If You Had Bought Greenlight Capital Re's (NASDAQ:GLRE) Shares Five Years Ago You Would Be Down 59%

Statistically speaking, long term investing is a profitable endeavour. But that doesn't mean long term investors can avoid big losses. For example the Greenlight Capital Re, Ltd. (NASDAQ:GLRE) share price dropped 59% over five years. That is extremely sub-optimal, to say the least. It's up 1.1% in the last seven days.

Check out our latest analysis for Greenlight Capital Re

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Greenlight Capital Re moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

The revenue fall of 0.09% per year for five years is neither good nor terrible. But if the market expected durable top line growth, then that could explain the share price weakness.

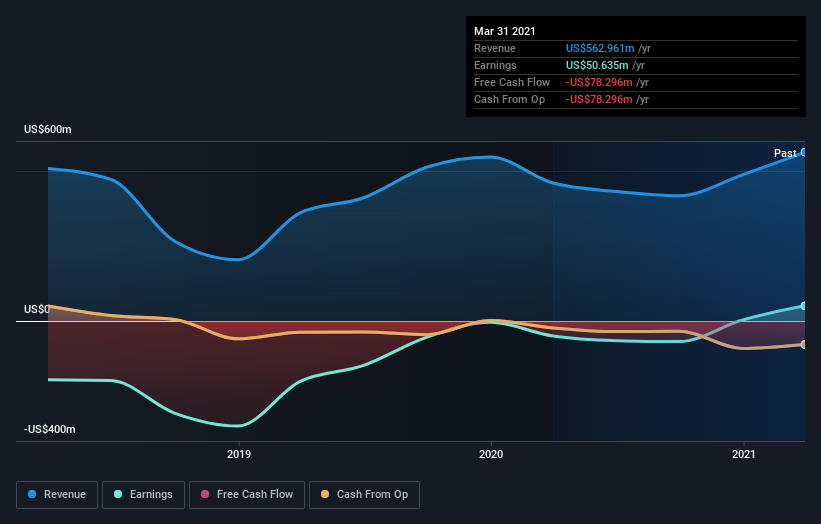

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Dive deeper into the earnings by checking this interactive graph of Greenlight Capital Re's earnings, revenue and cash flow.

A Different Perspective

Greenlight Capital Re provided a TSR of 28% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 10% endured over half a decade. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Greenlight Capital Re has 1 warning sign we think you should be aware of.

Greenlight Capital Re is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.