Those who invested in KKR Real Estate Finance Trust (NYSE:KREF) a year ago are up 33%

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But investors can boost returns by picking market-beating companies to own shares in. For example, the KKR Real Estate Finance Trust Inc. (NYSE:KREF) share price is up 22% in the last 1 year, clearly besting the market return of around 13% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! The longer term returns have not been as good, with the stock price only 9.2% higher than it was three years ago.

So let's assess the underlying fundamentals over the last 1 year and see if they've moved in lock-step with shareholder returns.

View our latest analysis for KKR Real Estate Finance Trust

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

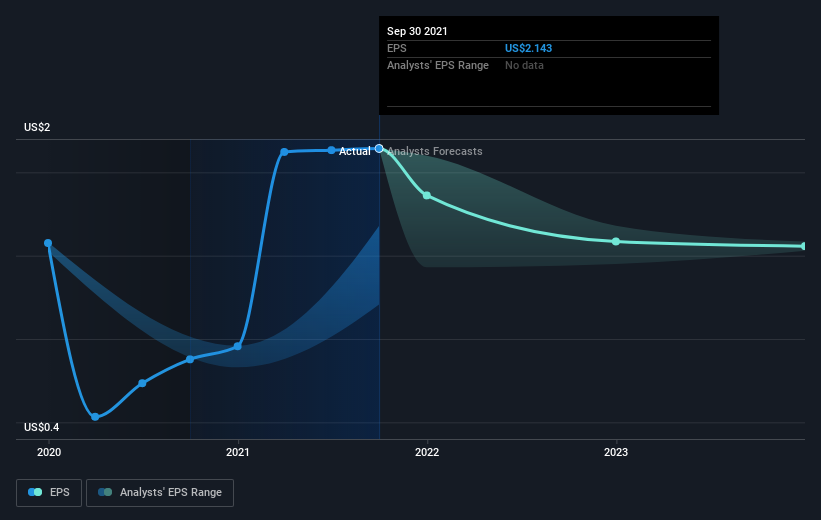

During the last year KKR Real Estate Finance Trust grew its earnings per share (EPS) by 144%. This EPS growth is significantly higher than the 22% increase in the share price. So it seems like the market has cooled on KKR Real Estate Finance Trust, despite the growth. Interesting. This cautious sentiment is reflected in its (fairly low) P/E ratio of 11.42.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of KKR Real Estate Finance Trust, it has a TSR of 33% for the last 1 year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that KKR Real Estate Finance Trust rewarded shareholders with a total shareholder return of 33% over the last year. And yes, that does include the dividend. That gain actually surpasses the 13% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting KKR Real Estate Finance Trust on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for KKR Real Estate Finance Trust (2 can't be ignored) that you should be aware of.

We will like KKR Real Estate Finance Trust better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.