Ball Corp (BLL) to Post Q4 Earnings: What's in the Cards?

Ball Corporation BLL is scheduled to report fourth-quarter 2021 results on Jan 27, before the opening bell.

Q3 Performance

In the last reported quarter, Ball Corp’s earnings and revenues increased year over year, reflecting strong aluminum aerosol volume growth. However, the company missed the Zacks Consensus Estimate on both counts. It has a trailing four-quarter earnings surprise of 2.71%, on average.

Q4 Estimates

The Zacks Consensus Estimate for the fourth-quarter earnings per share is pegged at 90 cents, suggesting growth of 11.1% from the prior-year period’s levels. The Zacks Consensus Estimate for total sales is pegged at $3.59 billion, indicating a year-over-year improvement of 15.7%.

Factors to Note

Ball Corp provides key aluminum packaging products and services to consumer-oriented end markets, such as food and beverages, household and healthcare. Demand for these products has been robust on the increased at-home consumption amid the pandemic. The company is gaining from the strong global beverage-can demand as consumers prefer cans over glass and plastic. These factors are likely to have favored the company’s fourth-quarter performance. The company has been focused on improving its efficiency and reducing costs. These initiatives are anticipated to have boosted the company’s margin in the to-be-reported quarter.

The Beverage packaging, North and Central America segment is projected to have generated sales of $1,476 million during the December-end quarter, calling for a 13.4% year-over-year increase. The segmental operating income is estimated at $155 million compared with the prior-year quarter’s $139 million. Operational efficiency, investment in new can plant capacity expansions and solid demand for aluminum beverage packaging are likely to have aided the segment during the quarter to be reported.

The Zacks Consensus Estimate for the Beverage packaging, South America segment’s net sales is pegged at $606 million, suggesting growth of 14.5% from the year-ago period’s levels. This reflects the demand for beverage cans and the production commencement of multiple can production lines. The segment’s operating income is pinned at $105 million, suggesting a decline from the prior-year quarter’s $107 million.

The Zacks Consensus Estimate for the Beverage packaging, Europe segment’s sales is at $846 million for the to-be-reported quarter, calling for an improvement of 10.2% from the prior-year quarter’s levels. The segment’s operating income is projected at $112 million, suggesting an improvement of 5.7% year over year. Increasing demand for sustainable aluminum cans and the company’s investment in incremental capacity in its existing facilities is expected to have contributed to the segment’s performance during the quarter under review.

The Aerospace segment’s contracted backlog remained strong at $2.8 billion as of the end of third-quarter 2021. Program execution remains at a high level across the business. The segment continues to win and provide mission-critical programs and technologies to the U.S. government, defense, intelligence, reconnaissance and surveillance customers. This is likely to get reflected in the segment’s fourth-quarter top line. The Zacks Consensus Estimate for the Aerospace segment's revenues is pegged at $473 million for the period in the discussion, indicating a year-over-year improvement of 12.6%. The segment’s operating income is projected at $48.9 million, suggesting year-over-year growth of 25.6%.

High input and labor costs might have impacted the company’s margins in the quarter. Higher-than-expected start-up costs stemming from capacity-expansion measures are likely to have dented performance. Ball Corp has been importing cans to meet demand until the ramp up of its new plants, which might have led to higher freight costs. These factors are likely to have impacted its margins during the quarter to be reported.

Ball Corporation Price and EPS Surprise

Ball Corporation price-eps-surprise | Ball Corporation Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Ball Corp this season. The combination of a positive Earnings ESP, and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), increases the odds of a positive surprise. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Ball Corp has an Earnings ESP of +0.68%.

Zacks Rank: Currently, the company carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank stocks here.

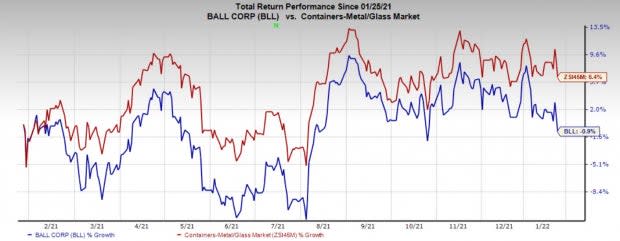

Price Performance

Shares of Ball Corp have declined 0.9% in the past year against the industry's growth of 6.4%.

Image Source: Zacks Investment Research

Stocks Worth a Look

Here are some Industrial Products stocks worth considering as these have the right combination of elements to post an earnings beat in their upcoming releases:

W.W. Grainger, Inc. GWW currently has an Earnings ESP of +2.29% and a Zacks Rank of 2. The Zacks Consensus Estimate for fourth-quarter 2021 earnings has moved up 0.2% in the past 30 days to $5.25 per share, suggesting year-over-year growth of 43.4%.

The Zacks Consensus Estimate for quarterly revenues is pegged at $3.2 billion, which indicates an increase of 11.3% from the prior-year quarter’s levels. Grainger has a long-term earnings growth rate of 13%.

AGCO Corporation AGCO currently has an Earnings ESP of +25% and a Zacks Rank of 2. The Zacks Consensus Estimate for fourth-quarter 2021 earnings is currently pegged at $1.72 per share, suggesting 11.7% growth from the year-ago quarter’s tally.

The Zacks Consensus Estimate for quarterly revenues is pinned at $3.04 billion, highlighting year-over-year growth of 11.9%. AGCO Corporation has a trailing four-quarter earnings surprise of 47.5%, on average. It has a long-term earnings growth of 19.1%.

Terex Corporation TEX currently has an Earnings ESP of +1.36% and a Zacks Rank #3. The Zacks Consensus Estimate for fourth-quarter 2021 earnings have been stable in the past 30 days and is currently pegged at 55 cents per share. The projection indicates 162% growth from the prior-year quarter’s tally.

The Zacks Consensus Estimate for Terex’s quarterly revenues is pegged at $948.5 million, which indicates a year-over-year improvement of 20.5%. TEX has a trailing four-quarter earnings surprise of 80.4%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Terex Corporation (TEX) : Free Stock Analysis Report

AGCO Corporation (AGCO) : Free Stock Analysis Report

Ball Corporation (BLL) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research