Ameren (AEE) Gains From Investments, Hurt by Solvency Position

Ameren Corporation AEE is benefiting from systematic and consistent investments in growth projects and infrastructure upgradation. Yet, weak solvency position is a threat.

This Zacks Rank #3(Hold) stock delivered an earnings surprise of 6.85%, on average, in the last four quarters. The Zacks Consensus Estimate for 2021 earnings per share is pegged at $3.79, up 1% in the past 60 days.

Tailwinds

Ameren plans to invest $17.8 billion in growth projects and infrastructure upgrade, in the 2021-2025 period. The company boasts a solid pipeline of regulated infrastructure investments of more than $20 billion in the 2025-2029 period. This will enable the company support system reliability, environmental compliance as well as electric and natural gas utility infrastructure improvements.

In January 2021, Ameren Missouri acquired an up-to 300-MW wind generation project located in northwestern Missouri. Ameren is also closing its coal-fired plants to reduce carbon dioxide emissions and promote green energy. It aims to expand renewable sources by adding 3,100 MWs of renewable generation by the end of 2030 and a total of 5,400 MWs of renewable generation by 2040.

Headwinds

The adverse economic condition stemming from the COVID-19 outbreak dented the company’s sales volume. Further, environmental regulations might increase the company’s overall capital expenses, thereby affecting the stock’s potential.

The company bears a weak solvency position, with long term as well as current debt pegged significantly higher than its cash reserve, as of Mar 31, 2021.

Price Performance

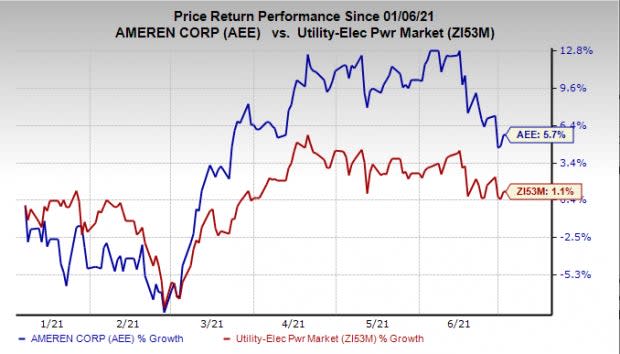

In the past six months, units of Ameren have gained 5.7% compared with the industry’s 1.1% rally.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks in the same industry are Korea Electric Power Corporation KEP, Entergy Corporation ETR and Hawaiian Electric Industries, Inc. HE, each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for 2021 earnings per share for Korea Electric, Entergy and Hawaiian Electric has moved up 1.4%, 0.2% and 8.8%, respectively, in the past 60 days.

The current dividend yield of Korea Electric, Entergy and Hawaiian Electric is 4.75%, 3.73% and 3.21%, respectively.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report

Korea Electric Power Corporation (KEP) : Free Stock Analysis Report

Hawaiian Electric Industries, Inc. (HE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research