Regency Centers (REG) Q3 FFO Declines, Revenues Beat, View Up

Regency Centers Corporation’s REG third-quarter 2022 core operating earnings per share were 94 cents, falling 2.1% year over year. The company reported NAREIT funds from operations (FFO) of $1.01, which declined 9.8% from the prior-year quarter. The Zacks Consensus Estimate was pegged at 95 cents.

Total revenues of $303.9 million were 1.1% lower than the year-ago period’s $307.4 million. Nonetheless, the figure outpaced the Zacks Consensus Estimate of $298.7 million.

Regency’s results reflect healthy leasing activity and year-over-year improvement in base rent. However, same-property net operating income (NOI) falls year over year.

On Oct 12, 2022, REG closed on the acquisition of East Meadow Plaza in East Meadow, NY, for a gross sales price of $30 million.

Inside the Headlines

During the third quarter, Regency Centers executed 2.3 million square feet of comparable new and renewal leases at a blended cash rent spread of 7%.

As of Sep 30, 2022, REG’s wholly-owned portfolio and its pro-rata share of co-investment partnerships were 94.6% leased. Its same-property portfolio was 94.7% leased, reflecting an expansion of 20 basis points (bps) sequentially and 90 bps year over year.

The same-property anchor percent leased (includes spaces greater than or equal to 10,000 square feet) was 96.7%, marking a rise of 10 bps from the prior quarter.

The same-property shop percent leased (includes spaces less than 10,000 square feet) was 91.4%, rising 40 bps from the prior quarter.

During the quarter, the same-property base rent improved 3.9% year over year to $224.5 million.

The same-property net operating income (NOI), excluding lease termination fees, declined 0.4% on a year-over-year basis to $215.4 million.

As of Sep 30, 2022, Regency Centers’ in-process development and redevelopment projects had estimated net project costs of around $398 million at the company’s share. So far, it has incurred 55% of the costs.

Balance Sheet

Regency Centers ended the third quarter with cash, cash equivalents and restricted cash of $154.9 million, down from $121.2 million as of Jun 30, 2022.

As of Sep 30, 2022, this retail REIT had full capacity available under its $1.2-billion revolving credit facility. As of the same date, its pro-rata net debt-to-operating EBITDAre was 5.0X.

In September, Moody’s Investors Service upgraded REG’s outlook to positive from stable while affirming its rating of Baa1 on the company’s senior unsecured debt.

Dividend Update

On Nov 2, Regency Centers’ board of directors increased the quarterly cash dividend payment on its common stock from 62.50 cents per share to 65 cents. This represents a 4% hike on the prior quarterly dividend payment. The increased amount will be paid out on Jan 4 to its shareholders on record as of Dec 16, 2022.

2022 Outlook Raised

Regency Centers raised its 2022 guidance.

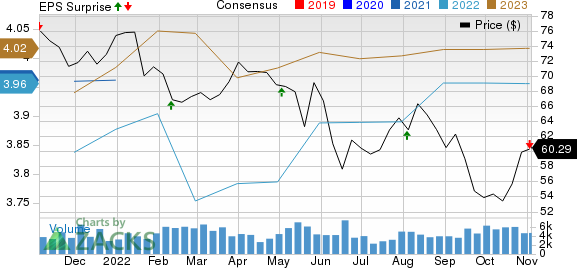

Management projects core operating earnings per share to lie between $3.75 and $3.78, up from $3.70-$3.74. The current-year NAREIT FFO per share is expected to lie in the range of $4.00-$4.03, revised upward from $3.92-$3.96 guided earlier. The Zacks Consensus Estimate is presently pegged at $3.96.

The same-property NOI (excluding termination fees) is expected to lie between 2.0% and 2.5%, up from 1.25-2.25% estimated earlier.

Regency Centers currently carries a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Regency Centers Corporation Price, Consensus and EPS Surprise

Regency Centers Corporation price-consensus-eps-surprise-chart | Regency Centers Corporation Quote

Performance of Other Retail REITs

Kimco Realty Corp.’s KIM third-quarter 2022 FFO per share came in at 41 cents, surpassing the Zacks Consensus Estimate of 39 cents. The figure grew 28.1% from the year-ago quarter’s 32 cents.

Results reflect year-over-year growth in the top line. The rise in occupancy levels and rental rate growth aided Kimco’s performance. It raised the 2022 FFO per share outlook.

Simon Property Group, Inc.’s SPG third-quarter 2022 comparable FFO per share of $2.97 exceeded the Zacks Consensus Estimate of $2.93. The figure compares favorably with the year-ago quarter’s $2.92.

SPG’s results reflect healthy operating performance and growth in occupancy levels. Based on the quarterly results, this retail REIT behemoth raised the 2022 FFO per share outlook and announced a hike in the quarterly dividend.

SITE Centers Corp. SITC reported third-quarter 2022 operating FFO (OFFO) per share of 29 cents, beating the Zacks Consensus Estimate by a cent. The figure was in line with the prior-year quarter’s FFO per share.

SITC’s results reflect healthy leasing activity and a year-over-year improvement in annualized base rent.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Simon Property Group, Inc. (SPG) : Free Stock Analysis Report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

Regency Centers Corporation (REG) : Free Stock Analysis Report

SITE CENTERS CORP. (SITC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research