Parnassus on VF Corp's Dividend Cut and Outlook

VF Corp. (NYSE:VFC), the owner of several prominent fashion brands, offered a very high dividend yield of 8.70% for a very short period of time, brought about by a steep drop in earnings and the share price before the company adjusted for the times and slashed the dividend. Now, the forward dividend yield is "just" 5.64%. Does this make the stock an attractive value opportunity?

Warning! GuruFocus has detected 6 Warning Sign with VFC. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Parnassus weighs in

The Parnassus Value Equity Fund (Trades, Portfolio)s fourth-quarter 2022 commentary provided a good summary on what's currently going on with VF Corp.:

Shares suffered their worst annual performance in over 20 years due to company missteps amid heightened macro uncertainty. Management lowered their outlook three times in three months, as U.S. sales slowed with the end of stimulus payments, inflation waylaid European consumers and Chinese sales collapsed under Covid-19 lockdowns. Moreover, an inventory glut, unfavorable foreign exchange, and an impairment charge on the companys earlier purchase of streetwear brand Supreme all weighed on profitability, culminating in the retirement of the companys long-time CEO. We held our shares, encouraged by the companys efforts to revitalize Vans and by evidence that problems related to inventory, freight and inflation are beginning to abate.

As we can see, the company, which claims to have the worlds leading portfolio of active lifestyle brands, has endured a lot of turbulence in the past few years.

Originally known as Vanity Fair, VF Corp used to be the home to blue jeans and other basic clothing lines. But, in 2019, it bundled up those old reliables and spun them off as Kontoor Brands (NYSE:KTB). That left it with just the fashion lines, such as The North Face and Vans.

As Parnassus noted, various headwinds emerged since then, which affect fashion (more expensive brands) more than active (staple) brands.

Thus, it's no surprise to me that VF Corp. In addition, the market as a whole took a tumble in both 2020 and 2022. Combined, those effects dramatically reduced the share price and pushed up the dividend yield.

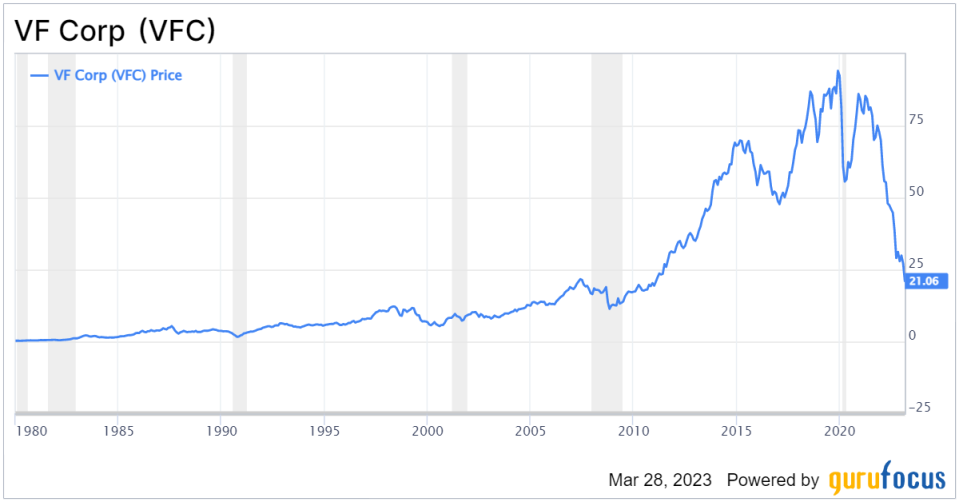

VFC Data by GuruFocus

Shares hit a high of $99.96 on Dec. 27, 2019, before plunging. At the close of trading on March 27, 2023, the shares were trading at $20.84. In other words, the share price had fallen off by roughly 80%.

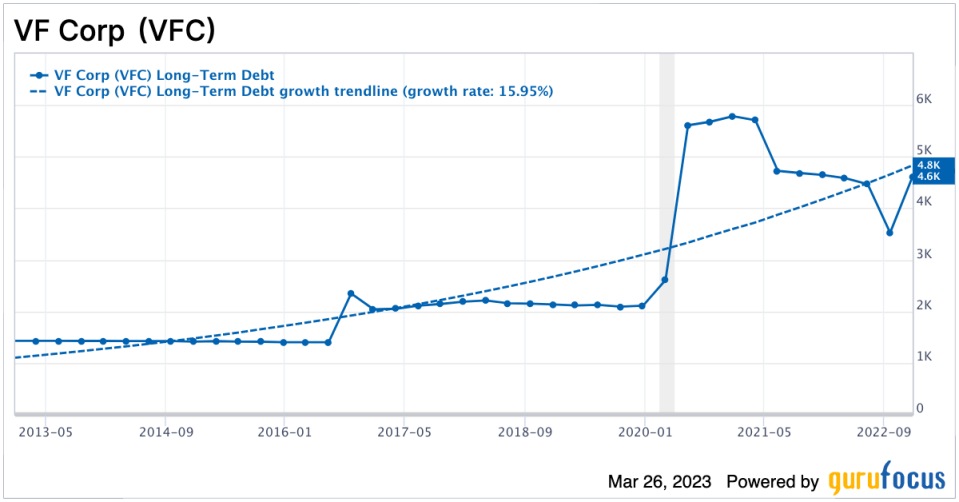

Over the same period, VF Corp.'s debt rose by an average of almost 16% per year:

