REAL TIME PRICE

EXTENDED HOURS

| Day’s Range | - |

| 52 Week Range | - |

| Department Stores | |

UBS Upgrades Burlington Stores (BURL)

Fintel reports that on May 2, 2024, UBS upgraded their outlook for Burlington Stores (NYSE:BURL) from Sell to Neutral.

Analyst Price Forecast Suggests 34.70% Upside

As of May 2, 2024, the average one-year price target for Burlington Stores is 248.34. The forecasts range from a low of 127.26 to a high of $299.25. The average price target represents an increase of 34.70% from its latest reported closing price of 184.36.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Burlington Stores is 10,554MM, an increase of 8.60%. The projected annual non-GAAP EPS is 8.37.

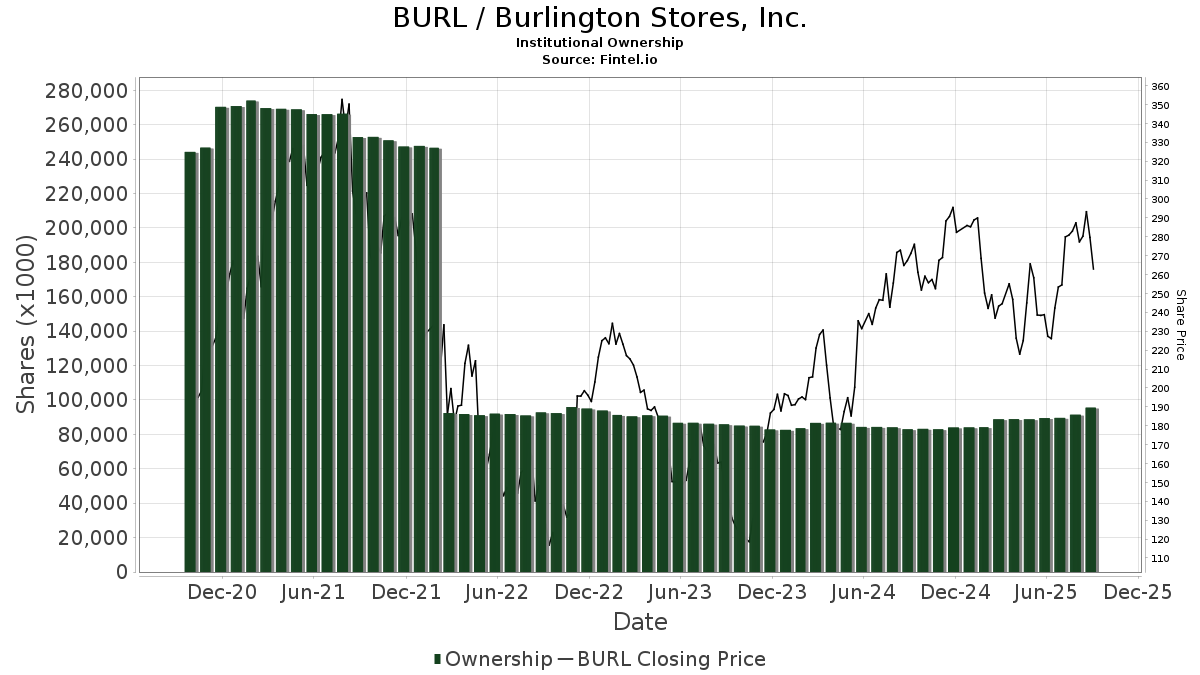

What is the Fund Sentiment?

There are 1,048 funds or institutions reporting positions in Burlington Stores.

This is an increase of 111 owner(s) or 11.85% in the last quarter.

Average portfolio weight of all funds dedicated to BURL is 0.28%, an increase of 23.81%.

Total shares owned by institutions increased in the last three months by 3.76% to 86,713K shares.

The put/call ratio of BURL is 1.00, indicating a

bullish outlook.

The put/call ratio of BURL is 1.00, indicating a

bullish outlook.

What are Other Shareholders Doing?

