According to the Buffett-Munger Screener, one of several predefined screens available to GuruFocus Premium members, five stocks with good business fundamentals and are trading at attractive GF Values are Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial), Usana Health Sciences Inc. (USNA, Financial), La-Z-Boy Inc. (LZB, Financial), Credit Acceptance Corp. (CACC, Financial) and Allstate Corp. (ALL, Financial).

Berkshire co-mangers Warren Buffett (Trades, Portfolio) and Charlie Munger (Trades, Portfolio) look for good companies trading at fair prices using a four-criterion investing approach: understandable business, favorable long-term prospects, shareholder-oriented management and attractive share price. Key characteristics of Buffet-Munger companies include high business predictability, strong profit margin growth, no meaningful debt and low price-earnings-to-growth ratios.

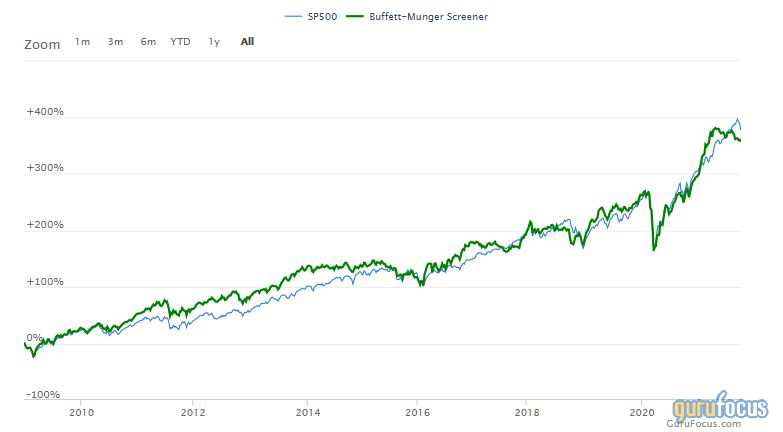

According to the Model Portfolio pages, GuruFocus’ Buffett-Munger strategy has returned a cumulative 361.71% since its inception in 2009, with an annualized return of 12% over the past 10 years and 27.91% over the past year.

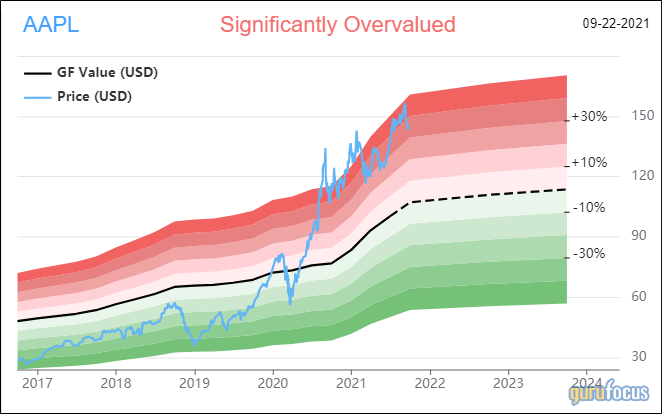

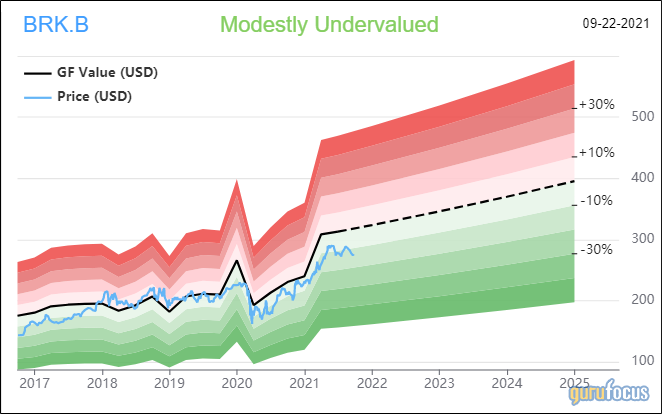

GuruFocus’ exclusive valuation method provides an alternative way to measure a stock’s intrinsic valuation. Patterned from legendary Fidelity Magellan Fund manager Peter Lynch’s earnings line, the GF Value considers several historical price multiples and adjusts for past performance and future growth estimates.

