How to build a Discounted Cash Flow (DCF) model and WACC automatically with ValueInvesting AAPL DCF

A discounted cash flow (DCF) model is a financial model used to value companies by discounting their future cash flow to the present value. A DCF is usually built after you have done a lot of stock research and analysis and need to know what is the intrinsic value of a stock. The whole process of building a DCF can be difficult and time-consuming if you need to do everything from scratch. In this blog I will illustrate how you can use ValueInvesting.io's stock research and financial modeling tool to build a DCF model for any value stocks in the world easily. We will use Apple Inc as an example.

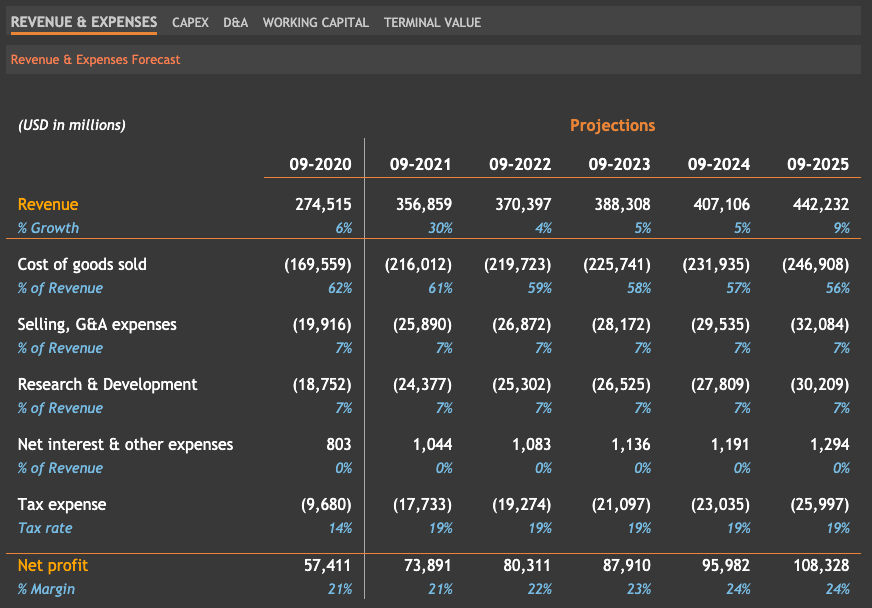

Forecast Revenue and Expenses

The most important thing when forecasting for DCF is to forecast the revenue growth. Revenue growth depends on many things such as the company's current performance, historical data, the industry trend and the macro economics. ValueInvesting.io takes all of that into consideration to come up with the revenue forecast for each company. For the expenses, we usually forecast them to be constant in term of proportion to revenue