Capital International Investors holds 7,283K shares representing 11.40% ownership of the company. In its prior filing, the firm reported owning 7,204K shares , representing an increase of 1.08%. The firm increased its portfolio allocation in BURL by 28.39% over the last quarter.

T. Rowe Price Investment Management holds 5,098K shares representing 7.98% ownership of the company. In its prior filing, the firm reported owning 6,305K shares , representing a decrease of 23.68%. The firm increased its portfolio allocation in BURL by 6.90% over the last quarter.

Jpmorgan Chase holds 3,725K shares representing 5.83% ownership of the company. In its prior filing, the firm reported owning 2,846K shares , representing an increase of 23.60%. The firm increased its portfolio allocation in BURL by 63.84% over the last quarter.

AMCPX - AMCAP FUND holds 3,549K shares representing 5.56% ownership of the company. In its prior filing, the firm reported owning 3,554K shares , representing a decrease of 0.13%. The firm increased its portfolio allocation in BURL by 7.85% over the last quarter.

AGTHX - GROWTH FUND OF AMERICA holds 2,213K shares representing 3.46% ownership of the company. No change in the last quarter.

Burlington Stores Background Information

(This description is provided by the company.)

Burlington Stores, Inc., headquartered in New Jersey, is a nationally recognized off-price retailer with Fiscal 2020 net sales of $5.8 billion. The Company is a Fortune 500 company.' The Company operated 761 stores as of the end of the fourth quarter of Fiscal 2020, in 45 states and Puerto Rico, principally under the name Burlington Stores. The Company's stores offer an extensive selection of in-season, fashion-focused merchandise at up to 60% off other retailers' prices, including women's ready-to-wear apparel, menswear, youth apparel, baby, beauty, footwear, accessories, home, toys, gifts and coats.

Stories by George Maybach

Oppenheimer Initiates Coverage of Capricor Therapeutics (CAPR) with Outperform Recommendation

Fintel reports that on May 17, 2024, Oppenheimer initiated coverage of Capricor Therapeutics (NasdaqCM:CAPR) with a Outperform recommendation.

Lake Street Initiates Coverage of Mission Produce (AVO) with Buy Recommendation

Fintel reports that on May 17, 2024, Lake Street initiated coverage of Mission Produce (NasdaqGS:AVO) with a Buy recommendation.

Guggenheim Downgrades Lithia Motors (LAD)

Fintel reports that on May 17, 2024, Guggenheim downgraded their outlook for Lithia Motors (NYSE:LAD) from Buy to Neutral.

CL King Downgrades Cracker Barrel Old Country Store (CBRL)

Fintel reports that on May 17, 2024, CL King downgraded their outlook for Cracker Barrel Old Country Store (NasdaqGS:CBRL) from Buy to Neutral.

Scotiabank Downgrades Macerich (MAC)

Fintel reports that on May 17, 2024, Scotiabank downgraded their outlook for Macerich (NYSE:MAC) from Sector Perform to Sector Underperform.

Scotiabank Upgrades Tanger (SKT)

Fintel reports that on May 17, 2024, Scotiabank upgraded their outlook for Tanger (NYSE:SKT) from Sector Underperform to Sector Perform.

B of A Securities Upgrades Robinhood Markets (HOOD)

Fintel reports that on May 17, 2024, B of A Securities upgraded their outlook for Robinhood Markets (NasdaqGS:HOOD) from Underperform to Buy.

Jefferies Upgrades DuPont de Nemours (DD)

Fintel reports that on May 17, 2024, Jefferies upgraded their outlook for DuPont de Nemours (NYSE:DD) from Hold to Buy.

William Blair Downgrades SoundThinking (SSTI)

Fintel reports that on May 17, 2024, William Blair downgraded their outlook for SoundThinking (NasdaqCM:SSTI) from Outperform to Market Perform.

JP Morgan Upgrades Bath & Body Works (BBWI)

Fintel reports that on May 17, 2024, JP Morgan upgraded their outlook for Bath & Body Works (NYSE:BBWI) from Underweight to Neutral.