First Pacific Advisors (Trades, Portfolio) recently disclosed its 13F portfolio updates for the third quarter of 2022, which ended on Sept. 30.

The Los Angeles-based investment management firm emphasizes a research-based, low-risk value investing strategy that seeks to increase capital in the long term while avoiding a high chance of loss. First Pacific invests through several funds, including the FPA Capital Fund (Trades, Portfolio), the FPA Crescent Fund, the FPA International Value Fund and the FPA Paramount Fund.

Based on its latest 13F filing, the firm’s top five trades for the quarter included a new position in Icon PLC (ICLR, Financial), additions to International Flavors & Fragrances Inc. (IFF, Financial) and CarMax Inc. (KMX, Financial), the sale of its entire stake in Open Text Corp. (OTEX, Financial) and a reduction to Howmet Aerospace Inc. (HWM, Financial).

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Icon

First Pacific Advisors (Trades, Portfolio) established a new position worth 173,228 shares in Icon (ICLR, Financial), giving it a weight of 0.51% in the equity portfolio at the quarter’s average share price of $217.64.

Icon is a leading global clinical research company that provides outsourced clinical development and commercialization services to companies in the pharmaceutical, biotechnology, medical devices and government and public health industries. It has its headquarters in Ireland.

With a three-year revenue per share growth rate of 19.3%, and with the company claiming in its third-quarter 2022 earnings report that it is on track for a 40.3% to 42.5% revenue increase in full fiscal 2022, it is easy to see why investors might be excited about this company. The company also expects its earnings per share to rise 20.7% to 22.8% for the year, a return to growth after a GAAP charge associated with non-controlling interest in MeDiNova Research tanked earnings in the third quarter of 2021.

On Nov. 11, shares of Icon traded around $198.30 apiece for a market cap of $16.17 billion. The GF Value chart rates the stock as significantly undervalued.

International Flavors & Fragrances

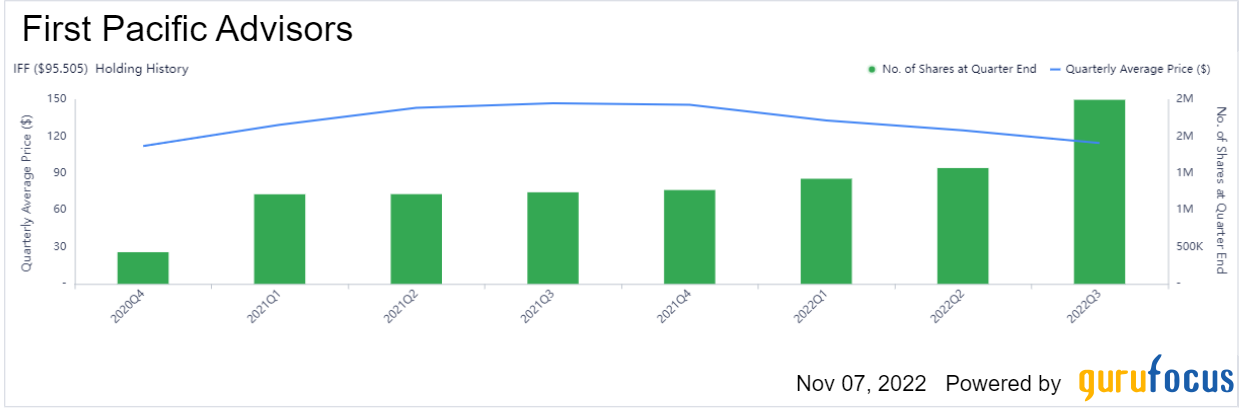

The firm added 925,805 shares to its International Flavors & Fragrances (IFF, Financial) holding for a total of 2,497,364 shares, adding 1.36% to the equity portfolio. Shares averaged $114.56 apiece during the quarter.

International Flavors & Fragrances is a New-York based company that produces a variety of flavors, fragrances, cosmetic actives and other chemicals for sale around the world. It has facilities in more than 44 countries.