Berkshire Hathaway

Class B shares of Berkshire (BRK.B, Financial) traded around $276.14, showing that the stock is modestly undervalued based on Wednesday’s price-to-GF Value ratio of 0.87.

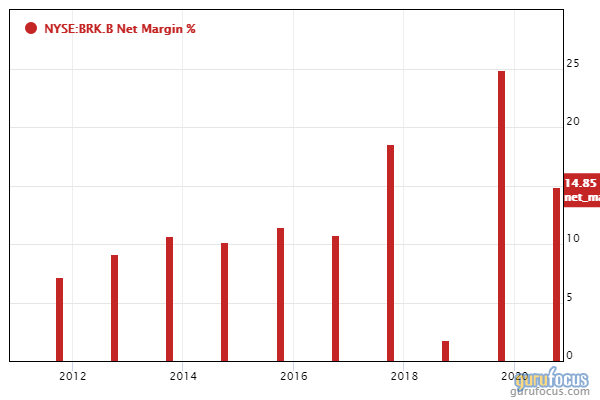

GuruFocus ranks Buffett’s Omaha, Nebraska-based insurance conglomerate’s profitability 7 out of 10 on several positive investing signs, which include a four-star business predictability rank, a high Piotroski F-score of 8 and net profit margins and returns outperform more than 89% of global competitors.

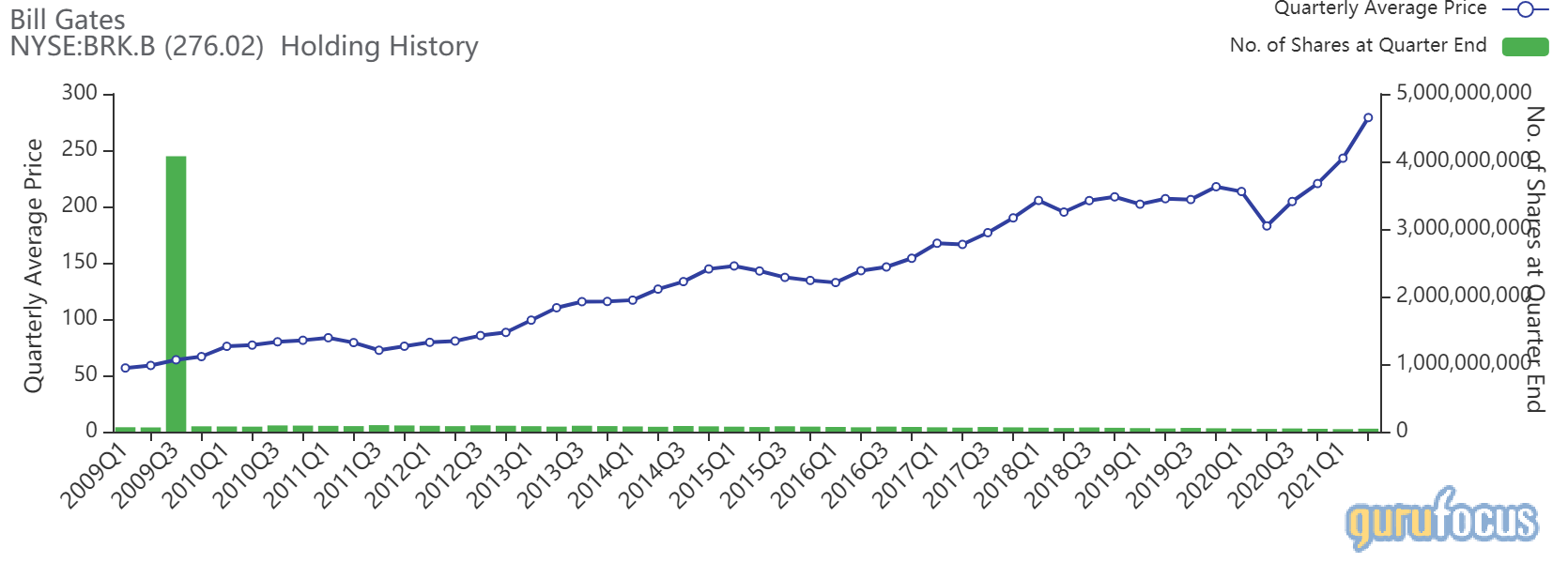

Gurus with holdings in Berkshire’s Class B shares include Bill Gates (Trades, Portfolio)’ foundation trust and Diamond Hill Capital (Trades, Portfolio).

