Some parts of the tech industry may have gotten a temporary boost from the Covid-19 pandemic, but cybersecurity was not one of them. Its growth has remained consistent even as the remote work trend slowed down and began to reverse course. This is because the growth of cloud computing overall had relatively little to do with remote work, fueled mostly by big data analytics, artificial intelligence, machine learning, business analytics and more.

The growing demand for cybersecurity is being fueled by the move to the Cloud, which is more vulnerable to hackers than on-site servers and represents greater potential for rapid growth in computing. According to Fortune Business Insights, the growth of the global cybersecurity market is expected to slow down somewhat in the near term, growing from $139.77 billion in 2021 to $155.83 billion in 2022, but growth is expected to speed up in the years ahead to reach a value of $376.32 billion by 2029, achieving a compound annual growth rate of 13.4%.

While business has remained strong for cybersecurity companies, the same cannot be said for their stock prices. Growth stocks tend to perform poorly in periods of economic trouble and high inflation as investors are wary of paying sky-high valuation multiples for them. Most cybersecurity stocks have fallen back to earth, with the First Trust NASDAQ CEA Cybersecurity ETF (CIBR, Financial) down 25% year to date while the S&P 500 is down 20.16% over the same timeframe.

Some companies are taking advantage of the devaluation of cybersecurity stocks to make acquisitions, speeding up the process of industry consolidation.

In light of the long-term tailwinds for the cybersecurity industry, let’s take a look at three cybersecurity stocks that are trading below GF Value and could be undervalued based on their long-term potential: Check Point Software Technologies Ltd. (CHKP, Financial), CrowdStrike Holdings Inc. (CRWD, Financial) and Okta Inc. (OKTA, Financial).

Check Point Software Technologies

Check Point Software Technologies (CHKP, Financial) is modestly undervalued based on its GF Value chart. This stock has actually bucked the trend by rising 6% year to date rather than falling like most of its peers:

The stock’s success this year is due largely to the fact that it is one of the few profitable names in the cloud cybersecurity industry. As an older company that adapted quickly and efficiently to industry innovations as they came, Check Point has been profitable in 10 out of the past 10 years.

Of course, this also means recent growth has been slower since it has a larger historical earnings base to compare to. The three-year revenue per share growth rate is 10.4% while the three-year earnings per share without non-recurring items growth rate is 5.7%.

According to reviews, customers like how easy to use and cheap to maintain Check Point’s cybersecurity solutions are, though some complain that the process of adding exceptions for threat prevention services is too difficult.

Overall, while Check Point may be in a growth industry, its stock falls more into the value basket due to the maturity of its business as well as its earnings multiples; at a price-earnings ratio of just 20.43, it is cheaper than the industry average.

CrowdStrike Holdings

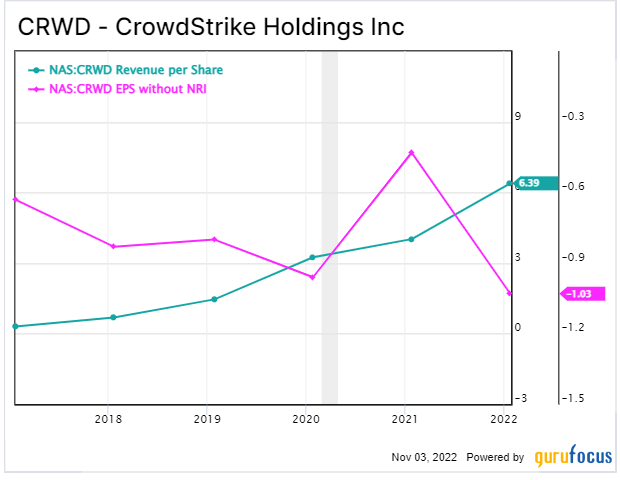

CrowdStrike Holdings (CRWD, Financial) is significantly undervalued according to its GF Value chart after its price has fallen 30% year to date.

There is definitely a case to be made that the stock deserved the selloff because the company is not profitable and never has been. Founded in 2011, Crowdstrike provides cloud-native cybersecurity solutions and is focusing on growth over profitability.

Crowdstrike has a three-year revenue per share growth rate of 63.6% and a three-year earnings per share without non-recurring items growth rate of -8.8%. Even though its sales are skyrocketing much faster than Check Point’s, it has an astronomical price-sales ratio of 18.37, which means it could have further left to fall as long as market conditions remain bearish.

According to PeerSpot ratings, “CrowdStrike Falcon is the #1 ranked solution in endpoint security software, top Anti-Malware Tools, top Threat Intelligence Platforms and EDR tools.” Its best-in-class solutions are hampered only by what customers consider to be insufficient customer support.

Crowdstrike may be undervalued based on its historical valuation levels and growth projections. In August, the company was still reporting stellar growth with revenue rising 58% year over year. However, it seems unlikely the price will recover much in the near term due to bearish market sentiment.

Okta Inc.

According to its GF Value chart, Okta Inc. (OKTA, Financial) is a possible value trap after its price dropped about 77% year to date amid plummeting earnings.

Okta’s three-year revenue per share growth rate is a solid 33.2%, but its three-year earnings per share without non-recurring items growth rate is atrocious at -69.8%. Not only has the company been focusing on growth over profitability, it has also made several acquisitions in recent years.

In particular, its pricey acquisition of Auth0 in early March 2021 has not been well-received by investors. The company is also developing new products to compete with CyberArk Software (CYBR, Financial) and SailPoint Technologies (SAIL, Financial), further broadening its horizons in identity and access management.

Okta specializes in identity management; no other product currently on the market can match its flexibility on policies and automation. As identity theft cases continue to rise, high-level identity management solutions will remain an essential part of cybersecurity.

On its own, I think this stock would fall into the same category as Crowdstrike: with the economic downturn, investors will not be turning bullish on an extremely unprofitable growth stock anytime soon. However, Okta has been identified by several analysts as a potential acquisition target. With valuations down, cybersecurity outfits that are strapped for cash may find themselves targeted by larger companies or private equity.