New York Community (NYCB) Up 9.6% as Q2 Earnings Beat Estimates

New York Community Bancorp, Inc.’s NYCB shares jumped 9.6% in response to its better-than-expected second-quarter 2021 results. Adjusted earnings per share of 33 cents surpassed the Zacks Consensus Estimate of 30 cents. The bottom line surged 57% year over year.

Higher net interest income and non-interest income supported the results. Margin expansion, higher loan balance and provision benefits were other tailwinds. However, a rise in expenses was a headwind.

Results excluded merger-related expenses pertaining to the agreement with Flagstar Bancorp, Inc. FBC and NYS tax changes. After considering these, net income available to common shareholders of $144 million jumped 48% from the prior-year quarter.

Revenues & Expenses Rise

Total revenues were $347 million, up 23% year over year. The top line beat the Zacks Consensus Estimate of $336 million.

Net interest income grew 24% year over year to $331 million. The rise mainly resulted from lower interest expenses.

Adjusted net interest margin of 2.38% rose 29 basis points (bps).

Non-interest income was $16 million, up 7%. The rise was primarily driven by to higher fee income.

Non-interest expenses of $139 million increased 13%. Higher occupancy and equipment, and general and administrative expenses, partially offset by lower compensation and benefits, chiefly resulted in the rise. Adjusted non-interest expenses rose 5% to $129 million.

Efficiency ratio was 37.11%, down from 43.94% in the year-ago quarter. A fall in efficiency ratio indicates improving profitability.

Solid Loans & Deposit Balance

As of Jun 30, 2021, total deposits were relatively stable sequentially at $34.2 billion. Total loans rose 1% to $43.4 billion.

During the second quarter, loan originations were $3.1 billion, soaring 21% sequentially. The improvement was driven by 42% increase in multi-family originations and a 12% rise in specialty finance loans and leases.

The company has $1.4 billion of loans in its current pipeline, including $884 million of multi-family loans, $105 million of commercial real estate loans, $377 million in specialty finance loans and $32 million in commercial and industrial loans.

Credit Quality Improves

Non-performing assets plunged 37% year over year to $40 million. Provision for loan losses was recovery of $4 million against a provision of $18 million in the prior-year quarter.

Net recoveries came in at $6 million against net charge-offs of $4 million in the prior-year quarter.

Strong Profitability and Capital Ratios

As of Jun 30, 2021, return on average assets and return on average common stockholders’ equity was 1.04% and 9.00% compared with 0.78% and 6.31%, respectively, in the year-ago quarter.

Common equity tier 1 ratio was 9.84% compared with 9.77% as of Jun 30, 2020. Total risk-based capital ratio was 13.05% compared with 13.13% in the year-ago quarter. Leverage capital ratio was 8.25%, down from 8.42%.

Our View

New York Community delivered solid performance in the second quarter. Higher revenues, aided by the expansion of margin and rise in loan balance, and a solid capital position remain major tailwinds. In addition, the planned acquisition of Flagstar Bancorp (expected to close in the fourth quarter) will lead to improvement in market share.

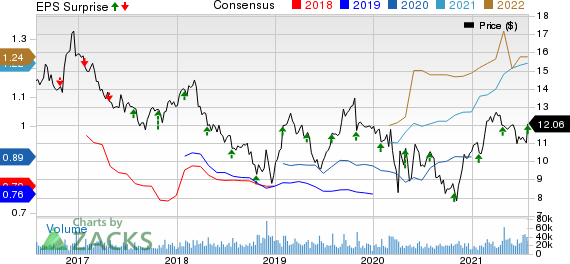

New York Community Bancorp, Inc. Price, Consensus and EPS Surprise

New York Community Bancorp, Inc. price-consensus-eps-surprise-chart | New York Community Bancorp, Inc. Quote

New York Community currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Zions Bancorporation’s ZION second-quarter 2021 net earnings per share of $2.08 surpassed the Zacks Consensus Estimate of $1.25. The bottom line marks a significant improvement from 34 cents earned in the year-ago quarter.

Hancock Whitney Corporation’s HWC second-quarter 2021 adjusted earnings per share of $1.37 surpassed the Zacks Consensus Estimate of $1.15. The bottom line improved significantly from the prior-year quarter’s loss of $1.36.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zions Bancorporation, N.A. (ZION) : Free Stock Analysis Report

Flagstar Bancorp, Inc. (FBC) : Free Stock Analysis Report

New York Community Bancorp, Inc. (NYCB) : Free Stock Analysis Report

Hancock Whitney Corporation (HWC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research