The Figeac Aero Société Anonyme (EPA:FGA) Share Price Is Down 54% So Some Shareholders Are Wishing They Sold

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the last three years have been particularly tough on longer term Figeac Aero Société Anonyme (EPA:FGA) shareholders. Unfortunately, they have held through a 54% decline in the share price in that time. More recently, the share price has dropped a further 16% in a month. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Check out our latest analysis for Figeac Aero Société Anonyme

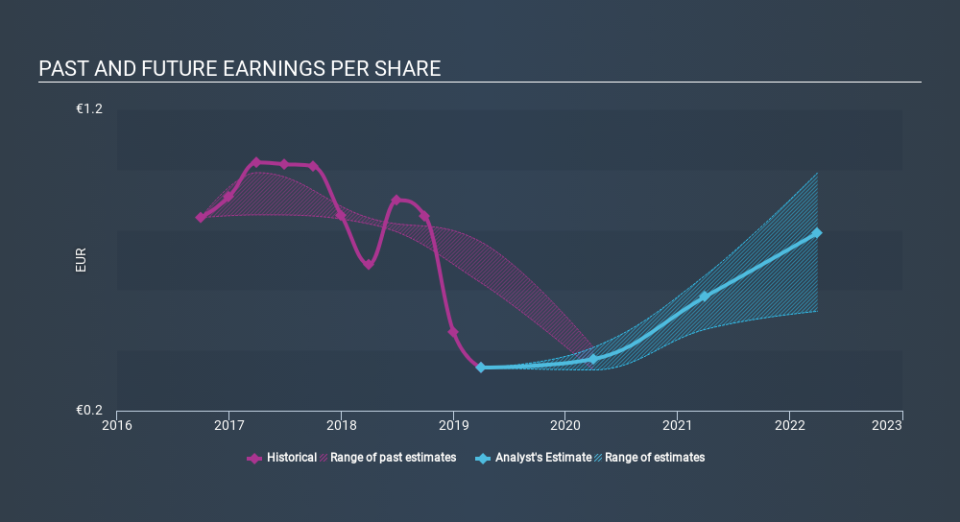

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Figeac Aero Société Anonyme saw its EPS decline at a compound rate of 26% per year, over the last three years. This change in EPS is reasonably close to the 23% average annual decrease in the share price. That suggests that the market sentiment around the company hasn't changed much over that time, despite the disappointment. It seems like the share price is reflecting the declining earnings per share.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Figeac Aero Société Anonyme's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Figeac Aero Société Anonyme shareholders are down 14% for the year, but the market itself is up 29%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4.4% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Is Figeac Aero Société Anonyme cheap compared to other companies? These 3 valuation measures might help you decide.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.