PacBio (PACB) Enhances Sequencing Platform Via Latest Buyout

Pacific Biosciences of California, Inc. PACB, popularly known as PacBio, recently inked a definitive merger agreement to acquire Omniome, Inc, subject to customary closing conditions and regulatory approvals. The buyout will enable PacBio to become the only company having both largely accurate long-read and short-read sequencing platforms under its wings.

For investors’ note, San Diego-based Omniome develops a highly differentiated proprietary short-read sequencing platform, which is capable of delivering high accuracy.

The latest acquisition will aid PacBio to significantly expand its market share for sequencing in innovative ways, thus strengthening its global foothold.

Rationale Behind the Buyout

Per PacBio’s management, the acquisition of Omniome is expected to pave the way for wider and faster adoption of Single Molecule, Real-Time or SMRT sequencing technology. The company expects to reach more customers with a deeper product offering following the addition of short-read sequencing technology to its long-read portfolio.

PacBio also expects to penetrate the large and fast-growing clinical application areas in oncology, transcriptomics, metagenomics and non-invasive prenatal testing with the newly-added short read sequencing platform.

Industry Prospects

Per a report by Allied Market Research, the global DNA sequencing market was valued at $6,243 million in 2017 and is expected to reach $25,470 million in 2025 at a CAGR of 19%. Factors like surge in sequencing applications and rise in technological advancements are likely to drive the market.

Given the market potential, the inking of the buyout deal seems to be timed well.

Other Notable Deals

Of late, PacBio has entered into a slew of strategic deals.

The company, this month, announced its intent to expand its multi-year collaboration with Invitae Corporation NVTA to develop a production-scale high-throughput HiFi sequencing platform to include the sequencing technology developed by Omniome.

In June, PacBio partnered with Rady Children’s Institute for Genomic Medicine for research related to whole genome sequencing. The study aims to identify potential disease-causing genetic variants and increase the solve rates of rare diseases.

Q2 Preliminary Result

PacBio also announced preliminary revenues for second-quarter 2021. The company expects to release detailed financial results for the period on Aug 3.

Per the preliminary report, second-quarter 2021 revenues are estimated at $30.5 million, suggesting around 78% growth from the year-ago quarter. The Zacks Consensus Estimate of $30 million is below the preliminary figure.

Notably, the expected uptick in the second quarter will represent the fifth consecutive quarter of growth.

Price Performance

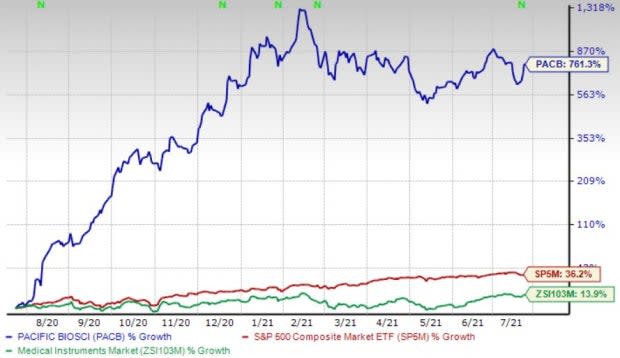

Shares of the company have gained a massive 761.3% in the past year compared with the industry’s 13.9% rise and the S&P 500’s 36.2% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Currently, PacBio carries a Zacks Rank #4 (Sell).

A couple of better-ranked stocks from the broader medical space are Veeva Systems Inc. VEEV and Henry Schein, Inc. HSIC.

Veeva Systems’ long-term earnings growth rate is estimated at 15.8%. The company presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Henry Schein’s long-term earnings growth rate is estimated at 11.2%. It currently carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

Invitae Corporation (NVTA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research