Decoding Chesapeake Energy Corp (CHK): A Strategic SWOT Insight

Chesapeake Energy Corp (NASDAQ:CHK) faces a significant decrease in net income and earnings per share compared to the previous year.

Despite reduced revenues, CHK maintains a strong operational focus in key shale regions, offering potential for strategic growth.

CHK's recent merger agreement with Southwestern Energy Company could reshape its competitive landscape.

Environmental initiatives, such as the CCUS project with Momentum Sustainable Ventures LLC, highlight CHK's commitment to sustainability.

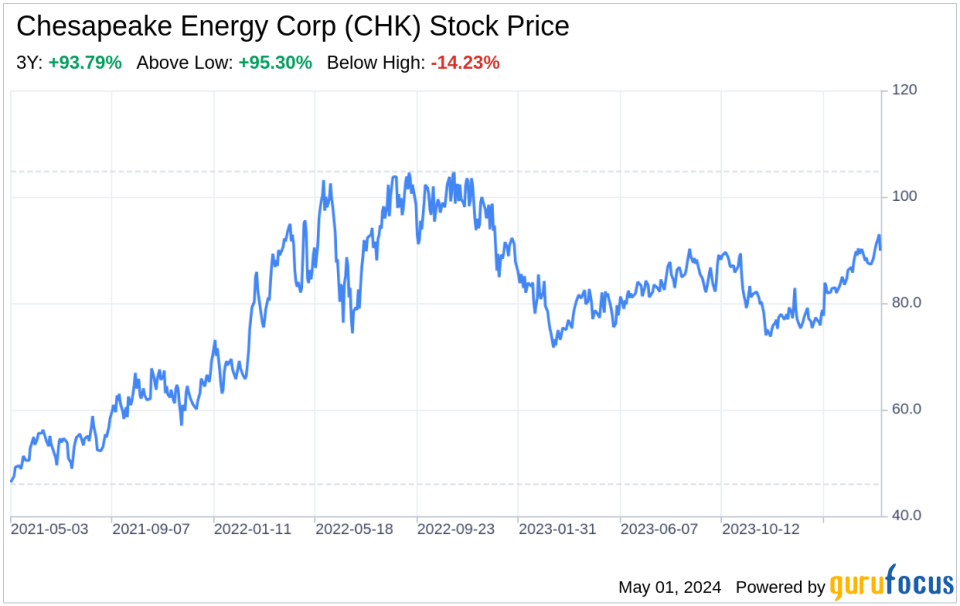

Chesapeake Energy Corp (NASDAQ:CHK), a leading exploration and production company, filed its 10-Q on April 30, 2024, revealing a challenging quarter with a stark decrease in net income from $1,389 million in 2023 to $26 million in 2024. Earnings per share plummeted from $10.31 (basic) and $9.60 (diluted) in 2023 to $0.20 (basic) and $0.18 (diluted) in 2024. Total revenues also saw a significant drop from $3,370 million to $1,081 million. This financial overview sets the stage for a detailed SWOT analysis, providing investors with a comprehensive understanding of CHK's current position and future prospects.

Strengths

Operational Efficiency and Asset Quality: CHK's operational strengths are rooted in its high-quality asset portfolio, particularly in the Marcellus and Haynesville shale regions. The company's focus on these key areas has allowed it to optimize production and maintain a competitive cost structure. CHK's strategic divestitures, such as the recent sale of a portion of its Eagle Ford assets, demonstrate its ability to streamline operations and focus on its most profitable segments. This operational efficiency is further evidenced by its relatively low production expenses of $59 million in the current quarter compared to $131 million in the previous year.

Strategic Partnerships and Merger Agreements: CHK's recent merger agreement with Southwestern Energy Company is a testament to its strategic foresight. This all-stock merger is set to enhance CHK's scale and operational capabilities. Additionally, CHK's equity investment in Momentum Sustainable Ventures LLC for the development of a natural gas gathering pipeline and carbon capture project showcases its commitment to sustainability and innovation, potentially opening new revenue streams and improving its environmental footprint.

Weaknesses

Financial Performance Volatility: The stark decline in CHK's net income and earnings per share highlights the volatility in its financial performance. The company's total revenues and other income have decreased significantly, reflecting the challenges in the energy market and the impact of asset divestitures. This volatility may concern investors and could impact CHK's ability to secure financing or invest in growth opportunities.

Debt and Interest Expenses: While CHK has managed to reduce its interest expenses from $37 million to $19 million, the presence of debt on its balance sheet remains a concern. The company must continue to manage its debt levels carefully to maintain financial flexibility and avoid the constraints that high leverage can impose on strategic decision-making and growth initiatives.

Opportunities

Market Recovery and Price Improvements: The energy sector is cyclical, and CHK stands to benefit from potential market recoveries and improvements in natural gas, oil, and NGL prices. As market conditions improve, CHK's operational focus and asset quality could position it to capitalize on rising prices and increased demand, particularly in its core shale regions.

Merger and Acquisition Synergies: The planned merger with Southwestern Energy Company presents significant opportunities for operational synergies and cost savings. The combined entity is expected to have a stronger competitive position, with an enhanced ability to optimize assets and potentially increase market share in the natural gas and oil sectors.

Threats

Market and Commodity Price Risks: CHK operates in a market that is highly sensitive to fluctuations in commodity prices. The company's financial performance can be significantly impacted by changes in the prices of natural gas, oil, and NGL, which are influenced by global economic conditions, geopolitical events, and other external factors beyond the company's control.

Regulatory and Environmental Risks: The energy industry is subject to stringent environmental regulations, which can impose additional costs and operational constraints on companies like CHK. The company must navigate these regulatory challenges while also addressing the growing societal and investor demand for sustainable and environmentally responsible practices.

In conclusion, Chesapeake Energy Corp (NASDAQ:CHK) exhibits a mix of strengths, weaknesses, opportunities, and threats in its current strategic position. While facing financial volatility and market risks, the company's operational efficiency, strategic partnerships, and potential synergies from its merger with Southwestern Energy Company position it for future growth. CHK's commitment to sustainability and innovation, as seen in its investment in the CCUS project, aligns with the industry's shift towards environmentally responsible practices. Investors should closely monitor CHK's ability to leverage its strengths, mitigate its weaknesses, capitalize on opportunities, and navigate threats in the dynamic energy market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.