Steven Madden (SHOO) Looks Robust on Digital & Brand Strength

Steven Madden, Ltd. SHOO has been witnessing immense strength in the e-commerce business since the outbreak of the coronavirus pandemic. SHOO is steadily performing well on the back of its solid digital efforts and robust strategies, including brand strength.

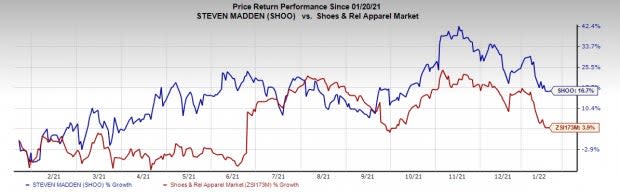

This renowned fashion-footwear player’s shares have increased 16.7% in the past year and outperformed the industry 3.9% growth. An expected long-term earnings growth rate of 15% for this currently Zacks Rank #2 (Buy) stock further speaks volumes.

For 2022, the Zacks Consensus Estimate for Steven Madden’s sales and earnings per share (EPS) suggests growth of 12.3% and 22.2%, respectively, from the year-ago period’s corresponding figures.

Image Source: Zacks Investment Research

Let’s Delve Deeper

E-commerce business remains a bright spot for Steven Madden. Solid gains from increased investment in digital marketing and robust consumer capabilities, such as try before you buy, have been contributing to its performance for a while. Management is also significantly accelerating its digital commerce initiatives with respect to distribution. E-commerce revenues soared 83.7% year over year during the third quarter of 2021.

SHOO added a high-level talent to the organization, ramped up digital marketing spend, improved data science capabilities, rolled out buy online, pick-up in store across its entire U.S. full price retail outlets plus introduced advanced delivery and return options. Going forward, strength in the e-commerce realm is likely to stay and keep boosting Steven Madden’s overall results.

Additionally, Steven Madden has been benefiting from its joint venture (JV) and smart buyouts for a while now. SHOO’s European JV distributes its branded footwear and accessories across most countries in Europe. It had formed the European JV roughly five years ago and the same registered solid double-digit percentage revenue growth each year.

Management is also optimistic about the buyout of BB Dakota, a California-based women's apparel company, through which SHOO is steadily expanding its apparel category. These buyouts are likely to sustain Steven Madden’s encouraging performance record.

Wrapping up, Steven Madden is focused on creating trendy products, deepening relations with customers via marketing, enhancing digital commerce agenda, expanding international markets, including Europe, and efficiently controlling inventory and expenses.

Strength in SHOO’s brands and e-commerce unit coupled with a robust business model position it well to cash in on market-growth opportunities and boost its stakeholders’ value in the long term.

Eye These Solid Picks Too

Gildan Activewear GIL, the apparel products’ manufacturer, currently sports a Zacks Rank #1 (Strong Buy). GIL has an expected EPS growth rate of 9% for three-five years. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Gildan Activewear’s 2022 sales and EPS suggests growth of 7.6% and 9.2%, respectively, from the year-ago corresponding figures. GIL has a trailing four-quarter earnings surprise of 85%, on average.

Crocs CROX, the manufacturer and distributor of casual lifestyle footwear and accessories, flaunts a Zacks Rank of 1 at present. CROX has an expected EPS growth rate of 15% for three-five years.

The Zacks Consensus Estimate for Crocs’ 2022 sales and EPS suggests growth of 34.2% and 29%, respectively, from the year-ago corresponding figures. CROX has a trailing four-quarter earnings surprise of 41.6%, on average.

Delta Apparel DLA is a manufacturer of activewear and lifestyle apparel products. DLA flaunts a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Delta Apparel’s current financial-year sales and EPS suggests growth of 11.9% and 10.1%, respectively, from the year-ago corresponding figures. DLA has a trailing four-quarter earnings surprise of 95.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

Steven Madden, Ltd. (SHOO) : Free Stock Analysis Report

Delta Apparel, Inc. (DLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research