3 Reasons to Add LHC Group (LHCG) Stock to Your Portfolio

LHC Group, Inc. LHCG has been gaining from its slew of strategic deals over the past few months. A robust first-quarter 2021 performance, along with a broad array of services, is expected to contribute further. However, stiff competition and regulatory bottlenecks persist.

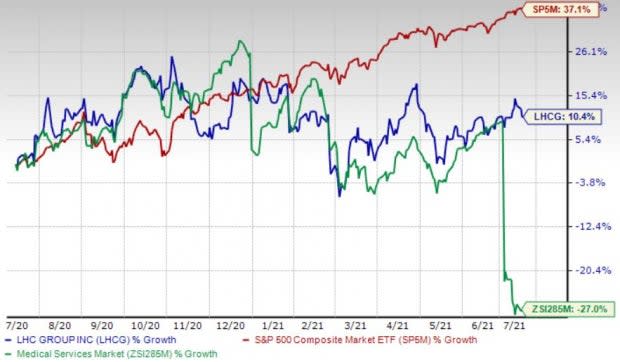

Over the past year, this Zacks Rank #2 (Buy) stock has gained 10.4% against 26.9% fall of the industry and 37.1% rise of the S&P 500 composite.

The renowned post-acute healthcare service provider has a market capitalization of $6.48 billion. The company projects 13.7% growth for the next five years and expects to maintain its strong performance. Further, it has delivered an earnings surprise of 25% for the past four quarters, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strategic Deals: We are optimistic about LHC Group’s robust growth opportunities via buyouts and partnerships. The company, this month, entered into a partnership with SCP Health to jointly develop and deliver advanced at-home clinical care services.

Also in July, LHC Group announced agreements to purchase three home health, hospice and palliative care providers across three states as well as closure on previously announced purchases in four western states. In June, the company signed a definitive agreement to acquire Heart of Hospice from Charleston, SC-based EPI Group, LLC.

In May, LHC Group entered into an acquisition agreement wherein it agreed to purchase two Casa de la Luz provider locations in Tucson, AZ (anticipated to be completed on Jul 1, 2021, subject to certain customary closing conditions).

Broad Array of Services: LHC Group’s wide array of services through its diverse business segments, which have also been instrumental in driving the top line, buoy our optimism. Within the home health services arm, nurses, home health aides and therapists work closely with patients and their families to design and implement individualized treatment plans in accordance with a physician-prescribed plan of care. The hospices segment offers a wide range of services, including pain and symptom management, and counseling.

Further, the company has been sourcing adequate personal protective equipment kits for patients and clinicians since the onset of the pandemic.

Strong Q1 Results: LHC Group’s solid first-quarter 2021 earnings, along with year-over-year uptick in the bottom line, buoy optimism. The company continues to gain from hospice admissions that witnessed organic growth in the quarter on a year-over-year basis. Expansion in both gross and operating margins bodes well. A raised 2021 outlook boosts our confidence on the stock.

Downsides might result from LHC Group’s operation in a highly regulated health care industry where it is required to comply with federal, state and local laws, which significantly affect it and other similar companies. These laws and regulations are extremely complex, and in many instances, the industry does not have the benefit of significant regulatory or judicial interpretation.

LHC Group operates in a highly competitive industry characterized by a fragmented home health care market. Some of its competitors are MedTech bigwigs like Amedisys, Inc. AMED, who have greater resources and better access to capital. Even local and regional providers of home health service pose stiff competition. These include facility- and hospital-based providers, visiting nurse associations and nurse registries.

Estimate Trend

LHC Group is witnessing a positive estimate revision trend for 2021. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 8.9% north to $6.36.

The Zacks Consensus Estimate for the company’s second-quarter 2021 revenues is pegged at $551.5 million, suggesting a 13.2% improvement from the year-ago quarter’s reported number.

Key Picks

A couple of other top-ranked stocks from the broader medical space are AMN Healthcare Services Inc AMN and Veeva Systems Inc. VEEV.

AMN Healthcare’s long-term earnings growth rate is estimated at 6.5%. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Veeva Systems’ long-term earnings growth rate is estimated at 15.8%. It currently carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amedisys, Inc. (AMED) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

LHC Group, Inc. (LHCG) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research