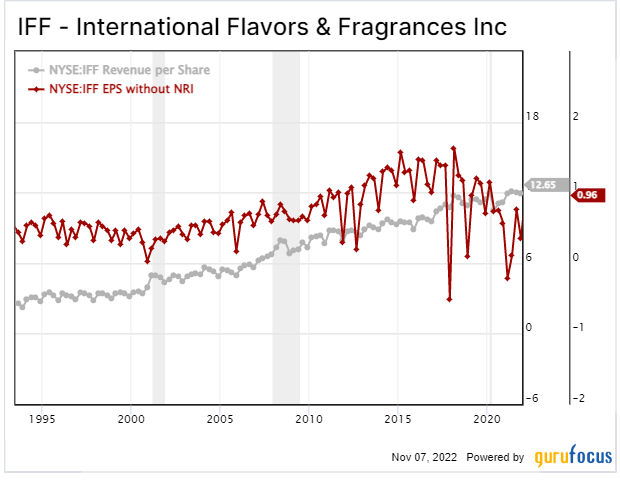

The company is making progress in carrying out its business optimization strategy, which aims to divest non-core businesses and acquire core-related businesses in order to focus on its main areas of expertise. It is certainly in need of a turnaround because while revenue has remained consisted, earnings per share have dropped in recent years, as shown in the chart below.

Shares traded around $96.18 on Monday for a market cap of $24.52 billion. The GF Value chart rates International Flavors and Fragrances as a possible value trap since the dramatic share price drop has been accompanied by a declining bottom line.

CarMax

The firm also upped its stake in CarMax (KMX, Financial) by 503,035 shares for a total holding of 1,944,929 shares. The traded added 0.54% to the equity portfolio at the quarter’s average share price of $91.38.

Headquartered in Richmond, Virginia, CarMax is an American used-car company with approximately 195 stores across the U.S. It offers upfront prices, nationwide availability and online shopping.

As the strong used car begins to show signs of weakness, this used car retailer has come under pressure. Moreover, CarMax was prioritizing market share gains over profitability increases during favorable market conditions, which may or may not prove beneficial depending on how bad the economic downturn is and how long supply chain issues persist in the automotive industry.

At Monday’s share price of $64.63, the GF Value chart rates CarMax as significantly undervalued. The company had a market cap of $10.21 billion.

Open Text

The firm dumped all 3,649,657 of its Open Text (OTEX, Financial) shares, which previously took up 2.06% of the equity portfolio. Shares traded for an average price of $35.31 during the quarter.

A global leader in enterprise information management, Open Text helps companies securely capture, govern and exchange information. Its services are becoming increasingly valuable as more companies transfer operations to the cloud. It is one of Canada’s largest software companies.

With a three-year revenue per share growth rate of 5.2% and a three-year earnings per share without non-recurring items growth rate of 9.9%, Open Text continues its strong growth as the leading provider of enterprise-level information management software. The main risk with this stock appears to be its growth by acquisition strategy, which could weaken its balance sheet or dilute shareholders in the coming years.

The GF Value chart rates Open Text as a potential value trap at $27.55 per share due to the combination of an undervalued share price and a weak balance sheet; the Altman Z-Score of 1.68 implies a risk of bankruptcy within the next two years. The company’s market cap was $7.20 billion.

Howmet Aerospace

The firm reduced its Howmet Aerospace (HWM, Financial) holding by 1,095,981 shares, leaving a remaining stake of 4,425,744 shares and trimming 0.51% off the equity portfolio. Shares averaged $35.09 apiece during the quarter.

Howmet is a Pennsylvania-based company that manufactures engineered metal products such as components for jet engines, fasteners and titanium structures for aerospace applications and forged aluminum wheels for heavy trucks.

Howmet’s current form came about in April 2020, when Arconic Corp. (ARNC, Financial) spun itself off and kept the Arconic name while the remaining business renamed itself Howmet Aerospace. Thus, we can only use the company’s post-spinoff numbers as reference. As shown in the below chart, the company has been growing well, though it is being adversely impacted by rising raw materials costs in light of the Russia-Ukraine war.

According to the GF Value chart as of Nov. 7, the stock was fairly valued at a share price of $36.61. The market cap was $15.15 billion.

Portfolio overview

As of the quarter’s end, the firm held 185 common stock positions valued at a total of $6.21 billion. Turnover for the quarter was 4%.

Its top holdings were Alphabet Inc. (GOOG, Financial) with 5.77% of the equity portfolio, Analog Devices Inc. (ADI, Financial) with 5.46% and Comcast Corp. (CMCSA, Financial) with 5.37%.

In terms of sector weighting, the firm was most invested in communication services, financial services and technology stocks.