Factors to Note as General Mills (GIS) Readies for Q3 Earnings

General Mills, Inc. GIS is likely to register a top-and-bottom-line increase from the respective year-ago fiscal quarter’s reading when it reports third-quarter fiscal 2023 earnings on Mar 23. The Zacks Consensus Estimate for quarterly revenues is pegged at $4,917 million, suggesting a rise of 8.4% from the prior-year fiscal quarter’s reported figure.

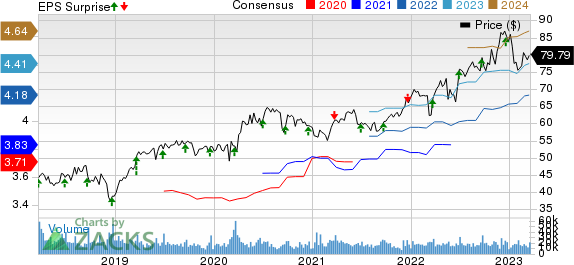

The Zacks Consensus Estimate for quarterly earnings has risen by a penny in the past seven days to 91 cents per share. The figure indicates growth of 8.3% from the figure reported in the prior-year fiscal quarter. This branded consumer food company has a trailing four-quarter earnings surprise of 8.7%, on average. GIS delivered an earnings surprise of 3.8% in the last reported quarter.

Factors at Play

General Mills has been consistently focused on its Accelerate strategy, which aids the company in making the choices of how to win and where to play to boost profitability. Gains from the strategy are likely to have aided the company in the quarter under review.

General Mills, Inc. Price, Consensus and EPS Surprise

General Mills, Inc. price-consensus-eps-surprise-chart | General Mills, Inc. Quote

Under how to win, General Mills is focused on four pillars designed to provide a competitive advantage. These include brand building, undertaking innovations, unleashing scale and maintaining business strength.

The where-to-play principle is outlined to enhance the company’s capabilities to generate profitability through geographic and product prioritization, along with portfolio restructuring. This includes prioritizing investments, investing in five Global Platforms, driving growth in Local Gem brands and reshaping the portfolio.

For fiscal 2023, GIS remains committed to the Accelerate strategy, underscored by its three priorities — competing efficiently through brand building, investing in Holistic Margin Management (“HMM”) and Strategic Revenue Management initiatives to counter inflation, making other strategic business investments, staying committed to ESG goals and reshaping the portfolio. It expects HMM cost savings of 3-4% of the cost of goods sold in fiscal 2023.

General Mills has been battling cost inflation. On its second-quarter earnings call, management stated that it still expects the biggest factors impacting its show in fiscal 2023 are likely to be consumers’ economic status, cost inflation and supply-chain bottlenecks. The company anticipates volume elasticities to remain lower than historical levels in the second half of the fiscal. This may have somewhat impacted third-quarter results.

Raised Guidance

Management recently raised its fiscal 2023 guidance at the Consumer Analyst Group of New York 2023 Conference. This also raises optimism about the quarter to be reported.

Organic sales for fiscal 2023 are now anticipated to grow nearly 10%, up from the 8.2% growth projected during the company’s second-quarter fiscal 2023 earnings call. Management expects adjusted operating profit growth of 6-7% at constant currency or cc compared with the earlier view of a 3-5% increase. Adjusted earnings per share (EPS) are envisioned to increase 7-8% at cc compared with the 4-6% increase projected before.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for General Mills this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is the case here.

General Mills has a Zacks Rank #2 and an Earnings ESP of +1.93%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks With the Favorable Combination

Here are three other companies worth considering as our model shows that these also have the right combination of elements to beat earnings this time.

Ollie's Bargain Outlet OLLI currently has an Earnings ESP of +4.12% and a Zacks Rank of 2. The company is likely to register a top-and-bottom-line increase when it reports fourth-quarter fiscal 2022 results. The consensus mark for OLLI’s quarterly revenues is pegged at around $543 million, which suggests growth of 8.3% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ollie's Bargain’s earnings has been unchanged at 80 cents per share in the past 30 days. The consensus estimate indicates a nearly 16% jump from the year-ago quarter’s reported figure.

The Estee Lauder Companies EL currently has an Earnings ESP of +3.55% and a Zacks Rank #3. The company is expected to register a bottom-line decline when it reports third-quarter fiscal 2023 results. The Zacks Consensus Estimate for quarterly earnings per share of 49 cents suggests a decrease of 74.2% from the year-ago quarter.

The consensus mark for The Estee Lauder Companies’ revenues is pegged at $3.7 billion, indicating a decrease of 12.6% from the figure reported in the year-ago quarter. EL has a trailing four-quarter earnings surprise of 17.8%, on average.

TreeHouse Foods THS currently has an Earnings ESP of +12.10% and a Zacks Rank of 3. The company is likely to register an increase in the bottom line when it reports fourth-quarter 2022 results. The Zacks Consensus Estimate for THS’ quarterly EPS of 39 cents suggests a significant increase from the year-ago quarter’s loss of 15 cents.

The Zacks Consensus Estimate for TreeHouse Foods’ quarterly revenues is pegged at $851.3 million, which suggests a drop of 25.4% from the figure reported in the prior-year quarter.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report