydrogenation pilot plant in Louisiana in fourth-quarter 2022 to manufacture propylene for coatings, electronics and durables markets. It also delivered silicones downstream debottlenecking projects last year.

The company is also committed to return value to its shareholders by leveraging healthy cash flows. Dow generated strong operating cash flows of $7.5 billion in 2022. It also generated free cash flow of roughly $5.7 billion for the year. The company returned $4.3 billion to its shareholders in 2022 through dividends and share buybacks.

A Few Headwinds

Dow is exposed to headwinds from weaker demand in Europe and Asia. Lower consumer spending amid inflationary pressures is affecting demand in Europe. In Packaging & Specialty Plastics, the company is seeing lower olefins and packaging demand in Europe as witnessed in the last reported quarter. Dow sees the ongoing destocking through the value chain to impact functional polymer strength and demand in Europe in the first quarter of 2023. Inflationary pressures are also impacting industrial demand and the building and construction market, which is expected to affect the Industrial Intermediates & Infrastructure segment.

The company’s Performance Materials & Coatings unit faces challenges from lower siloxane prices. Siloxane prices fell to their lowest levels at the end of 2022, per DOW. Prices are likely to remain under pressure in the first quarter due to increased industry supply. Lower prices may weigh on the segment’s margins in the quarter.

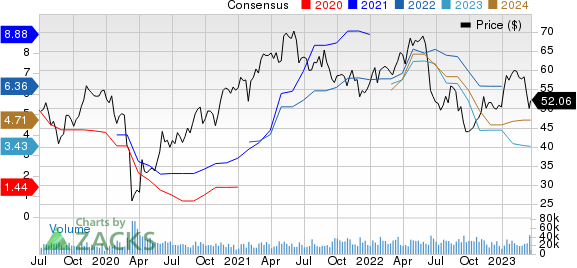

Dow Inc. Price and Consensus

Dow Inc. price-consensus-chart | Dow Inc. Quote

Stocks to Consider

Better-ranked stocks worth considering in the basic materials space include Steel Dynamics, Inc. STLD, Olympic Steel, Inc. ZEUS and Nucor Corporation NUE.

Steel Dynamics currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for STLD's current-year earnings has been revised 26.4% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 11.3%, on average. STLD has gained around 30% in a year.

Olympic Steel currently sports a Zacks Rank #1. The Zacks Consensus Estimate for ZEUS's current-year earnings has been revised 60.6% upward in the past 60 days.

Olympic Steel’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 26.2%, on average. ZEUS has rallied around 48% in a year.

Nucor currently carries a Zacks Rank #1. The Zacks Consensus Estimate for NUE’s current-year earnings has been revised 10.7% upward in the past 60 days.

Nucor beat Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 7.7% on average. NUE’s shares have gained roughly 3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report