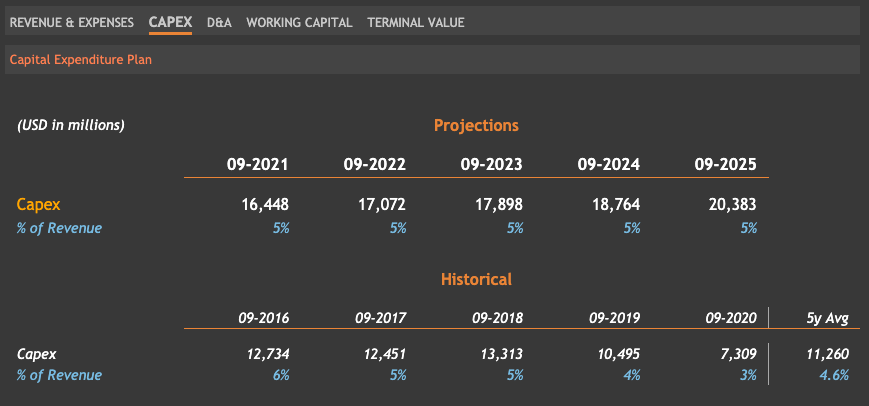

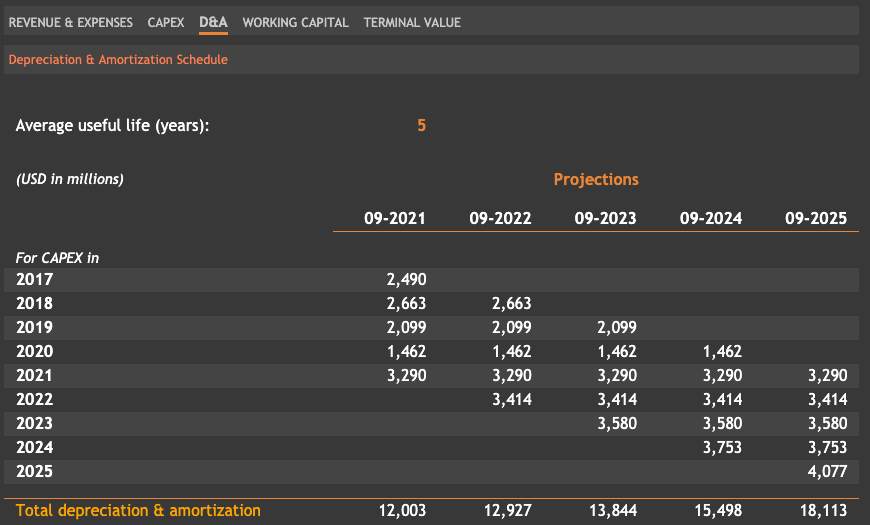

CAPEX and depreciation/amortization

DCF is all about cash flow. In order to accurately forecast future cash flow, we need to adjust our forecast net income with CAPEX and depreciation/amortization

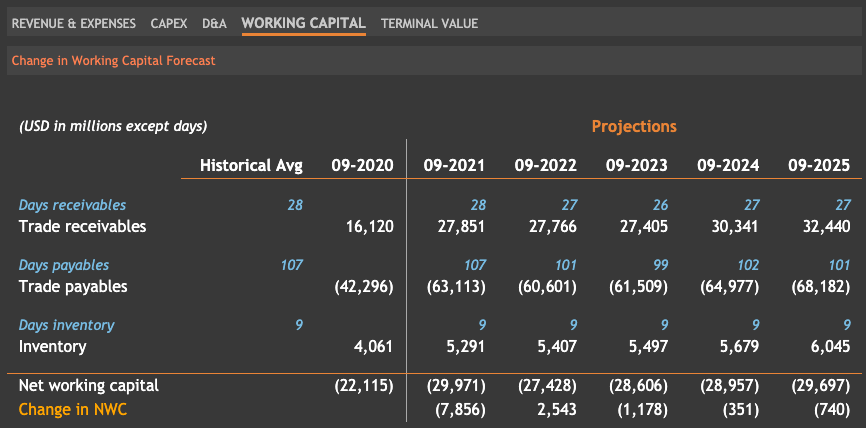

Working Capital

Working capital is also a needed component when forecasting cash flow. Working capital involves days sales outstanding, days inventory outstanding, days payable outstanding. It is common the use historical average when forecasting these days.

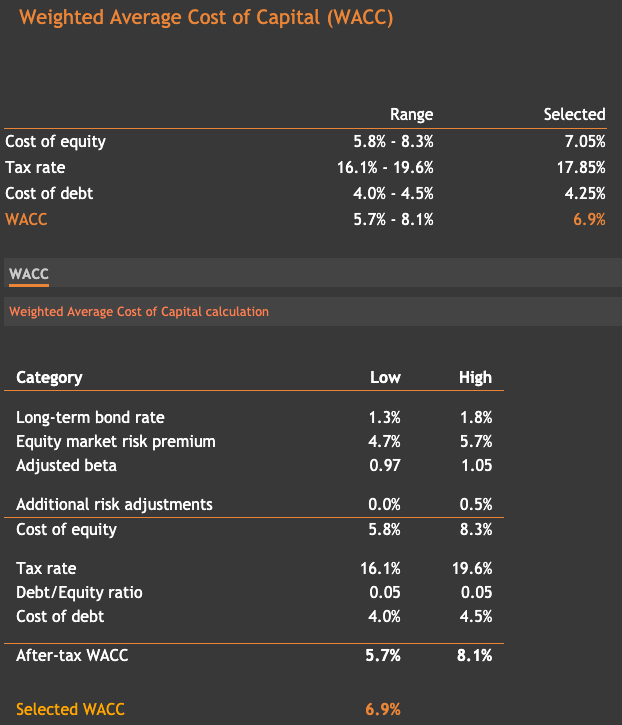

Weighted Average Cost of Capital

Arguably the most important component of any valuation is the Weighted Average Cost of Capital (WACC). It tells us how much of the return rate the investors expect given the current macronomics variables