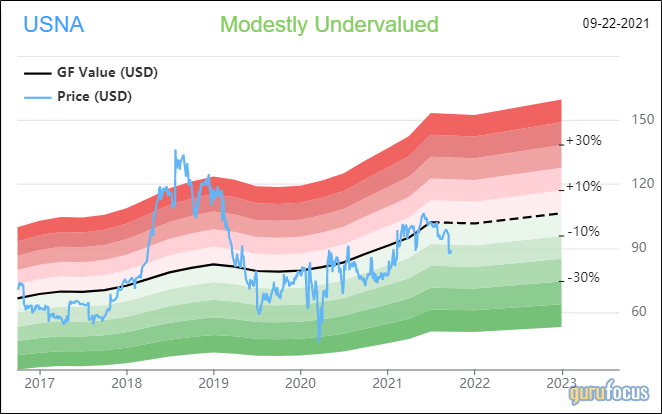

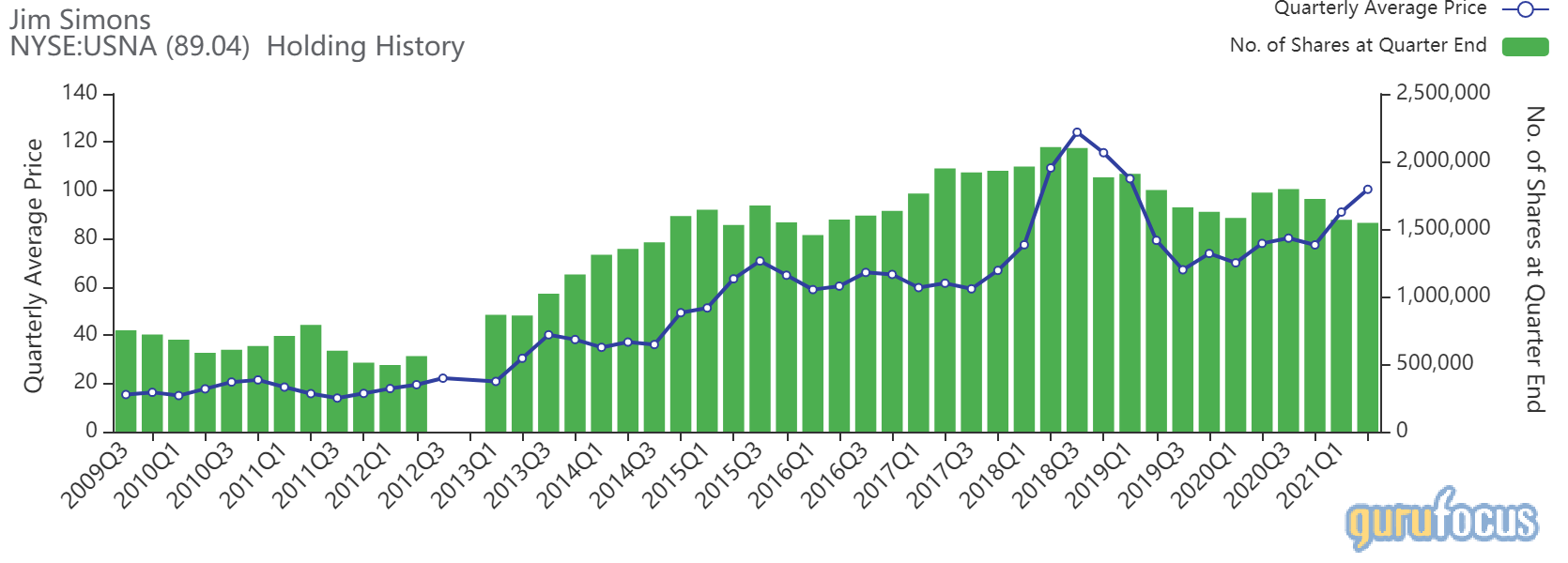

Usana Health Sciences

Shares of Usana Health Sciences (USNA, Financial) traded around $89.20, showing that the stock is modestly undervalued based on Wednesday’s price-to-GF Value ratio of 0.87.

