REAL TIME PRICE

EXTENDED HOURS

| Day’s Range | - |

| 52 Week Range | - |

| Real Estate Investment Tr... | |

Barclays Initiates Coverage of Public Storage (PSA) with Equal-Weight Recommendation

Fintel reports that on March 27, 2024, Barclays initiated coverage of Public Storage (NYSE:PSA) with a Equal-Weight recommendation.

Analyst Price Forecast Suggests 13.86% Upside

As of March 10, 2024, the average one-year price target for Public Storage is 313.45. The forecasts range from a low of 252.50 to a high of $365.40. The average price target represents an increase of 13.86% from its latest reported closing price of 275.29.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Public Storage is 4,742MM, an increase of 4.32%. The projected annual non-GAAP EPS is 12.40.

Public Storage Declares $3.00 Dividend

On February 23, 2024 the company declared a regular quarterly dividend of $3.00 per share ($12.00 annualized). Shareholders of record as of March 13, 2024 will receive the payment on March 28, 2024. Previously, the company paid $3.00 per share.

At the current share price of $275.29 / share, the stock's dividend yield is 4.36%.

Looking back five years and taking a sample every week, the average dividend yield has been 3.37%, the lowest has been 1.95%, and the highest has been 5.02%. The standard deviation of yields is 0.75 (n=234).

The current dividend yield is 1.32 standard deviations above the historical average.

Additionally, the company's dividend payout ratio is 0.98. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is 0.50%, demonstrating that it has increased its dividend over time.

What is the Fund Sentiment?

There are 1984 funds or institutions reporting positions in Public Storage.

This is an increase

of

81

owner(s) or 4.26% in the last quarter.

Average portfolio weight of all funds dedicated to PSA is 0.51%,

an increase

of 1.00%.

Total shares owned by institutions decreased

in the last three months by 1.68% to 162,586K shares.

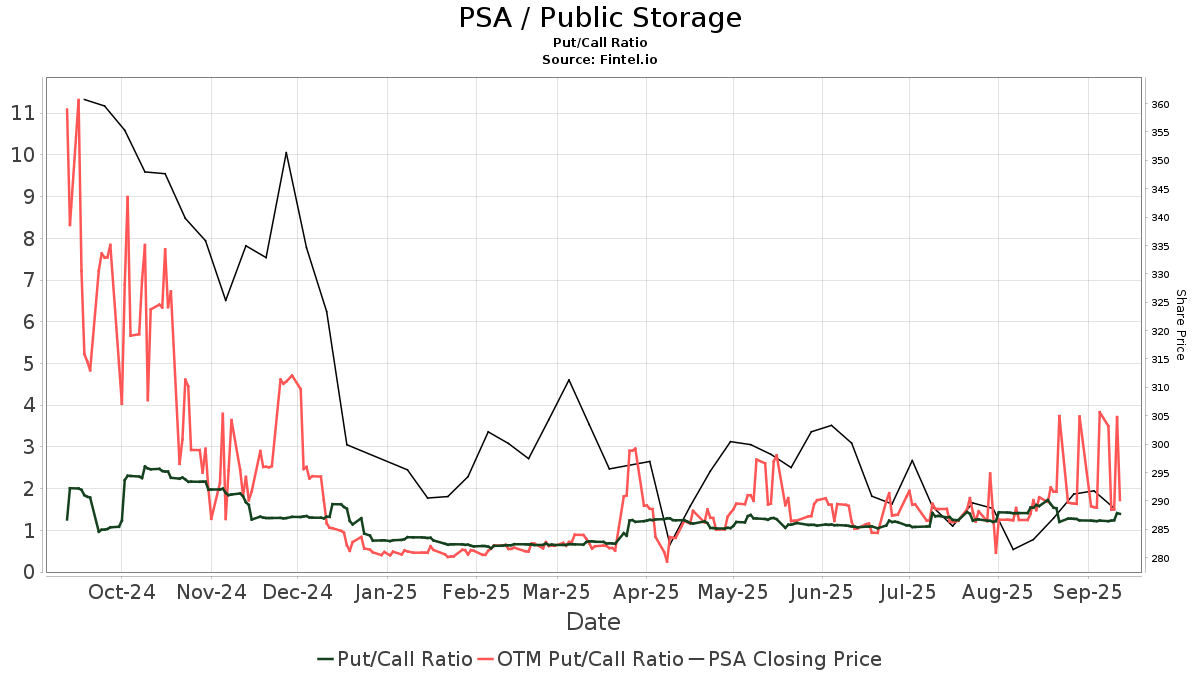

The put/call ratio of PSA is 1.42, indicating a

bearish

outlook.