CEO troubles

We dont know if he voluntarily resigned or was pushed out by disgruntled executives, but former Chairman and CEO Steve Rendle resigned on Dec. 5, 2022. Benno Dorer, the boards lead independent director, has taken over while the company seeks out a permanent replacement.

Although he is only an interim CEO, Dorer has taken action (which may or may not have been planned while Rendle remained in office). According to Dorer:

We are committed to improving execution through a sharpened focus on the biggest consumer opportunities and enhanced operational performance. Consistent with this objective, we are shifting resource priorities across the Company, including by reducing the dividend, exploring the sale of non-core assets, cutting costs and eliminating non-strategic spend, while enhancing the focus on the consumer through targeted investments.

In terms of the dividend, this meant cutting the quarterly dividend by 41%, from $0.51 to $0.30. This 10-year chart shows the companys dividends per share to the end of 2022, but doesnt include the cut that has been made for the first quarter of 2023:

Thus, some investors may be misled by the trailing 12-month dividend yield of 8.7%, which is why it's always essential to look at the forward dividend yield and any recent company annoucements before making an assessment on the dividend prospects of a stock. The new annual payment will be $1.20 (4 x $0.30).

Some commentators have lamented that VF Corp. lost the opportunity to become a Dividend King followoing its business split. Before the split, it had paid a dividend since the first quarter of 1985. However, the company felt the change was necessary for long-term growth.

Looking forward

Parnassus is cautiously optimistic about VF Corp.'s future, citing a revitalization of Vans, as well as indications its inventory, freight and inflation problems are beginning to abate.

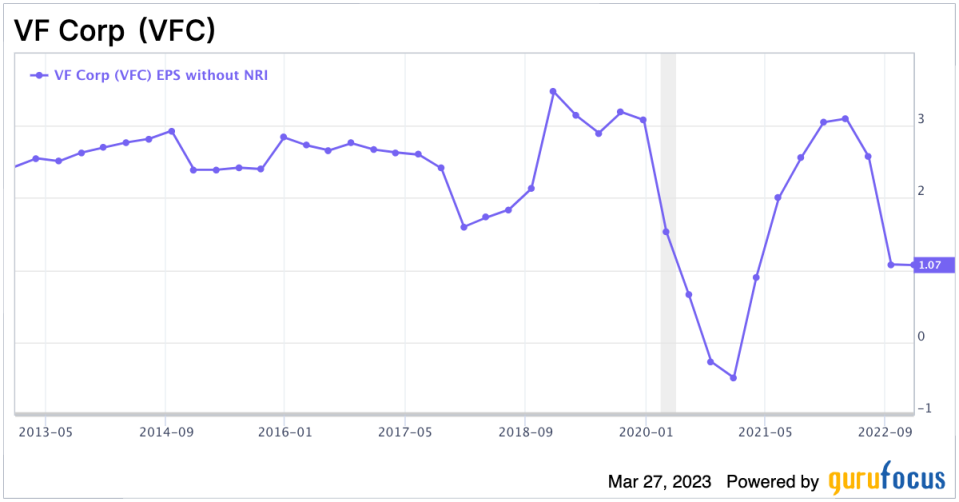

Ultimately, the long-term share price and dividend growth depend on the companys ability to get its earnings back on track. As this 10-year chart of earnings per share without non-recurring items shows, that could be a challenge:

For my part, I'm hesitant to make an assessment on the company until it gets a new CEO. In this kind of situation, a CEO can make or break a company.

VF Corp. has a GuruFocus financial strength ranking of 4 out of 10, so it can't afford many more mistakes. GuruFocus gives it a profitability ranking of 6 out of 10 for good margins, but its growth has been nearly absent. Over the past three years, its revenue growth rate averaged 5.60%, while its Ebitda growth rate was 11.9% per year. Its earnings per share without non-recurring items growth rate over the past three years was 12.60%, but it was extremely volatile. This is reflected by the three-year free cash flow growth rate of -26.80%, which is a serious shortcoming since the company is loaded with debt and is unlikely to issue new shares at the current prices. The dividend cut will help shore up that aspect of its financials.

Investors who like bargains, are willing to overlook the debt and are prepared to wait five to 10 years for a potential payoff may like this stock, but personally, I'll be steering clear of this uncertain situation. Stretching for that dividend yield just doesn't seem worth it.

This article first appeared on GuruFocus.