Update: Precision BioSciences (NASDAQ:DTIL) Stock Gained 32% In The Last Year

Precision BioSciences, Inc. (NASDAQ:DTIL) shareholders might be concerned after seeing the share price drop 14% in the last month. But at least the stock is up over the last year. In that time, it is up 32%, which isn't bad, but is below the market return of 40%.

View our latest analysis for Precision BioSciences

Precision BioSciences wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, Precision BioSciences' revenue grew by 41%. We respect that sort of growth, no doubt. The share price gain of 32% in that time is better than nothing, but far from outlandish Its possible that shareholders had expected higher growth. However, if you can reasonably expect profits in the next few years, this stock might belong on your watchlist.

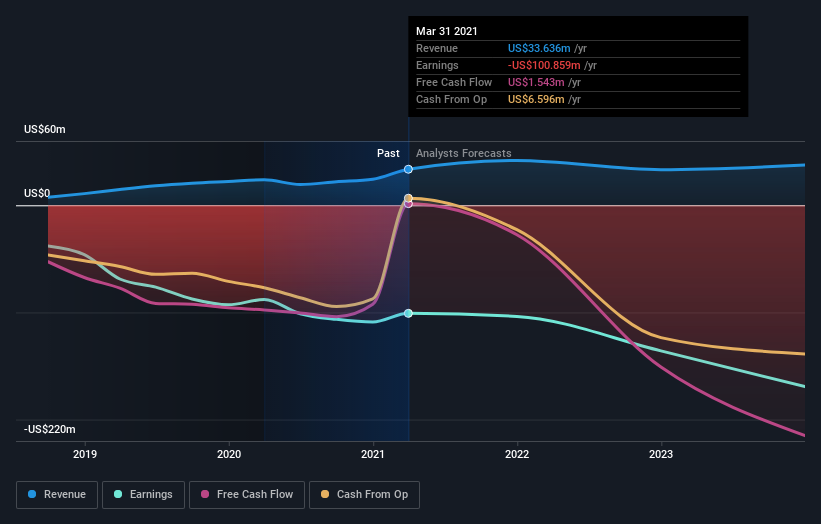

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're happy to report that Precision BioSciences are up 32% over the year. The bad news is that's no better than the average market return, which was roughly 40%. We regret to inform any shareholders that the share price dropped another 0.6% in the last three months. It's possible that this is just a short term share price setback. If the business executes and delivers key metric growth, it could definitely be worth putting on your watchlist. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 4 warning signs we've spotted with Precision BioSciences .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.