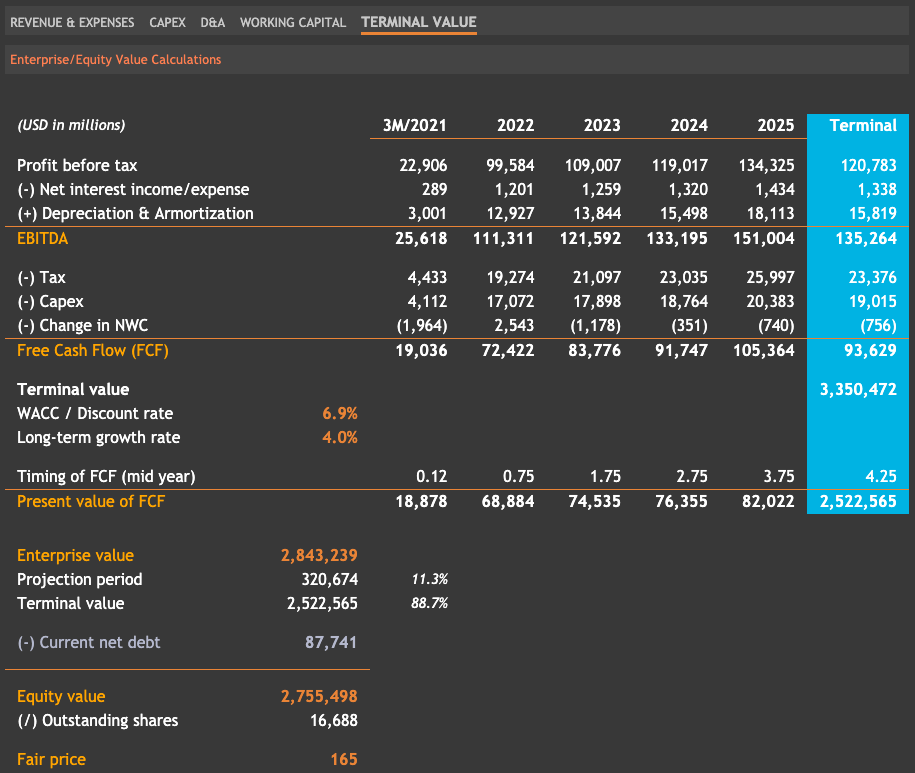

Project Future Cash Flows and discount to the current to get the final valuation

Now we have all quantities we need to forecast future cash flow. We can put them all together to get to the final valuation. Note that the value reported by the DCF model is the Enterprise Value. We need to substract Net debt from it to get to the Equity Value, which is what we want

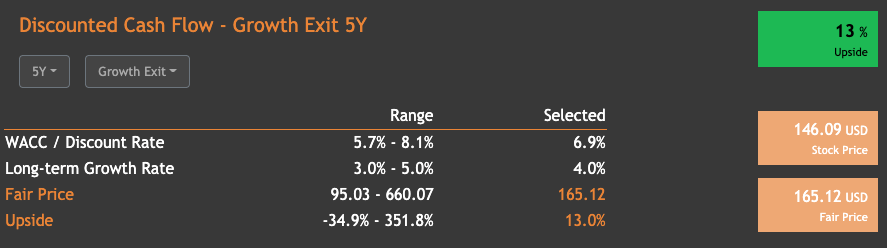

Sensitivity Analysis

For any valuation model, it is cruial to perform the sensitivity analysis to see how our model performs under different scenarios. ValueInvesting.io's financial modeling backend automates the process for us and displays the results nicely

Final thoughts

And that is how we build a DCF to find the instrinsic valuation of a company. With ValueInvesting.io, the whole process is automated and becomes a lot more convenient. I highly recommend that you check the website out. If you are also interested getting short interest and short squeeze data for your application, do take a look at this short squeeze API from RapidAPI which is sourced directly from the exchanges and cover all Russell 3000 stocks.