Is Diamondback (FANG) Headed for Another Earnings Beat in Q3?

Diamondback Energy FANG is set to release third-quarter results on Nov 7. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of $6.51 per share on revenues of $2.4 billion.

Let’s delve into the factors that might have influenced the Permian-focused oil and gas producer’s performance in the September quarter. But it’s worth taking a look at FANG’s previous-quarter performance first.

Highlights of Q2 Earnings & Surprise History

In the last reported quarter, this Midland, TX-based upstream player beat the consensus mark on strengthening commodity price realizations and production. Diamondback had reported adjusted earnings per share of $7.07, ahead of the Zacks Consensus Estimate of $6.66. Revenues of $2.8 billion also outperformed the Zacks Consensus Estimate by 10.4%.

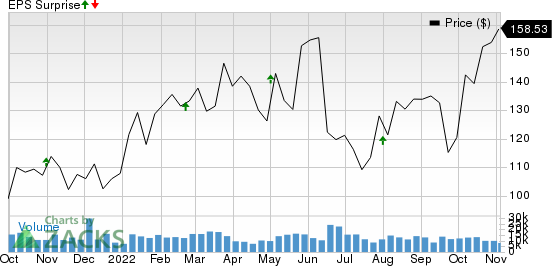

FANG beat the Zacks Consensus Estimate for earnings in each of the last four quarters, resulting in an earnings surprise of 7%, on average. This is depicted in the graph below:

Diamondback Energy, Inc. Price and EPS Surprise

Diamondback Energy, Inc. price-eps-surprise | Diamondback Energy, Inc. Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for the third-quarter bottom line has edged up 0.9% in the past seven days. The estimated figure indicates a 121.4% improvement year over year. The Zacks Consensus Estimate for revenues, meanwhile, suggests a 24.8% increase from the year-ago period.

Factors to Consider

Diamondback Energy is expected to have benefited from the strength in oil and natural gas realizations. As a reflection of this price boost, the respective Zacks Consensus Estimate for the third-quarter average sales price for crude and natural gas is pegged at $94 per barrel and $5.57 per thousand cubic feet, up significantly from a year earlier when the company had fetched $68.27 and $3.34. The year-over-year improvement in realizations has most likely buoyed Diamondback Energy’s revenues and cash flows.

Diamondback Energy is also expected to have benefited from a higher margin during the quarter. In the previous three-month period, the company’s unhedged cash margin improved 1% sequentially to more than 83%. The uptick is most likely to have continued in the to-be-reported quarter, thanks to FANG’s best-in-class cost structure. This margin boost is likely to have buoyed the third-quarter revenues and cash flows of the company.

Why a Likely Positive Surprise?

Our proven model predicts a likely earnings beat for Diamondback Energy this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

FANG has an Earnings ESP of +0.25% and a Zacks Rank #3.

Other Stocks to Consider

Diamondback Energy is not the only energy company looking up this earnings cycle. Here are some other firms from the space that you may want to consider on the basis of our model:

Cactus, Inc. WHD has an Earnings ESP of +2.74% and a Zacks Rank #1. The firm is scheduled to release earnings on Nov 7.

You can see the complete list of today’s Zacks #1 Rank stocks here.

For 2022, Cactus has a projected earnings growth rate of 144.4%. Valued at around $3.8 billion, WHD has gained 22.2% in a year.

HF Sinclair Corporation DINO has an Earnings ESP of +1.17% and a Zacks Rank #1. The firm is scheduled to release earnings on Nov 7.

For 2022, HF Sinclair has a projected earnings growth rate of 846.1%. Valued at around $13.2 billion, DINO has gained 94.9% in a year.

Calumet Specialty Products Partners, L.P. CLMT has an Earnings ESP of +40.15% and a Zacks Rank #3. The firm is scheduled to release earnings on Nov 9.

Calumet Specialty Products Partners topped the Zacks Consensus Estimate by an average of 62% in the trailing four quarters, including a 92% beat in Q2. Valued at around $1.5 billion, CLMT has surged 94.9% in a year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Calumet Specialty Products Partners, L.P. (CLMT) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

Cactus, Inc. (WHD) : Free Stock Analysis Report

HF Sinclair Corporation (DINO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research