The put/call ratio of PSA is 1.42, indicating a

bearish

outlook.

What are Other Shareholders Doing?

VGSIX - Vanguard Real Estate Index Fund Investor Shares holds 6,524K shares representing 3.71% ownership of the company. In it's prior filing, the firm reported owning 6,667K shares, representing a decrease of 2.19%. The firm decreased its portfolio allocation in PSA by 1.54% over the last quarter.

Price T Rowe Associates holds 5,213K shares representing 2.97% ownership of the company. In it's prior filing, the firm reported owning 4,896K shares, representing an increase of 6.08%. The firm increased its portfolio allocation in PSA by 13.00% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 4,963K shares representing 2.82% ownership of the company. In it's prior filing, the firm reported owning 4,927K shares, representing an increase of 0.72%. The firm increased its portfolio allocation in PSA by 4.18% over the last quarter.

Wellington Management Group Llp holds 4,187K shares representing 2.38% ownership of the company. In it's prior filing, the firm reported owning 4,235K shares, representing a decrease of 1.13%. The firm decreased its portfolio allocation in PSA by 84.67% over the last quarter.

VFINX - Vanguard 500 Index Fund Investor Shares holds 3,865K shares representing 2.20% ownership of the company. In it's prior filing, the firm reported owning 3,803K shares, representing an increase of 1.63%. The firm increased its portfolio allocation in PSA by 3.92% over the last quarter.

Public Storage Background Information

(This description is provided by the company.)

Public Storage, a member of the S&P 500 and FT Global 500, is a REIT that primarily acquires, develops, owns and operates self-storage facilities. At December 31, 2020, The Company had: interests in 2,548 self-storage facilities located in 38 states with approximately 175 million net rentable square feet in the United States, an approximate 35% common equity interest in Shurgard Self Storage SA which owned 241 self-storage facilities located in seven Western European nations with approximately 13 million net rentable square feet operated under the 'Shurgard' brand and an approximate 42% common equity interest in PS Business Parks, Inc. which owned and operated approximately 28 million rentable square feet of commercial space at December 31, 2020. Its headquarters are located in Glendale, California.

Stories by George Maybach

JP Morgan Upgrades Joby Aviation (JOBY)

Fintel reports that on May 3, 2024, JP Morgan upgraded their outlook for Joby Aviation (NYSE:JOBY) from Underweight to Neutral.

JP Morgan Downgrades Driven Brands Holdings (DRVN)

Fintel reports that on May 3, 2024, JP Morgan downgraded their outlook for Driven Brands Holdings (NasdaqGS:DRVN) from Overweight to Neutral.

JP Morgan Downgrades Vestis (VSTS)

Fintel reports that on May 3, 2024, JP Morgan downgraded their outlook for Vestis (NYSE:VSTS) from Overweight to Neutral.

JP Morgan Upgrades Williams-Sonoma (WSM)

Fintel reports that on May 3, 2024, JP Morgan upgraded their outlook for Williams-Sonoma (NYSE:WSM) from Underweight to Neutral.

BMO Capital Upgrades Coeur Mining (CDE)

Fintel reports that on May 3, 2024, BMO Capital upgraded their outlook for Coeur Mining (NYSE:CDE) from Market Perform to Outperform.

Craig-Hallum Downgrades XPEL (XPEL)

Fintel reports that on May 3, 2024, Craig-Hallum downgraded their outlook for XPEL (NasdaqCM:XPEL) from Buy to Hold.

Bernstein Downgrades Peloton Interactive (PTON)

Fintel reports that on May 3, 2024, Bernstein downgraded their outlook for Peloton Interactive (NasdaqGS:PTON) from Outperform to Market Perform.

JP Morgan Upgrades Mister Car Wash (MCW)

Fintel reports that on May 3, 2024, JP Morgan upgraded their outlook for Mister Car Wash (NYSE:MCW) from Neutral to Overweight.

RBC Capital Initiates Coverage of FTAI Aviation (FTAI) with Outperform Recommendation

Fintel reports that on May 3, 2024, RBC Capital initiated coverage of FTAI Aviation (NasdaqGS:FTAI) with a Outperform recommendation.

Compass Point Downgrades Centerspace (CSR)

Fintel reports that on May 3, 2024, Compass Point downgraded their outlook for Centerspace (NYSE:CSR) from Buy to Neutral.