GuruFocus ranks the Salt Lake City-based company’s financial strength and profitability 9 out of 10 on several positive investing signs, which include a four-star business predictability rank, a high Piotroski F-score of 8, a strong Altman Z-score of 10 and an operating margin that has increased approximately 0.8% per year on average over the past five years and is outperforming more than 84% of global competitors.

Gurus with holdings in Usana include Jim Simons (Trades, Portfolio)’ Renaissance Technologies and Ray Dalio (Trades, Portfolio)’s Bridgewater Associates.

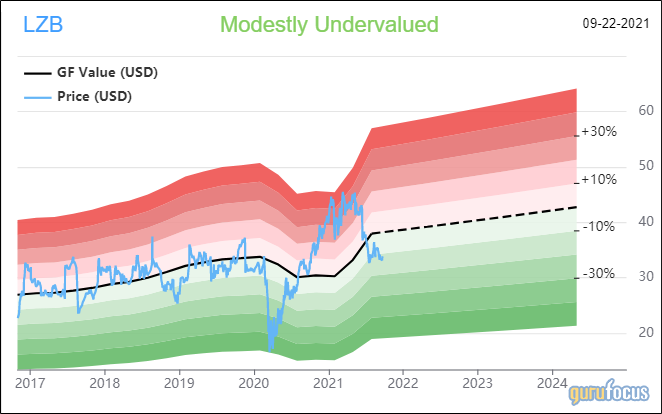

La-Z-Boy

Shares of La-Z-Boy (LZB, Financial) traded around $33.88, showing that the stock is modestly undervalued based on Wednesday’s price-to-GF Value ratio of 0.89.

GuruFocus ranks the Monroe, Michigan-based furniture retailer’s profitability 8 out of 10 on several positive investing signs, which include a 4.5-star predictability rank and a high Piotroski F-score of 7.

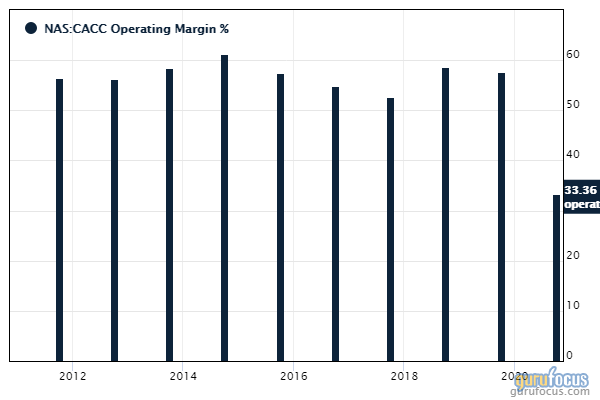

Credit Acceptance

Shares of Credit Acceptance (CACC, Financial) traded around $603.77, showing the stock is fairly valued based on Wednesday’s price-to-GF Value ratio of 0.99.

GuruFocus ranks the Southfield, Michigan-based consumer finance company’s profitability 9 out of 10 on several positive investing signs, which include a high Piotroski F-score of 9, a 4.5-star business predictability rank and profit margins and returns that outperform more than 84% of global competitors.

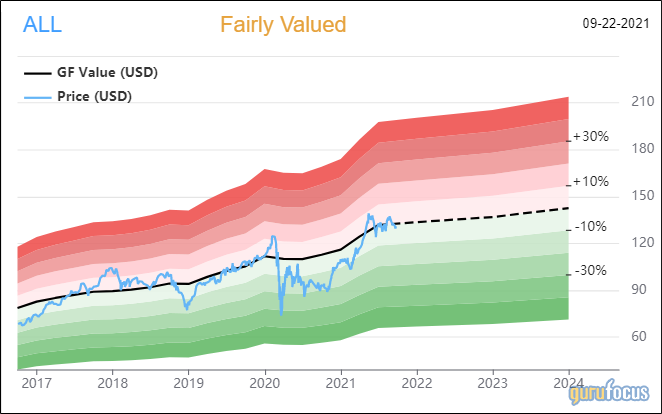

Allstate

Shares of Allstate (ALL, Financial) traded around $130.84, showing the stock is fairly valued based on Wednesday’s price-to-GF Value ratio of 0.99.

GuruFocus ranks the Northbrook, Illinois-based insurance company’s profitability 6 out of 10 on the back of a 4.5-star business predictability rank and returns that outperform more than 67% of global competitors.