Peabody Energy Corp (BTU) Faces Earnings Dip in Q1 2024, Misses EPS Estimates

Net Income: Reported at $39.6 million, fell short of the estimated $67.57 million.

Earnings Per Share (EPS): Achieved $0.29 per diluted share, below the estimate of $0.31.

Revenue: Specific figures not provided, thus comparison to the estimated $991.07 million cannot be made.

Adjusted EBITDA: Recorded at $160.5 million for the quarter, indicating operational performance.

Share Repurchase: Repurchased $80.4 million of shares, reflecting ongoing shareholder return efforts.

Strategic Acquisitions: Completed the acquisition of the Wards Well coal deposit to extend the life of the Centurion Mine.

Dividend: Declared a dividend of $0.075 per share, demonstrating commitment to shareholder returns.

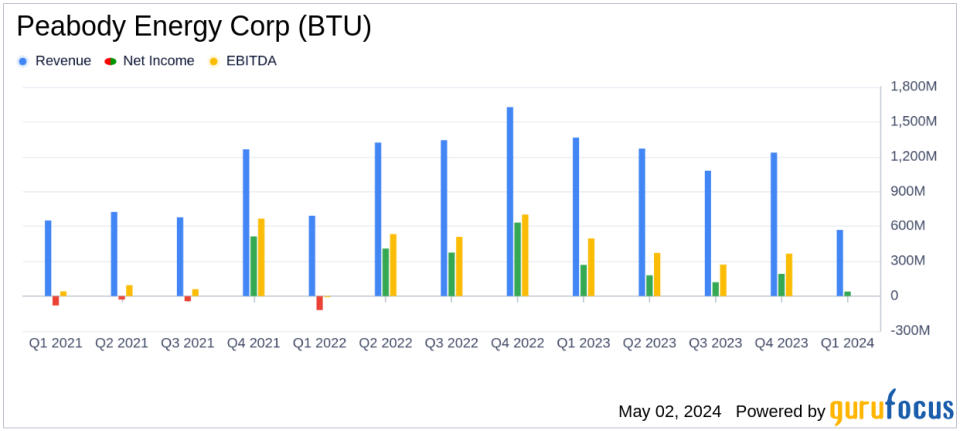

On May 2, 2024, Peabody Energy Corp (NYSE:BTU) disclosed its financial outcomes for the first quarter ended March 31, 2024, through an 8-K filing. The company reported a net income of $39.6 million, or $0.29 per diluted share, a significant decrease from $268.5 million, or $1.68 per diluted share, in the same period last year. These figures fell short of analyst expectations, which had projected earnings of $0.31 per share and a net income of $67.57 million.

Peabody Energy Corp, a key player in the thermal and metallurgical coal sectors, also reported an adjusted EBITDA of $160.5 million, down from $390.6 million in the prior year's quarter. Despite these declines, the company reaffirmed its full-year guidance, signaling confidence in overcoming initial production hurdles and focusing on long-term profitability through strategic initiatives like the Wards Well acquisition.

Strategic Moves and Financial Highlights

The company's strategic acquisition of the Wards Well coal deposit aims to extend the life of its Centurion Mine to over 25 years, enhancing the asset's long-term value. This move is part of Peabody's broader strategy to shift its portfolio towards metallurgical coal, which is crucial for steel production.

During the quarter, Peabody repurchased 3.2 million shares for $80.4 million and declared a dividend of $0.075 per share. These shareholder returns are part of a comprehensive program that has redistributed $470.7 million to shareholders since 2023. Additionally, Peabody closed a new $320 million revolving credit facility, bolstering its financial flexibility.

Operational Performance Across Segments

The Seaborne Thermal segment sold 4.0 million tons of coal, generating an adjusted EBITDA of $93.8 million with costs per ton at $47.71. The Seaborne Metallurgical segment, despite challenges in mine sequencing and coal quality, sold 1.4 million tons and recorded an adjusted EBITDA of $48.3 million. In the U.S., the Powder River Basin and Other U.S. Thermal segments faced reduced shipments due to mild winter weather and low natural gas prices, impacting their financial performance.

Looking Ahead

For the second quarter of 2024, Peabody anticipates increased volumes in both its Seaborne Thermal and Metallurgical segments. The company expects to maintain a strong focus on cost management and operational efficiency. Peabody's leadership remains committed to navigating market challenges and capitalizing on strategic growth opportunities to enhance shareholder value.

Today's earnings call, scheduled for 10 a.m. CT, will likely provide further insights into the company's strategies and outlook, accessible via Peabody's official website.

As Peabody Energy Corp (NYSE:BTU) continues to adjust its operations and strategy in response to global economic conditions and market demands, investors and stakeholders will be watching closely to see how these initiatives translate into financial performance in the upcoming quarters.

Explore the complete 8-K earnings release (here) from Peabody Energy Corp for further details.

This article first appeared on GuruFocus.